Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4119

Pages:92

Published On:December 2025

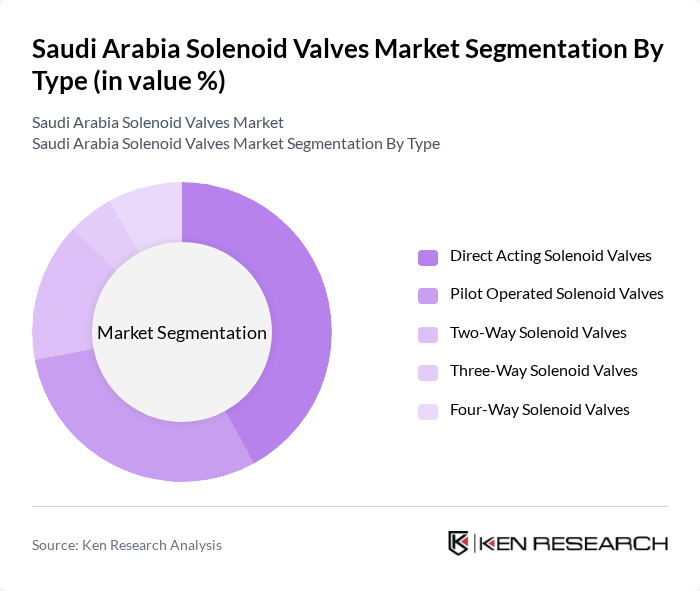

By Type:The solenoid valves market can be segmented into various types, including Direct Acting Solenoid Valves, Pilot Operated Solenoid Valves, Two-Way Solenoid Valves, Three-Way Solenoid Valves, and Four-Way Solenoid Valves. Among these, Direct Acting Solenoid Valves are leading the market due to their simplicity and reliability in various applications. They are widely used in low-pressure systems and are favored for their quick response times and ease of installation. Pilot Operated Solenoid Valves are also gaining traction, especially in high-pressure applications, due to their efficiency and ability to handle larger flow rates.

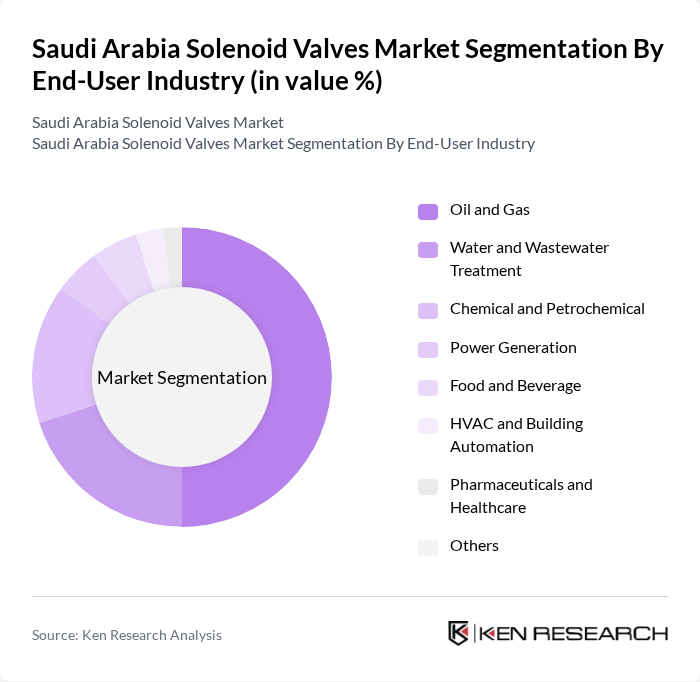

By End-User Industry:The solenoid valves market is segmented by end-user industries, including Oil and Gas, Water and Wastewater Treatment, Chemical and Petrochemical, Power Generation, Food and Beverage, HVAC and Building Automation, Pharmaceuticals and Healthcare, and Others. The Oil and Gas sector is the dominant segment, driven by the extensive use of solenoid valves in exploration, production, and refining processes. The Water and Wastewater Treatment industry is also significant, as increasing environmental regulations push for better management of water resources.

The Saudi Arabia Solenoid Valves Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co. (ASCO), Parker Hannifin Corporation, Honeywell International Inc., SMC Corporation, Bürkert Fluid Control Systems, Danfoss A/S, Siemens AG, Schneider Electric SE, Festo SE & Co. KG, AVK Holding A/S, KSB SE & Co. KGaA, Rotork plc, Metso Corporation, Auma Riester GmbH & Co. KG, Local and Regional Saudi Distributors and System Integrators contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia solenoid valves market appears promising, driven by technological advancements and a strong focus on sustainability. As industries increasingly adopt smart technologies, the integration of IoT in valve systems is expected to enhance operational efficiency and monitoring capabilities. Furthermore, the government's commitment to renewable energy projects will likely create new opportunities for solenoid valve applications, fostering innovation and growth in the market landscape over the next few years.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct Acting Solenoid Valves Pilot Operated Solenoid Valves Two-Way Solenoid Valves Three-Way Solenoid Valves Four-Way Solenoid Valves |

| By End-User Industry | Oil and Gas Water and Wastewater Treatment Chemical and Petrochemical Power Generation Food and Beverage HVAC and Building Automation Pharmaceuticals and Healthcare Others |

| By Application | Process Control and Automation Systems Fluid and Gas Handling Systems Safety and Emergency Shutdown Systems Irrigation and Water Distribution Others |

| By Material | Brass Stainless Steel Aluminum Plastic and Engineered Polymers Others |

| By Pressure Rating | Low Pressure Medium Pressure High Pressure Ultra-High Pressure |

| By Voltage | AC Solenoid Valves DC Solenoid Valves Low-Voltage and Energy-Efficient Solenoid Valves Others |

| By Control Type | On/Off Control Proportional Control Remote and IoT-Enabled Control Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Applications | 110 | Procurement Managers, Operations Engineers |

| HVAC Systems Integration | 85 | System Designers, Project Managers |

| Water Treatment Facilities | 75 | Facility Managers, Process Engineers |

| Manufacturing Automation | 95 | Production Managers, Maintenance Supervisors |

| Research & Development in Valve Technology | 65 | R&D Engineers, Product Development Managers |

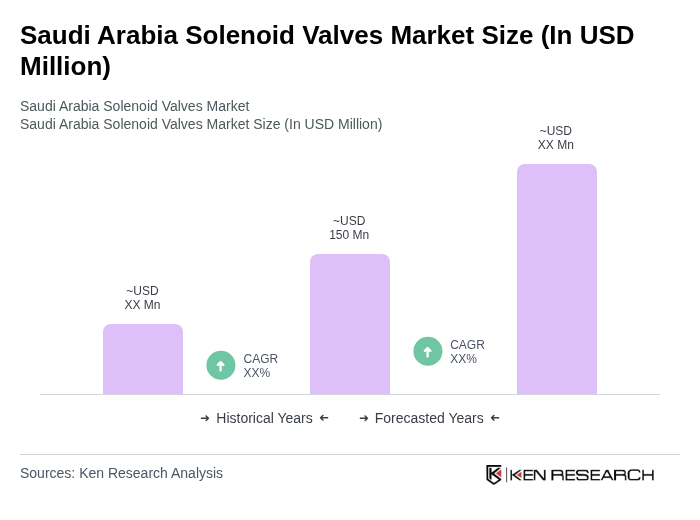

The Saudi Arabia Solenoid Valves Market is valued at approximately USD 150 million, driven by increasing automation demands and the expansion of the oil and gas sector, which significantly utilizes solenoid valves for fluid control systems.