Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3927

Pages:96

Published On:November 2025

By Type:The market is segmented into various types of self-defense products, including personal alarms, pepper sprays, self-defense keychains, stun guns, tactical flashlights, folding knives & multi-tools, tactical gloves, batons, and others. Among these, personal alarms and pepper sprays are particularly popular due to their ease of use and effectiveness in emergency situations. The growing trend of personal safety awareness has led to increased adoption of these products, especially among women and urban dwellers. The market is also witnessing the introduction of smart alarms and connected devices, reflecting a preference for innovative and discreet self-defense solutions .

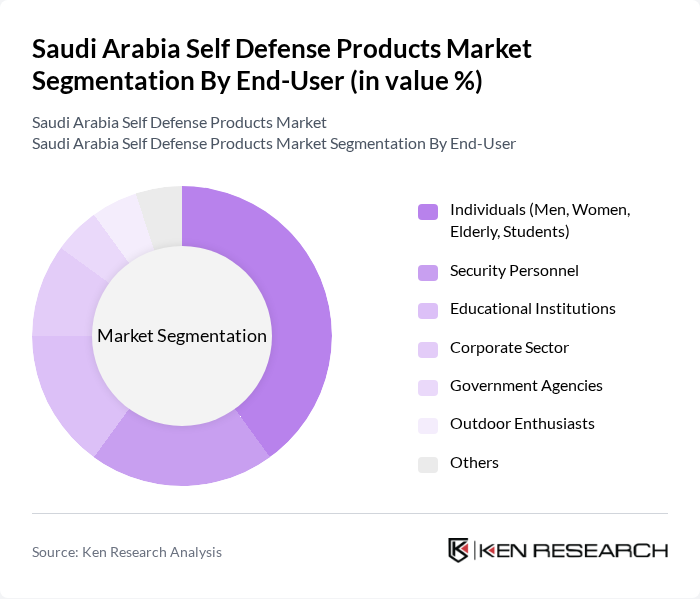

By End-User:The self-defense products market serves a diverse range of end-users, including individuals (men, women, elderly, students), security personnel, educational institutions, the corporate sector, government agencies, outdoor enthusiasts, and others. Among these, individuals, particularly women and students, represent the largest segment due to heightened concerns about personal safety. The increasing number of self-defense workshops and educational programs in schools and universities further drives the demand for these products. There is also a growing emphasis on personal safety in the workplace and among outdoor enthusiasts, reflecting broader adoption across end-user categories .

The Saudi Arabia Self Defense Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Military Industries (SAMI), Sabre – Security Equipment Corporation, Axon Enterprise, Inc., Al-Tamimi Group, Al-Jomaih Holding Company, Beretta Holding S.A., Victorinox AG, Al-Babtain Trading Company, Al-Hokair Group, Al-Suwaidi Industrial Services, Kimber Manufacturing, Inc., Al-Fahad Security Systems, Axon Middle East, Al-Muhaidib Group, and Al-Salam Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the self-defense products market in Saudi Arabia appears promising, driven by increasing urbanization and a growing focus on personal safety. As urban areas expand, the demand for effective self-defense solutions is expected to rise. Additionally, the integration of technology in self-defense products, such as smart devices, will likely attract tech-savvy consumers. Furthermore, collaboration with law enforcement agencies can enhance product credibility and encourage wider adoption among the public, fostering a safer environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Alarms Pepper Sprays Self Defense Keychains Stun Guns Tactical Flashlights Folding Knives & Multi-tools Tactical Gloves Batons (Expandable, Fixed, Telescopic) Others (e.g., Kubotans, Whistles, Self-defense Whips) |

| By End-User | Individuals (Men, Women, Elderly, Students) Security Personnel Educational Institutions Corporate Sector Government Agencies Outdoor Enthusiasts Others |

| By Distribution Channel | Online Retail Specialty Stores Supermarkets/Hypermarkets Direct Sales Others (e.g., Convenience Stores, Sports Retail Stores) |

| By Price Range | Low-End Products Mid-Range Products High-End Products Luxury Products Others |

| By Brand Type | Local Brands International Brands Private Labels Others |

| By Product Usage | Everyday Carry Home Defense Travel Safety Outdoor Activities Others |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Self-Defense Products | 150 | Store Managers, Sales Representatives |

| Consumer Awareness and Preferences | 150 | General Public, Self-Defense Enthusiasts |

| Law Enforcement Equipment Usage | 100 | Police Officers, Security Personnel |

| Training and Education Programs | 80 | Instructors, Training Coordinators |

| Market Trends and Innovations | 120 | Industry Experts, Product Developers |

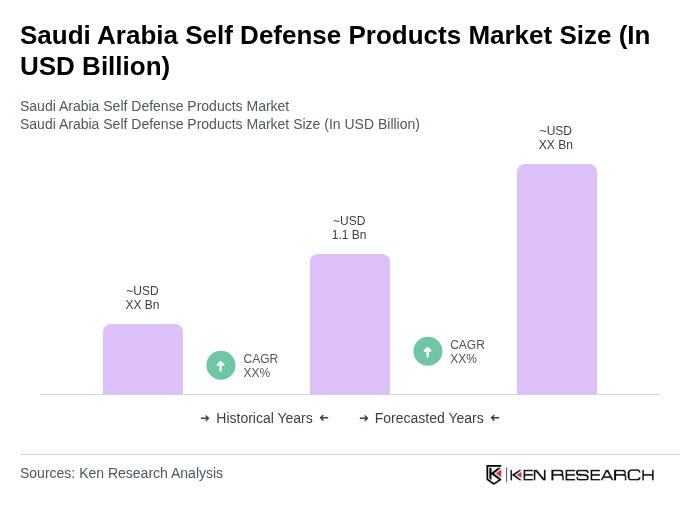

The Saudi Arabia Self Defense Products Market is valued at approximately USD 1.1 billion, reflecting a significant increase in demand for personal safety solutions driven by heightened security concerns and government initiatives promoting self-defense education.