Region:Middle East

Author(s):Rebecca

Product Code:KRAC1221

Pages:86

Published On:October 2025

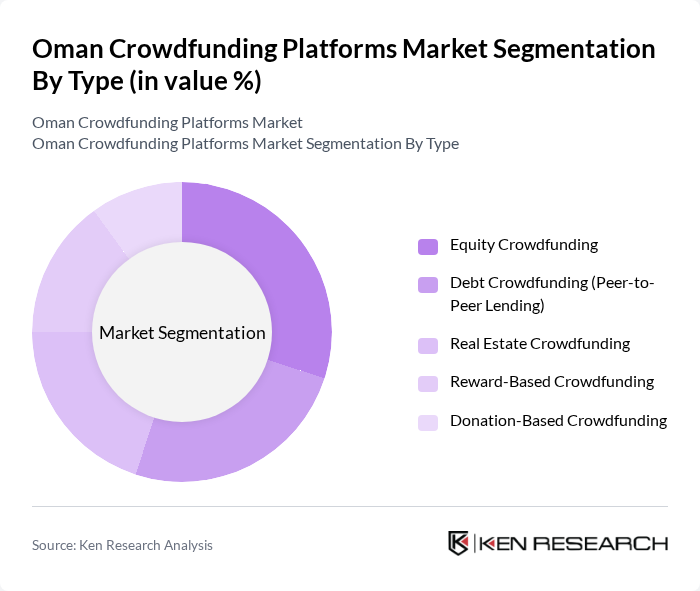

By Type:The crowdfunding platforms in Oman can be categorized into several types, including Equity Crowdfunding, Debt Crowdfunding (Peer-to-Peer Lending), Real Estate Crowdfunding, Reward-Based Crowdfunding, and Donation-Based Crowdfunding. Each type serves distinct purposes and attracts various investor profiles, contributing to the overall growth of the market. Equity and debt crowdfunding platforms are primarily used by startups and SMEs seeking capital for expansion, while real estate crowdfunding targets property developers and investors. Reward-based and donation-based models are favored by individual entrepreneurs and non-profit organizations for project-based and charitable initiatives .

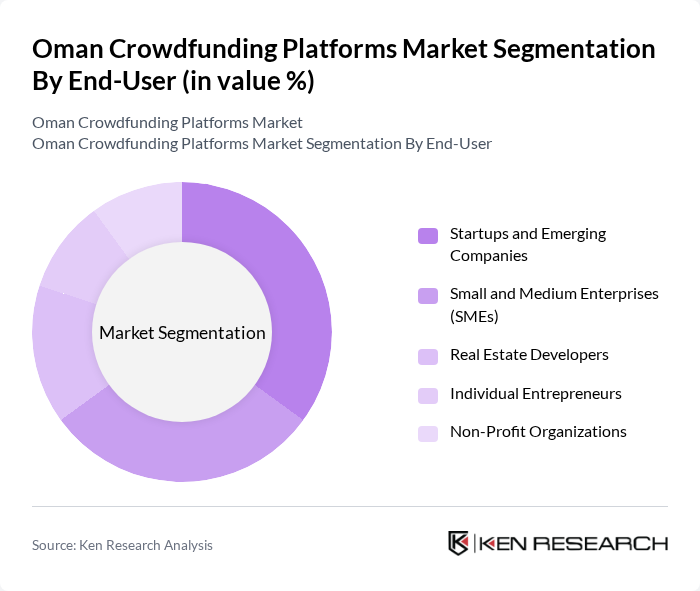

By End-User:The end-users of crowdfunding platforms in Oman include Startups and Emerging Companies, Small and Medium Enterprises (SMEs), Real Estate Developers, Individual Entrepreneurs, and Non-Profit Organizations. Startups and SMEs utilize crowdfunding for seed and growth capital, real estate developers for project financing, individual entrepreneurs for innovation-driven ventures, and non-profit organizations for fundraising and social impact projects .

The Oman Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, Eureeca, Zoomaal, Wadiaa, FundedHere, Aflamnah, Shekra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crowdfunding market in Oman appears promising, driven by increasing digital adoption and supportive government initiatives. As more entrepreneurs recognize the potential of crowdfunding, the market is likely to expand significantly. Additionally, the integration of advanced technologies, such as blockchain, will enhance transparency and security, attracting more investors. With a focus on sustainability and social impact, crowdfunding platforms can tap into new demographics, further diversifying their funding sources and fostering innovation in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Crowdfunding Debt Crowdfunding (Peer-to-Peer Lending) Real Estate Crowdfunding Reward-Based Crowdfunding Donation-Based Crowdfunding |

| By End-User | Startups and Emerging Companies Small and Medium Enterprises (SMEs) Real Estate Developers Individual Entrepreneurs Non-Profit Organizations |

| By Investment Source | Qualified Individual Investors Institutional Investors Retail Investors Family Offices |

| By Platform Type | Web-Based Platforms Mobile Applications Hybrid Platforms |

| By Industry Focus | Technology and Fintech Logistics and Transportation Oil and Gas Services Healthcare and Medical Services Education and Training Real Estate and Construction Tourism and Hospitality |

| By Geographic Focus | Muscat and Greater Capital Area Regional Governorates Pan-GCC Projects |

| By Regulatory Compliance Level | FSA-Licensed Platforms International Platforms Operating in Oman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Startup Founders Utilizing Crowdfunding | 60 | Entrepreneurs, Business Owners |

| Investors in Crowdfunding Platforms | 50 | Angel Investors, Venture Capitalists |

| Regulatory Bodies and Financial Institutions | 40 | Policy Makers, Financial Analysts |

| Users of Crowdfunding Platforms | 90 | General Public, Potential Backers |

| Advisors and Mentors in the Startup Ecosystem | 45 | Business Consultants, Incubator Managers |

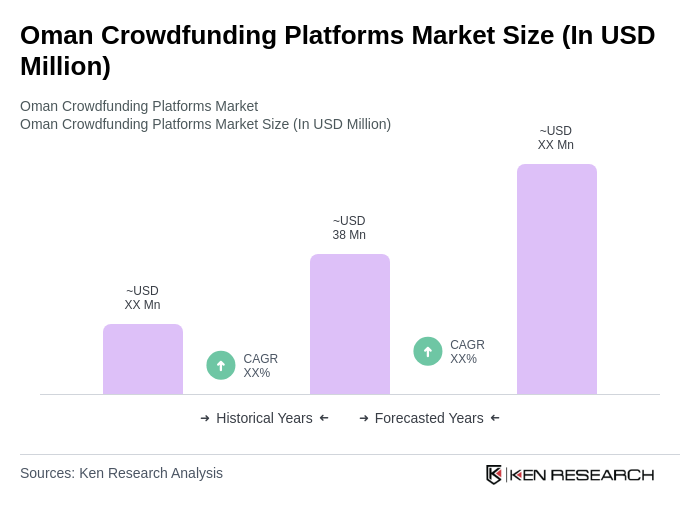

The Oman Crowdfunding Platforms Market is valued at approximately USD 38 million, based on a five-year historical analysis and the latest reported total financing of RO 14.9 million by Q2 2025.