Region:Middle East

Author(s):Shubham

Product Code:KRAE0355

Pages:100

Published On:December 2025

By Type:The building materials market is segmented into various types, including cement, aggregates, bricks and blocks, insulation materials, steel and metal products, wood and wood products, and others. Among these, cement and insulation materials are particularly dominant due to their essential roles in construction and energy efficiency. Cement is crucial for structural integrity, while insulation materials are increasingly sought after for their energy-saving properties, driven by regulatory mandates and consumer preferences for sustainable building practices.

By End-User:The market is also segmented by end-user categories, including residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by increasing urbanization and population growth, leading to a surge in housing demand. The commercial sector follows closely, fueled by ongoing investments in infrastructure and commercial real estate development, particularly in major cities across the region.

The Middle East Building Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Cement Company, Arabian Cement Company, LafargeHolcim, Al Jazeera Steel Products Co., Qatar National Cement Company, Oman Cement Company, Emirates Cement Company, CEMEX Holdings Philippines, Inc., National Cement Company, Boral Limited, Sika AG, Knauf Insulation, Saint-Gobain, Holcim Group, Gypsemna contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East building materials market is poised for significant transformation driven by technological advancements and sustainability initiatives. As urbanization accelerates, the demand for innovative building solutions will rise, particularly in smart construction technologies. Additionally, the integration of AI in supply chain management is expected to enhance efficiency and reduce costs. With a growing emphasis on eco-friendly materials, the market is likely to witness a shift towards sustainable practices, aligning with global trends and local government policies aimed at reducing environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Cement Aggregates Bricks and Blocks Insulation Materials Steel and Metal Products Wood and Wood Products Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Application | Residential Construction Commercial Construction Infrastructure Projects Renovation and Retrofitting Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| By Sustainability Initiatives | Green Certifications Waste Management Practices Energy Efficiency Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Materials | 150 | Contractors, Builders, Architects |

| Commercial Building Supplies | 100 | Project Managers, Procurement Officers |

| Infrastructure Development Materials | 80 | Government Officials, Civil Engineers |

| Green Building Materials | 70 | Sustainability Consultants, Product Developers |

| Prefabricated Construction Components | 90 | Manufacturers, Supply Chain Managers |

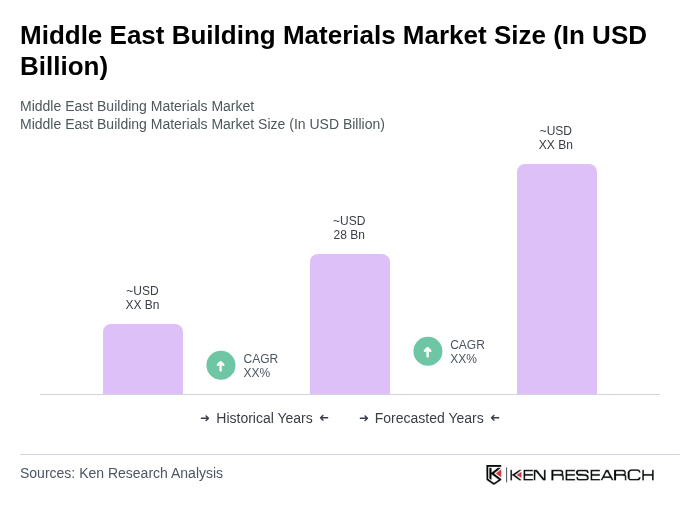

The Middle East Building Materials Market is valued at approximately USD 28 billion. This valuation reflects the growing demand driven by rapid urbanization and large-scale infrastructure projects across the region.