Region:Global

Author(s):Rebecca

Product Code:KRAA2449

Pages:93

Published On:August 2025

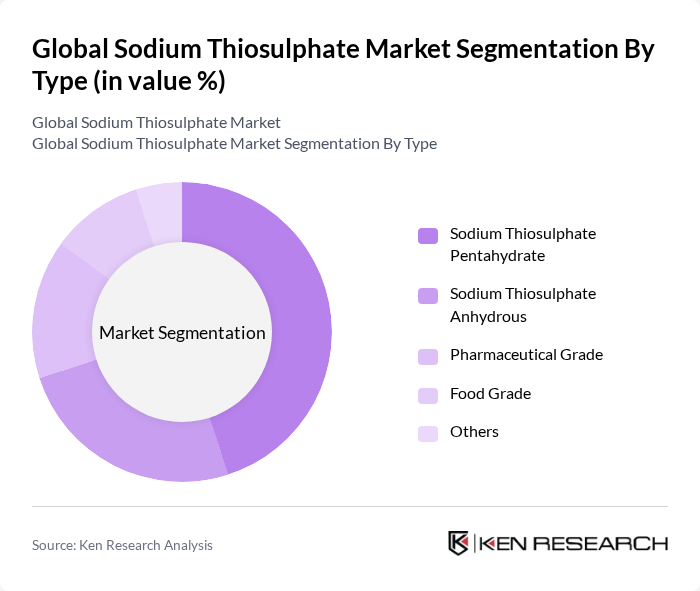

By Type:The sodium thiosulphate market is segmented into Sodium Thiosulphate Pentahydrate, Sodium Thiosulphate Anhydrous, Pharmaceutical Grade, Food Grade, and Others. Sodium Thiosulphate Pentahydrate is the most widely used form due to its high solubility and effectiveness in water treatment and gold extraction. Pharmaceutical grade is gaining traction for use in medical applications such as treatment of calciphylaxis and cyanide poisoning, while food grade is increasingly utilized in the food and beverage industry .

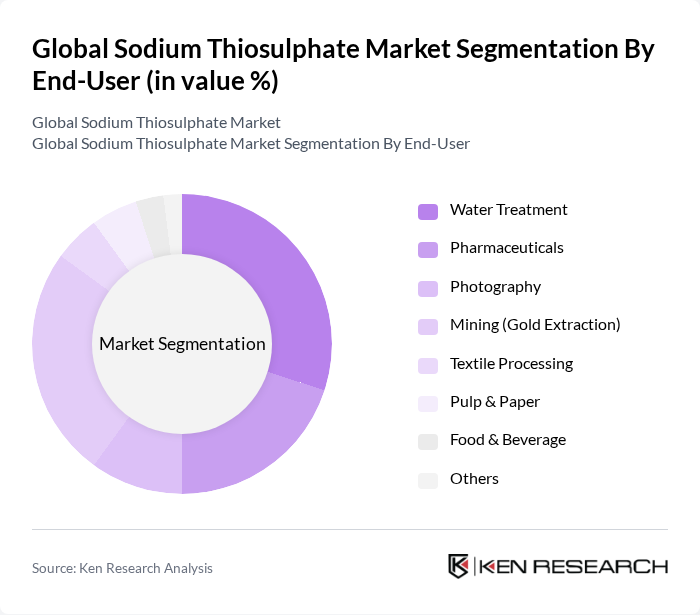

By End-User:The end-user segmentation includes Water Treatment, Pharmaceuticals, Photography, Mining (Gold Extraction), Textile Processing, Pulp & Paper, Food & Beverage, and Others. The mining sector, particularly gold extraction, remains a leading end-user due to sodium thiosulphate's critical role in cyanide detoxification. Water treatment is also a significant segment, driven by the increasing need for effective dechlorination methods in municipal and industrial applications. Pharmaceutical applications are expanding, especially for treating calciphylaxis and cyanide poisoning .

The Global Sodium Thiosulphate Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, INEOS Group Limited, Solvay S.A., Aditya Birla Chemicals, TATA Chemicals Limited, FBC Industries, Inc., GFS Chemicals, Inc., Hubei Yihua Chemical Industry Co., Ltd., Jiangshan Chemical Co., Ltd., Shandong Jinling Chemical Co., Ltd., Hubei Shuanghuan Science and Technology Co., Ltd., Jiangsu Huachang Chemical Co., Ltd., Liyang Qingfeng Fine Chemical Co., Ltd., Changsha Weichuang Chemical Co., Ltd., Nissei Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sodium thiosulphate market appears promising, driven by increasing applications across various sectors, particularly in water treatment and pharmaceuticals. As environmental concerns rise, the demand for sustainable and eco-friendly chemicals is expected to grow. Innovations in production technologies and strategic partnerships will likely enhance market competitiveness. Additionally, emerging economies are anticipated to present significant growth opportunities, as industrialization and urbanization drive demand for water treatment solutions and pharmaceuticals.

| Segment | Sub-Segments |

|---|---|

| By Type | Sodium Thiosulphate Pentahydrate Sodium Thiosulphate Anhydrous Pharmaceutical Grade Food Grade Others |

| By End-User | Water Treatment Pharmaceuticals Photography Mining (Gold Extraction) Textile Processing Pulp & Paper Food & Beverage Others |

| By Application | Dechlorination Chemical Synthesis Wastewater Treatment Cyanide Antidote Gold Leaching Photographic Fixer Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging Small Packaging Others |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 60 | R&D Managers, Quality Assurance Officers |

| Water Treatment Facilities | 50 | Environmental Engineers, Operations Supervisors |

| Photography Industry | 40 | Product Managers, Supply Chain Coordinators |

| Industrial Chemical Suppliers | 55 | Sales Directors, Procurement Managers |

| Research Institutions | 45 | Research Scientists, Laboratory Managers |

The Global Sodium Thiosulphate Market is valued at approximately USD 170 million, reflecting significant growth driven by its applications in water treatment, pharmaceuticals, and mining, particularly in gold extraction processes.