Region:Asia

Author(s):Rebecca

Product Code:KRAD2896

Pages:83

Published On:November 2025

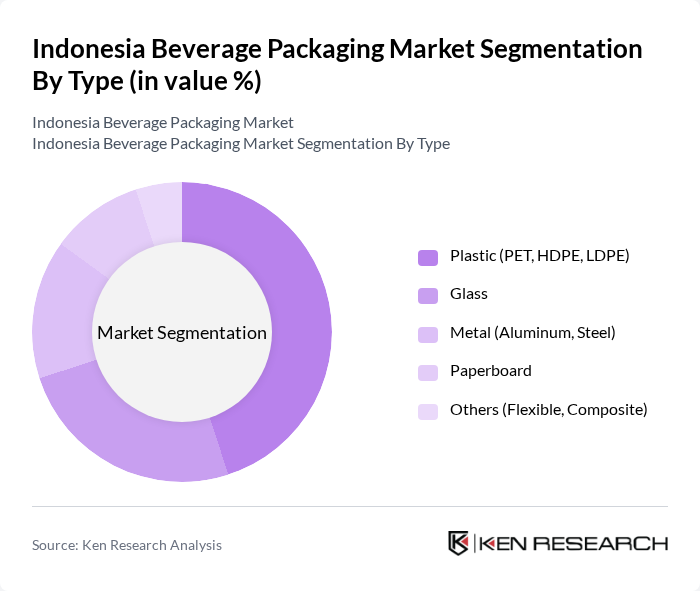

By Type:The beverage packaging market can be segmented into various types, including Plastic (PET, HDPE, LDPE), Glass, Metal (Aluminum, Steel), Paperboard, and Others (Flexible, Composite). Each type serves different consumer needs and preferences, with plastic packaging being the most widely used due to its lightweight and cost-effective nature. The market is witnessing a shift towards lightweight and flexible packaging formats, such as pouches and thin-wall containers, which offer reduced material use, lower logistics costs, and improved portability for on-the-go consumption .

The dominant sub-segment in the beverage packaging market is Plastic (PET, HDPE, LDPE), which accounts for a significant portion of the market share. This dominance is attributed to the lightweight, durable, and cost-effective nature of plastic materials, making them ideal for various beverage types. Additionally, the convenience of plastic packaging aligns with the fast-paced lifestyle of consumers, further driving its popularity. The versatility of plastic in design and functionality also contributes to its leading position in the market. The market is also seeing rapid adoption of recyclable PET bottles and compostable alternatives in response to sustainability trends .

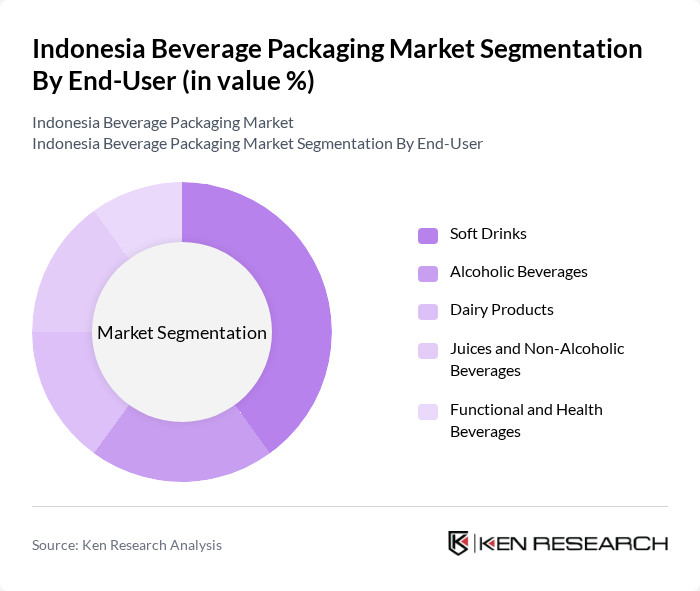

By End-User:The beverage packaging market is segmented by end-user into Soft Drinks, Alcoholic Beverages, Dairy Products, Juices and Non-Alcoholic Beverages, and Functional and Health Beverages. Each segment reflects the diverse preferences of consumers and the growing trend towards health-conscious products. The rise in functional beverages and plant-based drinks is driving the need for specialized packaging solutions that offer enhanced protection and shelf appeal .

The Soft Drinks segment is the leading sub-segment in the beverage packaging market, driven by the high consumption rates of carbonated and non-carbonated drinks among consumers. The increasing trend of on-the-go consumption and the popularity of convenience packaging have significantly contributed to the growth of this segment. Additionally, the introduction of innovative flavors and healthier options in the soft drinks category has further enhanced its market presence. The segment also benefits from the expansion of e-commerce and direct-to-consumer channels, which require robust and attractive packaging solutions .

The Indonesia Beverage Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak Indonesia, Amcor Indonesia, Coca-Cola Amatil Indonesia, Danone Indonesia, Nestlé Indonesia, Unilever Indonesia, Oji Fibre Solutions Indonesia, Mondi Indonesia, Ball Corporation Indonesia, Huhtamäki Indonesia, Sealed Air Indonesia, Smurfit Kappa Indonesia, Berry Global Indonesia, Crown Holdings Indonesia, PT. Trias Sentosa Tbk, PT. Indah Kiat Pulp & Paper Tbk, PT. Sinar Sosro, PT. Mayora Indah Tbk, PT. Indofood Sukses Makmur Tbk, PT. Garudafood Putra Putri Jaya Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian beverage packaging market appears promising, driven by a strong emphasis on sustainability and technological innovation. As consumer preferences continue to evolve, companies are likely to invest in advanced packaging solutions that enhance product safety and environmental responsibility. The integration of smart packaging technologies is expected to gain traction, providing brands with opportunities to engage consumers more effectively. Additionally, the collaboration between packaging manufacturers and beverage producers will foster customized solutions that meet specific market demands, further propelling growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Plastic (PET, HDPE, LDPE) Glass Metal (Aluminum, Steel) Paperboard Others (Flexible, Composite) |

| By End-User | Soft Drinks Alcoholic Beverages Dairy Products Juices and Non-Alcoholic Beverages Functional and Health Beverages |

| By Material | Recyclable Materials Biodegradable Materials Composite Materials Others |

| By Design | Rigid Packaging Flexible Packaging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Specialty Beverage Shops Foodservice and Vending |

| By Region | Java Sumatra Bali Kalimantan Others |

| By Application | Retail Packaging Bulk Packaging Industrial Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Soft Drink Packaging Trends | 120 | Product Managers, Marketing Directors |

| Alcoholic Beverage Packaging Innovations | 100 | Brand Managers, Packaging Engineers |

| Dairy and Juice Packaging Solutions | 80 | Operations Managers, Quality Assurance Heads |

| Eco-friendly Packaging Initiatives | 70 | Sustainability Officers, R&D Managers |

| Retail Packaging Preferences | 90 | Retail Buyers, Supply Chain Managers |

The Indonesia Beverage Packaging Market is valued at approximately USD 132.5 billion, driven by increasing demand for packaged beverages, urbanization, and consumer preferences for convenience and ready-to-drink products.