Region:Middle East

Author(s):Shubham

Product Code:KRAD4709

Pages:86

Published On:December 2025

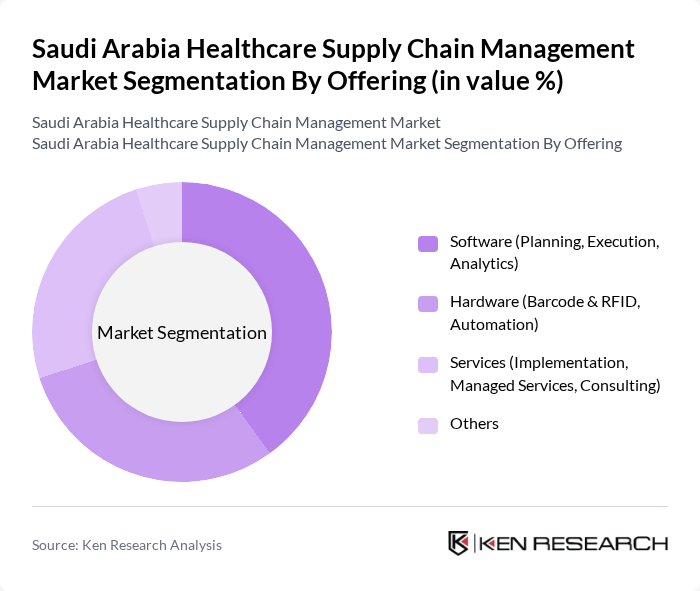

By Offering:The market is segmented into software, hardware, services, and others. Software includes planning, execution, and analytics tools that support forecasting, inventory optimization, and real?time tracking, and this segment is gaining traction as hospitals and distributors seek data?driven decision?making and integration with electronic medical records and enterprise resource planning systems. Hardware solutions such as barcode scanners, RFID tags, and automated storage and retrieval systems remain the largest product component in Saudi Arabia, reflecting continuing investments in traceability, cold?chain monitoring, and warehouse automation. Services—spanning implementation, managed services, and consulting—are increasingly important as healthcare providers rely on external expertise to design processes, integrate systems, comply with SFDA track?and?trace requirements, and support cloud and on?premise deployments.

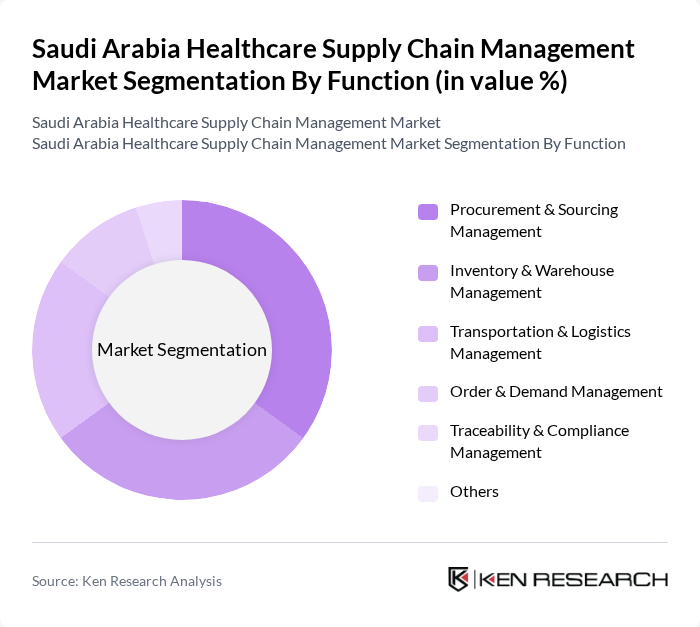

By Function:The market is segmented into procurement & sourcing management, inventory & warehouse management, transportation & logistics management, order & demand management, traceability & compliance management, and others. Procurement and sourcing management is critical for ensuring that healthcare providers have access to the necessary supplies at competitive prices. Inventory and warehouse management functions are increasingly digitized, using automated systems and real?time monitoring to manage high?value drugs, temperature?sensitive products, and large multisite hospital networks. Transportation and logistics management ensure timely and compliant delivery, with growing emphasis on cold?chain capabilities, last?mile reliability, and integration with SFDA’s Drug Track system.

The Saudi Arabia Healthcare Supply Chain Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Health (MOH) – Health Holding Company / Seha Virtual Hospital, Saudi Food and Drug Authority (SFDA) – RSD / Drug Track Platform, National Unified Procurement Company (NUPCO), Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Nahdi Medical Company, Al-Dawaa Medical Services Co. (Al-Dawaa Pharmacies), Jamjoom Pharma (Jamjoom Pharmaceuticals Co.), Tamer Group, Banaja Holdings Company (Banaja Healthcare), Saudi German Health (Saudi German Hospitals Group), Mouwasat Medical Services Co., Dr. Sulaiman Al Habib Medical Services Group, Bupa Arabia for Cooperative Insurance, SAP SE – Saudi Arabia, Oracle Corporation – Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare supply chain management market in Saudi Arabia appears promising, driven by ongoing technological innovations and government support. The anticipated growth in telehealth services and the integration of AI in supply chain processes are expected to enhance operational efficiency. Additionally, the focus on sustainability and value-based care will likely reshape supply chain strategies, ensuring that healthcare providers can meet evolving patient needs while optimizing resource utilization and reducing waste.

| Segment | Sub-Segments |

|---|---|

| By Offering | Software (Planning, Execution, Analytics) Hardware (Barcode & RFID, Automation) Services (Implementation, Managed Services, Consulting) Others |

| By Function | Procurement & Sourcing Management Inventory & Warehouse Management Transportation & Logistics Management Order & Demand Management Traceability & Compliance Management Others |

| By Mode of Delivery | On-premise Solutions Cloud-based Solutions Web-based Solutions Others |

| By End-User | Healthcare Providers (Hospitals & Clinics) Healthcare Manufacturers (Pharmaceuticals & Medical Devices) Distributors & Wholesalers Third-Party Logistics (3PL) & Specialized Healthcare Logistics Others |

| By Product Managed | Pharmaceuticals & Biologics Medical Devices & Equipment Consumables & Disposables Cold-chain / Temperature-sensitive Products Others |

| By Technology Utilization | Barcode-based Systems RFID and Real-time Location Systems (RTLS) Cloud & SaaS Platforms Advanced Analytics, AI & Automation Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Supply Chain Management | 120 | Supply Chain Managers, Procurement Officers |

| Medical Equipment Distribution | 90 | Logistics Coordinators, Operations Managers |

| Healthcare Facility Inventory Management | 80 | Inventory Managers, Healthcare Administrators |

| Patient Care Logistics | 70 | Clinical Operations Managers, Patient Services Directors |

| Telehealth Supply Chain Integration | 60 | IT Managers, Telehealth Coordinators |

The Saudi Arabia Healthcare Supply Chain Management Market is valued at approximately USD 45 million, reflecting growth driven by healthcare digitization, increased healthcare expenditure, and government initiatives under Saudi Vision 2030.