Region:Middle East

Author(s):Dev

Product Code:KRAA8410

Pages:88

Published On:November 2025

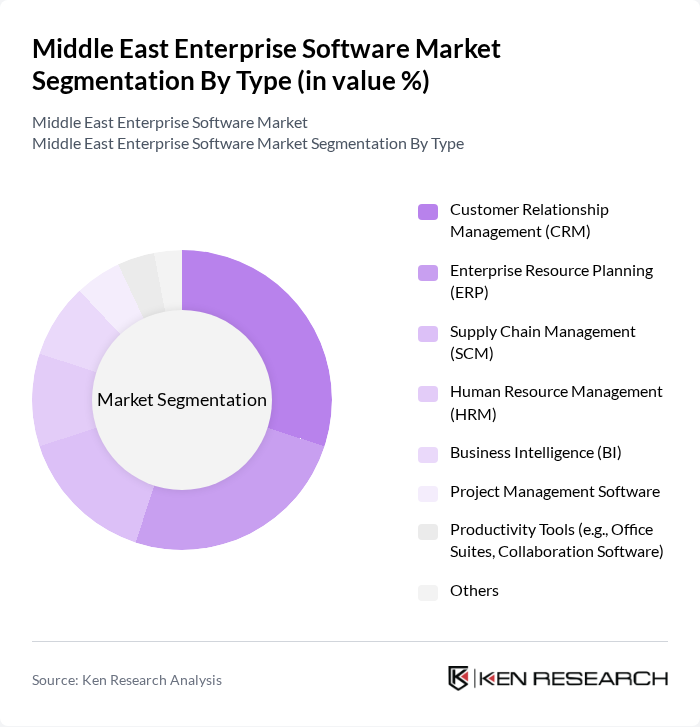

By Type:The enterprise software market can be segmented into various types, includingCustomer Relationship Management (CRM),Enterprise Resource Planning (ERP),Supply Chain Management (SCM),Human Resource Management (HRM),Business Intelligence (BI),Project Management Software,Productivity Tools, andOthers. Among these, CRM and ERP solutions are particularly dominant due to their critical role in enhancing customer engagement and streamlining business processes. The market is witnessing increased adoption of cloud-based ERP and CRM platforms, especially among SMEs, to improve scalability and reduce IT infrastructure costs .

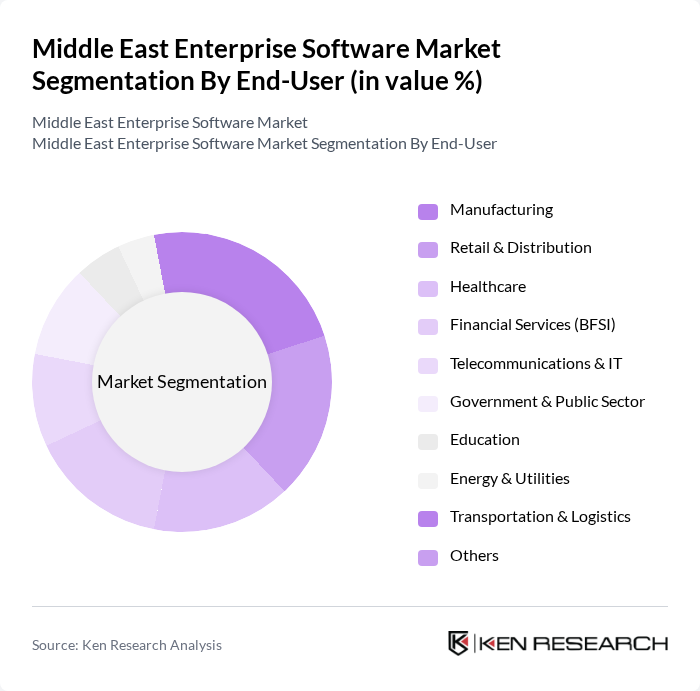

By End-User:The enterprise software market is also segmented by end-user industries, includingManufacturing,Retail & Distribution,Healthcare,Financial Services (BFSI),Telecommunications & IT,Government & Public Sector,Education,Energy & Utilities,Transportation & Logistics, andOthers. The healthcare and BFSI sectors are leading users of enterprise software due to their need for compliance, data management, and customer service enhancement. Rapid digitalization in manufacturing and retail is also driving demand for advanced ERP and SCM solutions .

The Middle East Enterprise Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP MENA, Oracle Middle East, Microsoft Gulf, Salesforce MENA, IBM Middle East, Infor Middle East, Sage Middle East, Zoho Corporation, ServiceNow, Workday, Atlassian, HubSpot, Freshworks, Odoo Middle East, and STS Group (Jordan) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East enterprise software market appears promising, driven by ongoing digital transformation efforts and increasing investments in IT infrastructure. As businesses continue to embrace cloud solutions and AI technologies, the demand for innovative software applications is expected to rise. Additionally, government initiatives aimed at fostering technology adoption will likely create a conducive environment for growth, enabling organizations to enhance operational efficiency and customer engagement through advanced software solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Relationship Management (CRM) Enterprise Resource Planning (ERP) Supply Chain Management (SCM) Human Resource Management (HRM) Business Intelligence (BI) Project Management Software Productivity Tools (e.g., Office Suites, Collaboration Software) Others |

| By End-User | Manufacturing Retail & Distribution Healthcare Financial Services (BFSI) Telecommunications & IT Government & Public Sector Education Energy & Utilities Transportation & Logistics Others |

| By Deployment Model | On-Premises Cloud-Based (SaaS, Hybrid Cloud) Edge-Based Hybrid Others |

| By Industry Vertical | Government Education Energy and Utilities Transportation and Logistics Hospitality & Tourism Others |

| By Functionality | Financial Management Operations Management Marketing Management Sales Management Compliance & Risk Management Others |

| By Size of Enterprise | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Geographic Presence | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Turkey Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Resource Planning (ERP) Adoption | 100 | IT Managers, CFOs, Operations Directors |

| Customer Relationship Management (CRM) Solutions | 80 | Sales Managers, Marketing Directors, Customer Service Heads |

| Supply Chain Management (SCM) Software | 60 | Supply Chain Managers, Logistics Managers |

| Cloud-based Software Solutions | 90 | IT Directors, Cloud Architects, Business Analysts |

| Cybersecurity Software in Enterprises | 70 | Chief Information Security Officers, IT Security Managers |

The Middle East Enterprise Software Market is valued at approximately USD 10.5 billion, driven by digital transformation initiatives across various sectors, including finance, healthcare, and retail, as well as the growth of small- and medium-sized enterprises (SMEs).