Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1078

Pages:84

Published On:November 2025

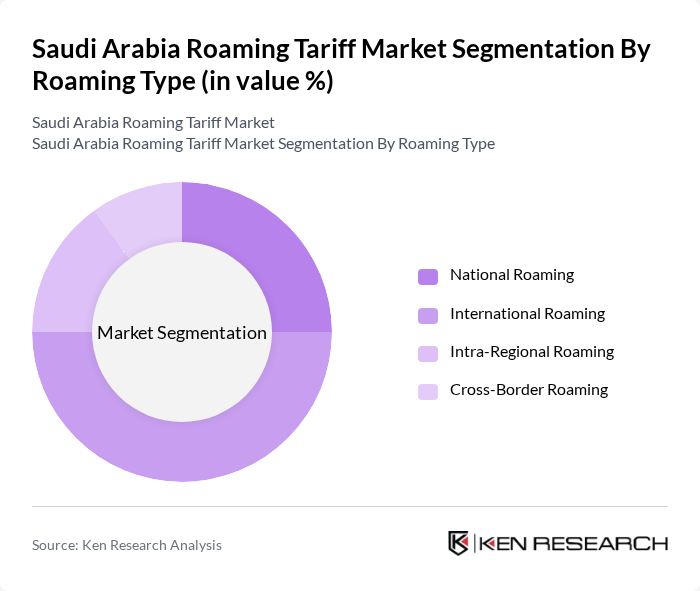

By Roaming Type:

The roaming type segmentation includesNational Roaming, International Roaming, Intra-Regional Roaming, and Cross-Border Roaming. Among these,International Roamingis the dominant segment, fueled by the increasing number of Saudi travelers abroad and the growing demand for high-speed data services. National Roaming remains significant, especially for domestic travelers requiring uninterrupted connectivity across different service providers. The surge in mobile data usage, 5G adoption, and the need for seamless connectivity are the primary factors shaping these trends .

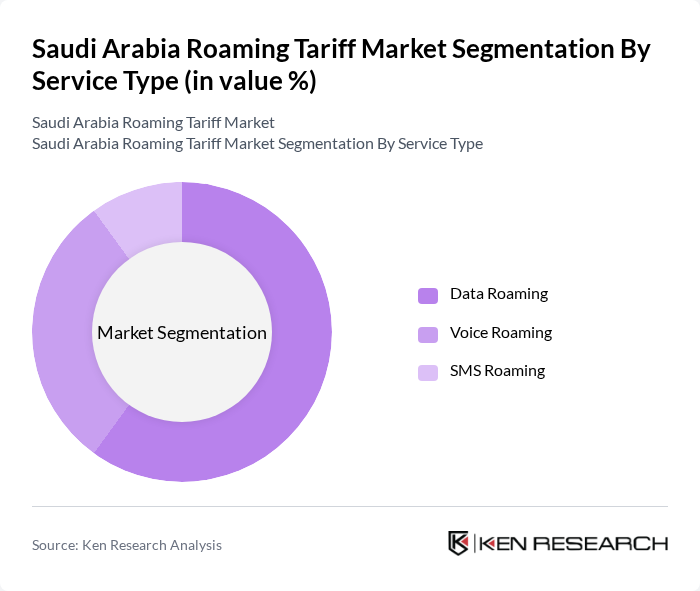

By Service Type:

This segmentation includesData Roaming, Voice Roaming, and SMS Roaming.Data Roamingleads the market, reflecting the shift toward mobile internet for communication, streaming, and social media while traveling. Voice Roaming remains relevant but is gradually overtaken by data-centric services as users increasingly prefer messaging apps and digital platforms. SMS Roaming continues to decline as consumers adopt more cost-effective data-based alternatives .

The Saudi Arabia Roaming Tariff Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, Virgin Mobile KSA, Lebara Mobile, Atheeb Telecom, GO Telecom, Taliya (MVNO), International Roaming Partners (Vodafone, Orange, Telefonica), Regional Telecom Providers (UAE Telecom, Omantel), Technology Enablers (Mavenir, Ericsson, Nokia), and Regulatory Bodies (CITC - Communications and Information Technology Commission) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia roaming tariff market is poised for significant transformation as mobile data usage continues to rise and international travel expands. The adoption of 5G technology will enhance user experiences, while competitive pricing strategies will attract more consumers. Additionally, the focus on customer experience will drive innovation in service offerings. As operators navigate regulatory challenges, they will need to leverage partnerships and technological advancements to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Roaming Type | National Roaming International Roaming Intra-Regional Roaming Cross-Border Roaming |

| By Service Type | Data Roaming Voice Roaming SMS Roaming |

| By Distribution Channel | Retail Roaming Wholesale Roaming |

| By End-User | Individual Consumers Business Travelers Corporate Clients Tourists IoT and M2M Applications |

| By Technology | G Roaming G/LTE Roaming G Roaming eSIM Technology |

| By Region | Central Region (Riyadh) Eastern Region (Dammam) Western Region (Jeddah) Southern Region Northern Region |

| By Plan Type | Prepaid Roaming Plans Postpaid Roaming Plans Unlimited Data Plans Regional Roaming Plans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frequent Business Travelers | 100 | Corporate Executives, Business Travelers |

| Tourists Visiting Saudi Arabia | 90 | International Tourists, Travel Agents |

| Telecom Service Users | 80 | Mobile Subscribers, Customer Service Representatives |

| Telecom Industry Experts | 50 | Regulatory Officials, Industry Analysts |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Market Researchers |

The Saudi Arabia Roaming Tariff Market is valued at approximately USD 1.1 billion, driven by increased international travel, mobile data consumption, and telecom infrastructure upgrades, particularly with the expansion of 5G technology.