Region:Asia

Author(s):Geetanshi

Product Code:KRAC3840

Pages:96

Published On:October 2025

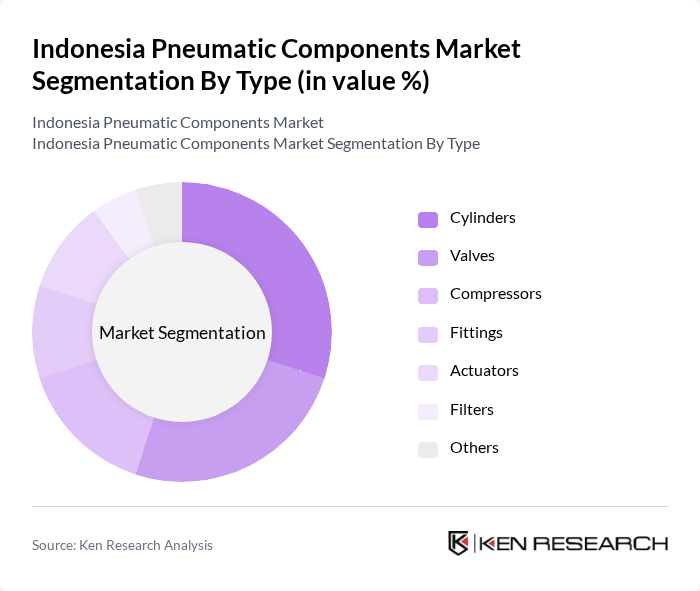

By Type:The pneumatic components market can be segmented into various types, including cylinders, valves, compressors, fittings, actuators, filters, and others. Among these, cylinders and valves are the most widely used due to their essential roles in automation and control systems. The demand for these components is driven by their application in various industries, including automotive and manufacturing, where efficiency and reliability are paramount.

By End-User:The end-user segmentation of the pneumatic components market includes automotive, food and beverage, pharmaceuticals, electronics, construction, and others. The automotive sector is the leading end-user, driven by the increasing demand for automation in vehicle manufacturing and assembly processes. Additionally, the food and beverage industry is witnessing significant growth due to the need for efficient packaging and processing solutions.

The Indonesia Pneumatic Components Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Festo Indonesia, PT. SMC Pneumatics Indonesia, PT. Parker Hannifin Indonesia, PT. Bosch Rexroth Indonesia, PT. AIRTAC Indonesia, PT. Camozzi Indonesia, PT. Norgren Indonesia, PT. Bimba Manufacturing Company, PT. Aignep Indonesia, PT. Pneumax Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia pneumatic components market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt smart manufacturing practices, the integration of IoT in pneumatic systems is expected to enhance operational efficiency. Additionally, the shift towards eco-friendly solutions will likely create new avenues for growth, as companies seek to comply with environmental regulations and meet consumer demand for sustainable products.

| Segment | Sub-Segments |

|---|---|

| By Type | Cylinders Valves Compressors Fittings Actuators Filters Others |

| By End-User | Automotive Food and Beverage Pharmaceuticals Electronics Construction Others |

| By Application | Assembly Lines Material Handling Packaging Robotics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Component | Pneumatic Tubing Pneumatic Hoses Pneumatic Connectors Pneumatic Actuators Others |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Standard Pneumatic Technology Smart Pneumatic Technology Energy-Efficient Pneumatic Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing | 50 | Production Managers, Engineering Leads |

| Food Processing Industry | 40 | Quality Control Managers, Operations Supervisors |

| Pharmaceutical Manufacturing | 40 | Process Engineers, Compliance Officers |

| Textile Manufacturing | 40 | Plant Managers, Supply Chain Coordinators |

| General Manufacturing | 50 | Maintenance Managers, Procurement Specialists |

The Indonesia Pneumatic Components Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing automation demands across various sectors, including manufacturing and automotive.