Region:Middle East

Author(s):Rebecca

Product Code:KRAC0225

Pages:100

Published On:August 2025

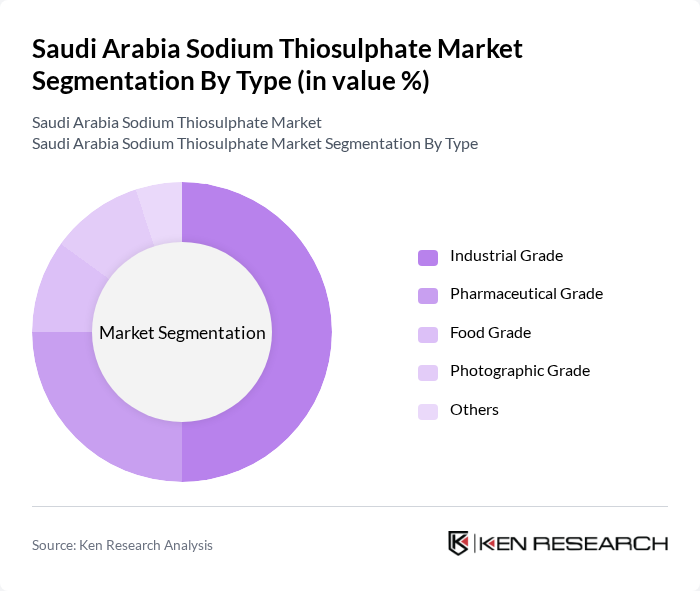

By Type:

The sodium thiosulphate market can be segmented into various types, including Industrial Grade, Pharmaceutical Grade, Food Grade, Photographic Grade, and Others. Among these, the Industrial Grade segment is the most dominant due to its extensive use in water treatment, gold extraction, and chemical manufacturing applications. The increasing industrial activities and the need for effective chemical solutions in sectors such as mining and water treatment have led to a higher consumption of industrial-grade sodium thiosulphate. The Pharmaceutical Grade segment is also witnessing significant growth, driven by the rising demand for sodium thiosulphate in medical applications, including as an antidote for cyanide poisoning and in dialysis solutions .

By End-User:

The end-user segmentation of the sodium thiosulphate market includes Water Treatment Facilities and Municipalities, Mining Industry, Agriculture Sector, Healthcare and Pharmaceutical Companies, Photography Studios and Printing Facilities, Chemical Manufacturing, and Others. The Water Treatment Facilities and Municipalities segment holds the largest share, driven by the increasing need for effective dechlorination methods in municipal water systems and the expansion of water infrastructure projects. The Mining Industry also significantly contributes to the market, as sodium thiosulphate is widely used in gold extraction processes as a safer alternative to cyanide. The Healthcare and Pharmaceutical Companies segment is growing due to the rising demand for pharmaceutical-grade sodium thiosulphate in medical and clinical applications .

The Saudi Arabia Sodium Thiosulphate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Fouz Chemical Company, Saudi (Overseas) Marketing & Trading Company (SOMATCO), AquaChemie Middle East, Chemsol, Al-Jubail Chemical Industries Company (JANA), National Chemical Company (NCC), Arabian Chemical Company Ltd. (ACC), Saudi Industrial Chemical Company (SICCO), Al-Falak Chemical Company, Saudi Arabian Mining Company (Ma'aden), Al-Suwaidi Industrial Services Co. Ltd., Al-Khodari & Sons Company, Al-Rajhi Holding Group, and Al-Babtain Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sodium thiosulphate market in Saudi Arabia appears promising, driven by increasing investments in water treatment and mining sectors. As the government continues to prioritize sustainable practices, the demand for environmentally friendly chemicals like sodium thiosulphate is expected to rise. Additionally, technological advancements in production methods will likely enhance efficiency and reduce costs, further supporting market growth. The focus on local production and strategic partnerships will also play a crucial role in shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade Food Grade Photographic Grade Others |

| By End-User | Water Treatment Facilities and Municipalities Mining Industry Agriculture Sector Healthcare and Pharmaceutical Companies Photography Studios and Printing Facilities Chemical Manufacturing Others |

| By Application | Dechlorination (Water & Wastewater Treatment) Gold Extraction Photographic Processing Medical Applications Chemical Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bulk Packaging Small Packaging Custom Packaging |

| By Pricing Strategy | Competitive Pricing Premium Pricing Discount Pricing |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Jubail) Western Region (Jeddah, Makkah) Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Water Treatment Facilities | 100 | Plant Managers, Environmental Compliance Officers |

| Pharmaceutical Manufacturers | 60 | Production Supervisors, Quality Control Managers |

| Photography and Imaging Companies | 40 | Product Managers, Supply Chain Coordinators |

| Industrial Chemical Distributors | 80 | Sales Managers, Logistics Coordinators |

| Research Institutions and Universities | 50 | Research Scientists, Academic Professors |

The Saudi Arabia Sodium Thiosulphate Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand in water treatment, gold extraction, and various industrial applications.