Region:Middle East

Author(s):Rebecca

Product Code:KRAC1067

Pages:98

Published On:October 2025

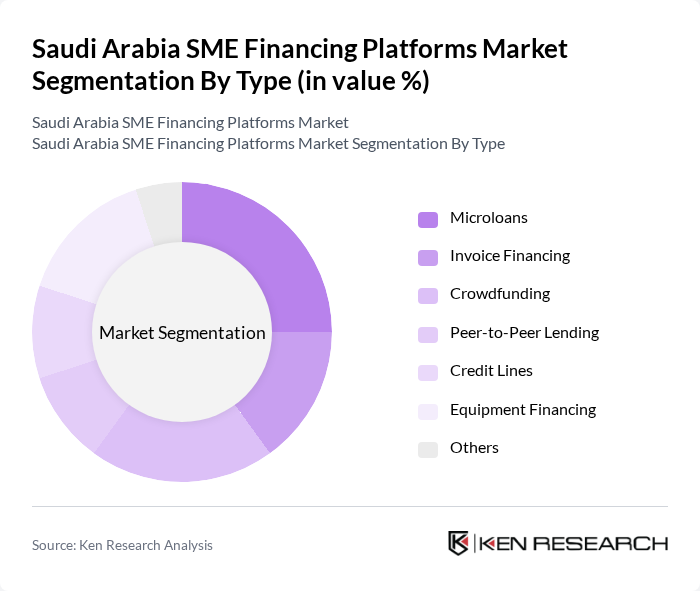

By Type:The market is segmented into various types of digital financing options available for SMEs, including microloans, invoice financing, crowdfunding, peer-to-peer lending, credit lines, equipment financing, and others. Each of these sub-segments caters to different financial needs and preferences of SMEs, addressing challenges related to collateral-based lending models and enabling asset-light, service-oriented businesses to access capital more effectively.

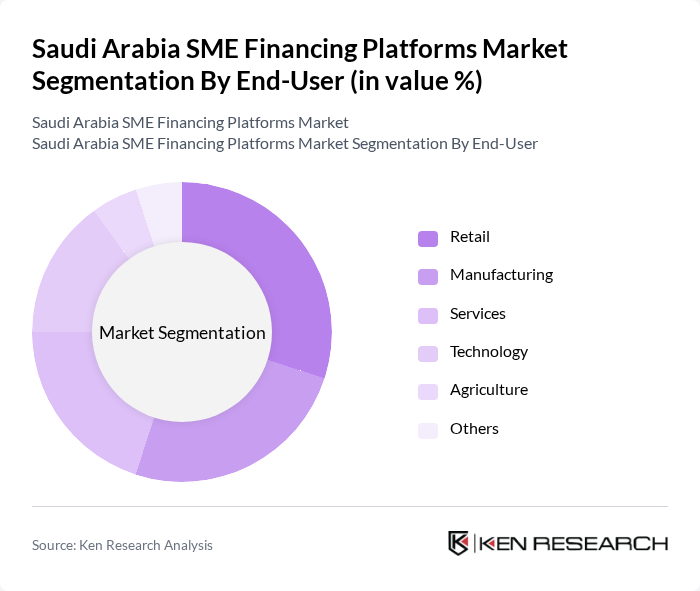

By End-User:The end-user segmentation includes various sectors that utilize SME financing platforms, such as retail, manufacturing, services, technology, agriculture, and others. Each sector has unique financing requirements, with technology and digital media sectors increasingly demanding alternatives to traditional collateral-based models, while retail and manufacturing continue requiring working capital and equipment financing solutions.

The Saudi Arabia SME Financing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alinma Bank, Riyad Bank, Saudi British Bank (SABB), Arab National Bank, Saudi National Bank (SNB), Banque Saudi Fransi, Al Rajhi Bank, STC Pay, Tamweelcom, Kiva, Funding Circle, Beehive, Lendo, Raqamyah, Fintech Saudi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SME financing platforms market in Saudi Arabia appears promising, driven by ongoing digital transformation and government support. As the adoption of fintech solutions continues to rise, SMEs will increasingly benefit from innovative financing options tailored to their needs. Furthermore, the collaboration between private sector players and government initiatives is expected to enhance the overall ecosystem, fostering a more inclusive financial environment that empowers SMEs to thrive and contribute to economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Microloans Invoice Financing Crowdfunding Peer-to-Peer Lending Credit Lines Equipment Financing Others |

| By End-User | Retail Manufacturing Services Technology Agriculture Others |

| By Business Size | Micro Enterprises Small Enterprises Medium Enterprises Others |

| By Financing Purpose | Working Capital Equipment Purchase Expansion Projects Inventory Financing Others |

| By Distribution Channel | Online Platforms Direct Sales Partnerships with Banks Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Focus Others |

| By Risk Profile | Low Risk Medium Risk High Risk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Owners in Retail Sector | 150 | Business Owners, Financial Managers |

| Fintech Platforms Offering SME Loans | 100 | Product Managers, Business Development Executives |

| Traditional Banks Providing SME Financing | 80 | Relationship Managers, Credit Analysts |

| Government Agencies Supporting SMEs | 50 | Policy Makers, Economic Development Officers |

| Consultants Specializing in SME Financing | 70 | Financial Advisors, Market Analysts |

The Saudi Arabia SME Financing Platforms Market is valued at approximately USD 5.3 billion, reflecting significant growth driven by government initiatives and the increasing importance of SMEs in the economy.