Region:Middle East

Author(s):Rebecca

Product Code:KRAD6316

Pages:87

Published On:December 2025

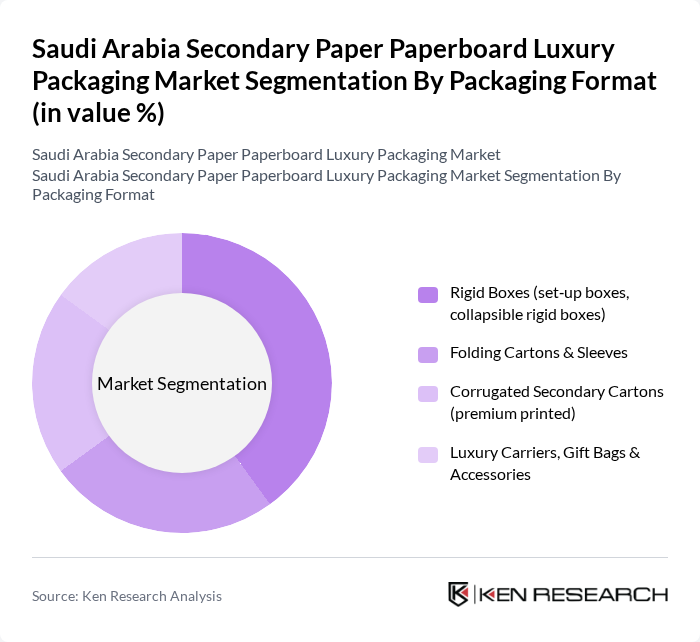

By Packaging Format:The packaging format segment includes various types of packaging solutions tailored for luxury products. The subsegments are Rigid Boxes (set-up boxes, collapsible rigid boxes), Folding Cartons & Sleeves, Corrugated Secondary Cartons (premium printed), and Luxury Carriers, Gift Bags & Accessories. Among these, Rigid Boxes are leading the market due to their ability to provide superior protection, structural rigidity, and high-end visual appeal, which is crucial for luxury items such as perfumes, jewelry, premium confectionery, and gifting. The trend towards personalized, limited-edition, and brand-differentiated packaging designs, including specialty finishes and embellishments, further drives the demand for this subsegment.

By End-Use Industry:This segment encompasses various industries utilizing luxury packaging, including Beauty, Cosmetics & Personal Care, Fragrances & Premium Home Care, Watches, Jewelry & Accessories, Premium Food, Confectionery & Gourmet, Wines, Spirits & Premium Beverages, Fashion, Apparel & Leather Goods, and Others (electronics gifting, corporate gifting, etc.). The Beauty, Cosmetics & Personal Care segment is currently the dominant player, driven by the strong regional focus on personal grooming, high per-capita spending on beauty products, and intensive brand competition that necessitates high-quality, visually distinctive packaging solutions to enhance shelf impact and consumer experience. Growing demand for premium fragrances, skincare, and gift sets further reinforces the leadership of this segment in luxury secondary paper and paperboard packaging.

The Saudi Arabia Secondary Paper Paperboard Luxury Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Paper Manufacturing Company (SPM), Al Watania Paper Products Co., Obeikan Paper Industries Co., Middle East Paper Company (MEPCO), Zamil Paper Industries Co., Falcon Pack Industry LLC – Saudi Operations, Arabian Packaging Co. Ltd., Napco National Packaging – Paper & Board Division, Saudi Printing & Packaging Company (SPPC), Al Jabr Printing & Packaging Co., Riyadh Carton and Printing Factory, Al Kifah Paper Products Co., United Carton Industries Co. (UCIC), Al Jazeera Factory for Paper Products, Al Rashed Printing & Packaging Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian secondary paper and paperboard luxury packaging market appears promising, driven by increasing consumer demand for sustainable and innovative packaging solutions. As e-commerce continues to expand, luxury brands are likely to invest in bespoke packaging that enhances their product appeal. Furthermore, advancements in recycling technologies and government support for sustainable practices will likely create a more favorable environment for growth, enabling manufacturers to meet evolving consumer preferences while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Packaging Format | Rigid Boxes (set?up boxes, collapsible rigid boxes) Folding Cartons & Sleeves Corrugated Secondary Cartons (premium printed) Luxury Carriers, Gift Bags & Accessories |

| By End-Use Industry | Beauty, Cosmetics & Personal Care Fragrances & Premium Home Care Watches, Jewelry & Accessories Premium Food, Confectionery & Gourmet Wines, Spirits & Premium Beverages Fashion, Apparel & Leather Goods Others (electronics gifting, corporate gifting, etc.) |

| By Material | Coated Bleached Kraft Board (Solid Bleached Sulfate) Folding Boxboard White-top & High-graphics Corrugated Board Recycled Board & Specialty Sustainable Grades |

| By Finishing & Decoration | Premium Printing (offset, digital, hybrid) Embossing, Debossing & Textured Effects Foiling, Metallization & Specialty Coatings Windowing, Inserts & Structural Enhancements |

| By Sales Channel | Direct Sales to Brand Owners Sales via Packaging Converters / Trade Printers Contract Packaging / Co?packers Others |

| By Region | Central Region (Riyadh & surrounding) Western Region (Makkah, Madinah, Jeddah) Eastern Region (Dammam, Khobar, Jubail) Southern & Northern Regions |

| By Application | Retail Shelf & Display-ready Secondary Packs E?commerce & Omni-channel Shipping Boxes Gifting, Limited Editions & Promotional Packs Duty-free, Travel Retail & Hospitality Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Cosmetics Packaging | 100 | Brand Managers, Product Development Heads |

| High-End Electronics Packaging | 80 | Marketing Directors, Supply Chain Managers |

| Fashion and Apparel Packaging | 70 | Retail Managers, Visual Merchandisers |

| Food and Beverage Luxury Packaging | 60 | Product Managers, Quality Assurance Officers |

| Luxury Gift Packaging | 90 | Sales Executives, Customer Experience Managers |

The Saudi Arabia Secondary Paper Paperboard Luxury Packaging Market is valued at approximately USD 1.0 billion, reflecting its significant share within the broader packaging and global luxury packaging markets.