Saudi Arabia RFID in Healthcare Market Overview

- The Saudi Arabia RFID in Healthcare Market is valued at USD 30 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of advanced technologies in healthcare, the need for efficient asset management, and the rising demand for patient safety and tracking solutions. The integration of RFID technology enhances operational efficiency and reduces costs, making it a preferred choice for healthcare facilities. Recent trends include the integration of RFID with Internet of Things (IoT), cloud analytics, and artificial intelligence, enabling predictive asset maintenance and automated workflow management. There is also a growing demand for real-time visibility of medical supplies, blood products, and medications, which is accelerating RFID deployment across healthcare operations in Saudi Arabia .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their advanced healthcare infrastructure and concentration of major hospitals and clinics. These urban centers are investing heavily in healthcare technology to improve service delivery and patient outcomes, thus fostering a conducive environment for RFID adoption in healthcare settings. Notably, RFID-based neonatal protection systems are already deployed in over 140 hospitals across the country, highlighting the scale of adoption in major cities .

- The Saudi Food and Drug Authority (SFDA) issued the “Drug Track and Trace System Executive Regulation” in 2019, mandating the use of serialization and traceability technologies, including RFID, for pharmaceuticals throughout the healthcare supply chain. This regulation aims to enhance patient safety, streamline operations, and ensure compliance with international healthcare standards, thereby driving the growth of RFID solutions in the healthcare sector. The regulation requires all pharmaceutical manufacturers, importers, and healthcare providers to implement traceability solutions for drug products, supporting the broader adoption of RFID in hospitals for equipment and patient identification .

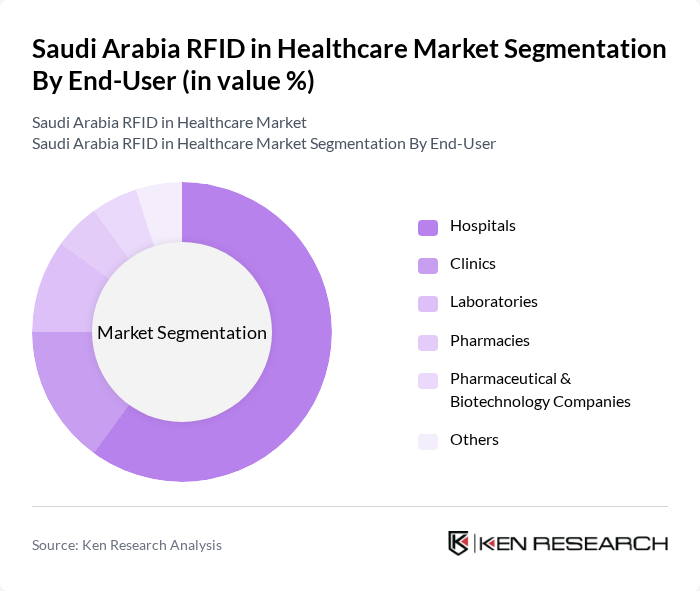

Saudi Arabia RFID in Healthcare Market Segmentation

By Type:The market is segmented into Active RFID, Passive RFID, Semi-passive RFID, and Hybrid RFID. Active RFID is gaining traction due to its long-range capabilities and real-time monitoring, while Passive RFID is widely used for cost-effective, high-volume tracking of medical assets and pharmaceuticals. Semi-passive RFID combines features of both, offering enhanced battery life and sensing capabilities, and Hybrid RFID provides flexibility for specialized applications. The adoption of passive RFID tags is particularly strong in Saudi Arabia’s healthcare sector, driven by the need for efficient medication and equipment tracking .

By End-User:The end-user segmentation includes Hospitals, Clinics, Laboratories, Pharmacies, Pharmaceutical & Biotechnology Companies, and Others. Hospitals are the largest segment due to their extensive need for asset tracking, patient management, and regulatory compliance solutions. Clinics and Laboratories are increasingly adopting RFID for operational efficiency and inventory control, while Pharmacies and Pharmaceutical & Biotechnology Companies utilize RFID to ensure drug traceability and combat counterfeiting. The deployment of RFID in neonatal protection, medication authentication, and supply chain management is particularly prominent in hospitals and large clinics .

Saudi Arabia RFID in Healthcare Market Competitive Landscape

The Saudi Arabia RFID in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zebra Technologies, Impinj, Siemens Healthineers, Avery Dennison, STMicroelectronics, Motorola Solutions, Checkpoint Systems, Alien Technology, NXP Semiconductors, SATO Holdings, Terso Solutions, CCL Industries, Invengo Technology, GAO RFID, Gulf Data International (GDI), Saudi RFID (local systems integrator), Wipro Arabia, Honeywell International, HID Global, Smartrac (a part of Avery Dennison) contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia RFID in Healthcare Market Industry Analysis

Growth Drivers

- Increasing Demand for Patient Safety and Tracking:The Saudi healthcare sector is witnessing a surge in demand for enhanced patient safety measures, with the Ministry of Health reporting a 15% increase in patient safety initiatives in future. RFID technology plays a crucial role in tracking patients and medical equipment, reducing errors and improving care quality. The implementation of RFID systems can lead to a 30% reduction in patient misidentification incidents, significantly enhancing overall safety and operational efficiency in healthcare facilities.

- Rising Adoption of Automation in Healthcare Facilities:Automation in healthcare is projected to grow, with an estimated 25% of hospitals in Saudi Arabia adopting automated systems in future. This shift is driven by the need for improved workflow efficiency and reduced labor costs. RFID technology facilitates automation by streamlining inventory management and patient tracking, which can lead to a 20% decrease in operational costs. The integration of automated systems is essential for modernizing healthcare delivery in the region.

- Government Initiatives for Digital Health Transformation:The Saudi government has allocated approximately SAR 2 billion (USD 533 million) for digital health initiatives in future, aiming to enhance healthcare services through technology. This funding supports the integration of RFID systems, which are essential for achieving the goals outlined in the National Transformation Program. The government's commitment to digital health is expected to drive a 40% increase in RFID adoption across healthcare facilities, improving service delivery and patient outcomes.

Market Challenges

- High Initial Investment Costs:The implementation of RFID technology in healthcare requires significant upfront investment, with costs ranging from SAR 500,000 to SAR 2 million (USD 133,000 to USD 533,000) per facility. This financial barrier can deter smaller healthcare providers from adopting RFID systems, limiting overall market growth. Additionally, the return on investment may take several years, making it challenging for organizations to justify the initial expenditure in a competitive healthcare landscape.

- Lack of Awareness and Technical Expertise:A considerable challenge in the Saudi RFID healthcare market is the lack of awareness and technical expertise among healthcare professionals. According to a survey, 60% of healthcare providers reported insufficient knowledge about RFID technology and its benefits. This gap in understanding can hinder the adoption of RFID systems, as organizations may struggle to implement and maintain these technologies effectively, ultimately affecting patient care and operational efficiency.

Saudi Arabia RFID in Healthcare Market Future Outlook

The future of the RFID in healthcare market in Saudi Arabia appears promising, driven by technological advancements and increasing government support. As healthcare facilities continue to embrace automation and digital transformation, the integration of RFID systems will likely become more prevalent. The focus on patient safety and operational efficiency will further propel adoption rates. Additionally, the growing trend of telemedicine and remote monitoring will create new avenues for RFID applications, enhancing patient care and streamlining healthcare processes across the region.

Market Opportunities

- Expansion of Telemedicine and Remote Patient Monitoring:The rise of telemedicine in Saudi Arabia, projected to reach SAR 1.5 billion (USD 400 million) in future, presents significant opportunities for RFID integration. RFID can enhance remote patient monitoring by ensuring accurate tracking of medical devices and patient data, improving care delivery and patient engagement in telehealth services.

- Growth in the Aging Population:With the aging population in Saudi Arabia expected to increase by 20% in future, there is a growing need for efficient healthcare solutions. RFID technology can play a vital role in managing chronic diseases and ensuring timely interventions, thereby improving the quality of care for elderly patients and addressing the challenges posed by an aging demographic.