Region:Middle East

Author(s):Dev

Product Code:KRAC1336

Pages:98

Published On:December 2025

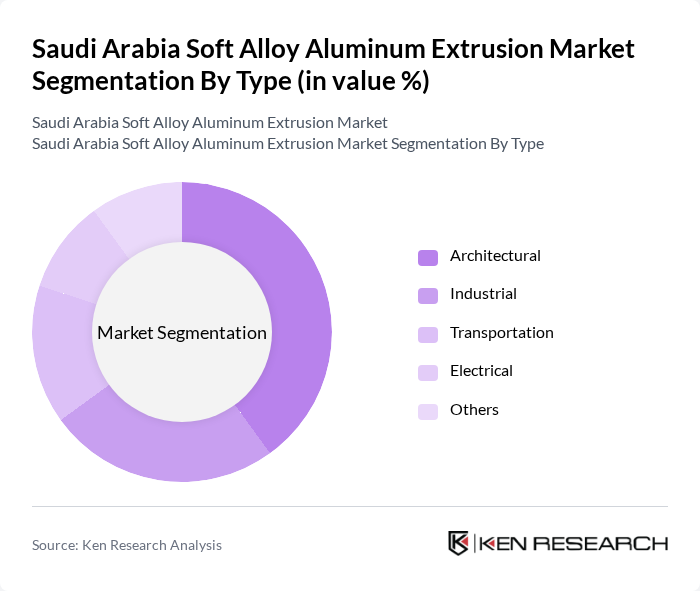

By Type:The market is segmented into various types, including Architectural, Industrial, Transportation, Electrical, and Others. Among these, the Architectural segment is currently dominating the market due to the rapid growth in construction activities and the increasing demand for aesthetically pleasing and functional building materials. The trend towards sustainable and energy-efficient buildings further drives the demand for aluminum extrusions in architectural applications.

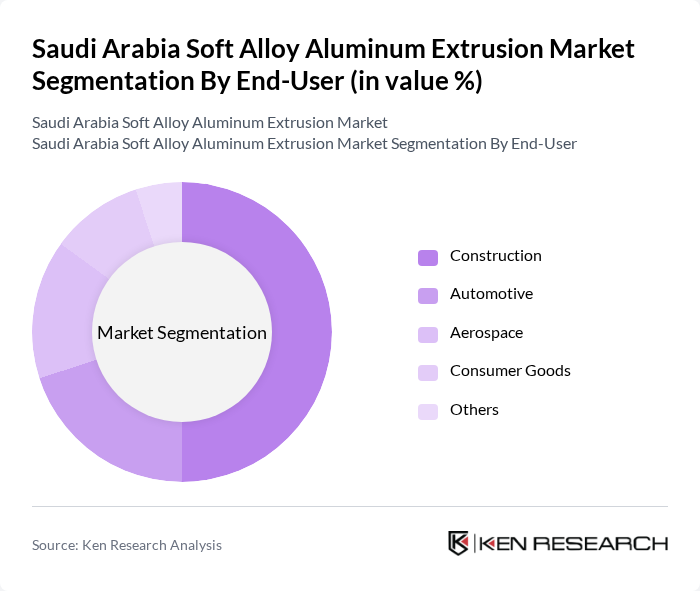

By End-User:The end-user segmentation includes Construction, Automotive, Aerospace, Consumer Goods, and Others. The Construction sector is the leading end-user, driven by the ongoing urbanization and infrastructure projects in Saudi Arabia. The demand for lightweight and durable materials in construction applications is propelling the growth of aluminum extrusions, particularly in high-rise buildings and commercial complexes.

The Saudi Arabia Soft Alloy Aluminum Extrusion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Extrusions Factory Co., Alupco (Aluminum Products Company), Gulf Extrusions Co. LLC, Al-Falak Al-Masriya, Al-Babtain Group, Al-Muhaidib Group, Al-Jazira Factories for Steel Products, Al-Rajhi Group, Al-Faisal Holding, Al-Muhaidib & Sons, Al-Suwaidi Industrial Services Co., Al-Hokair Group, Al-Mansour Group, Al-Salam International, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Saudi Arabia soft alloy aluminum extrusion market appears promising, driven by significant investments in renewable energy and infrastructure. The government’s commitment to expanding solar energy capacity, with SAR 12.3 billion allocated for photovoltaic projects, will likely enhance demand for aluminum components. Additionally, the establishment of new industrial facilities, such as the Kirby facility, indicates a growing capacity for production and export, positioning the market for further growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Architectural Industrial Transportation Electrical Others |

| By End-User | Construction Automotive Aerospace Consumer Goods Others |

| By Application | Structural Components Heat Exchangers Packaging Decorative Elements Others |

| By Product Form | Bars and Rods Sheets and Plates Tubes and Pipes Profiles Others |

| By Manufacturing Process | Direct Extrusion Indirect Extrusion Hydrostatic Extrusion Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Aluminum Usage | 100 | Project Managers, Procurement Officers |

| Automotive Industry Extrusion Applications | 80 | Manufacturing Engineers, Supply Chain Managers |

| Packaging Industry Trends | 70 | Product Development Managers, Quality Assurance Heads |

| Consumer Electronics Manufacturing | 60 | Operations Managers, R&D Directors |

| Export Market Dynamics | 90 | Export Managers, Trade Compliance Officers |

The Saudi Arabia Soft Alloy Aluminum Extrusion Market is valued at approximately USD 875 million, reflecting a robust growth trajectory driven by urbanization and significant infrastructure projects like NEOM and the Red Sea development.