Region:Middle East

Author(s):Dev

Product Code:KRAD5084

Pages:83

Published On:December 2025

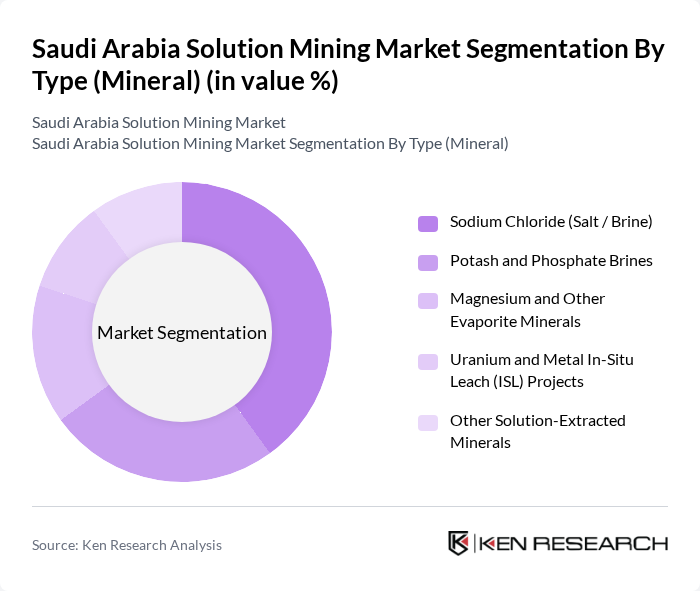

By Type (Mineral):The solution mining market is segmented into various types of minerals, including sodium chloride (salt/brine), potash and phosphate brines, magnesium and other evaporite minerals, uranium and metal in-situ leach (ISL) projects, and other solution-extracted minerals. Each of these subsegments plays a crucial role in meeting the diverse needs of industries such as agriculture, chemicals, and energy, with industrial salts and brines particularly important as feedstocks for chlor-alkali, water treatment, and downstream petrochemical chains in Saudi Arabia’s industrial cities.

The sodium chloride (salt/brine) subsegment dominates the market due to its extensive use in various industries, including food processing, chemical manufacturing, and water treatment, and as a critical input for chlor-alkali and industrial gas operations in Jubail and other industrial hubs. The growing deployment of smart and automated mining and brine-handling systems in the Kingdom further supports efficient large-scale production and handling of industrial salts. The reference to de-icing agents in colder regions is less relevant for Saudi Arabia’s climate; in the local context, demand is instead reinforced by desalination brine management, chemical feedstock needs, and regional exports of industrial salt. Potash and phosphate brines are also significant, driven by the agricultural sector's need for fertilizers, with Ma’aden’s integrated phosphate complexes at Ras Al Khair and Wa’ad Al Shamal underpinning strong demand for phosphate-derived inputs and related brine operations. The trend towards sustainable agriculture, food-security initiatives in the Gulf, and rising regional population are expected to sustain the demand for these minerals and support continued development of solution-based extraction and processing routes.

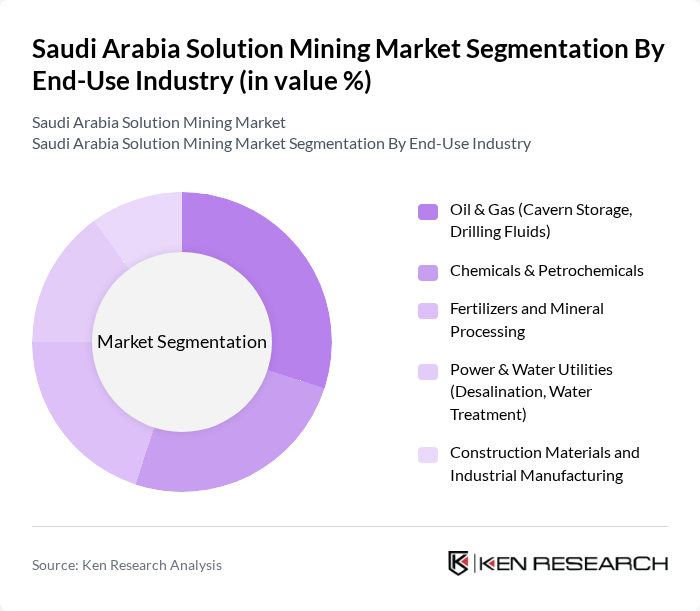

By End-Use Industry:The solution mining market is segmented by end-use industries, including oil & gas (cavern storage, drilling fluids), chemicals & petrochemicals, fertilizers and mineral processing, power & water utilities (desalination, water treatment), construction materials and industrial manufacturing, and others. Each of these industries utilizes solution-extracted minerals for various applications, contributing to the overall market growth, with integration into large petrochemical, fertilizer, and utility projects forming a key feature of Saudi Arabia’s industrial strategy.

The oil and gas industry is the leading end-user of solution-extracted minerals, particularly for cavern storage of strategic hydrocarbons and for drilling fluids that rely on brines and salts to manage wellbore stability and pressure during exploration and production. The chemicals and petrochemicals sector follows closely, utilizing sodium chloride brine for chlor-alkali, industrial gases, and a range of downstream polymers and intermediates produced in complexes at Jubail, Yanbu, and Ras Al Khair. Fertilizers and mineral processing constitute another major end-use, anchored by Ma’aden’s phosphate chains that depend on large-scale brine, reagent, and solution-processing circuits. The increasing focus on sustainable energy and water management solutions is driving demand in the power and water utilities sector, particularly for desalination and advanced water treatment applications, where high-purity salts and specialty chemicals derived from brines are required and where Saudi Arabia remains one of the world’s largest desalination markets.

The Saudi Arabia Solution Mining Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Mining Company (Ma’aden), Saudi Basic Industries Corporation (SABIC), Ma’aden Phosphate Company, Saudi Arabian Saudi Chlorine Industries Company, Jubail Chemical Industries Company (JANA), Saudi Arabian Amiantit Company, Saudi Arabian Oil Company (Saudi Aramco) – Underground Storage Caverns, The National Titanium Dioxide Company (Cristal / Tronox Saudi Arabia), Saudi Arabian Fertilizer Company (SAFCO), Gulf Cryo Saudi for Industrial Gases, Saudi Kayan Petrochemical Company, Yanbu National Petrochemical Company (Yansab), Advanced Petrochemical Company, National Industrialization Company (Tasnee), Ma’aden Wa’ad Al Shamal Phosphate Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia solution mining market appears promising, driven by ongoing technological advancements and government support. As the Kingdom continues to diversify its economy, the mining sector is expected to play a pivotal role in achieving Vision 2030 goals. Increased automation and digital integration will enhance operational efficiency, while a focus on sustainability will attract investment. The growing interest in rare earth elements and critical minerals will also open new avenues for exploration and development, positioning Saudi Arabia as a key player in the global mining landscape.

| Segment | Sub-Segments |

|---|---|

| By Type (Mineral) | Sodium Chloride (Salt / Brine) Potash and Phosphate Brines Magnesium and Other Evaporite Minerals Uranium and Metal In-Situ Leach (ISL) Projects Other Solution-Extracted Minerals |

| By End-Use Industry | Oil & Gas (Cavern Storage, Drilling Fluids) Chemicals & Petrochemicals Fertilizers and Mineral Processing Power & Water Utilities (Desalination, Water Treatment) Construction Materials and Industrial Manufacturing Others |

| By Region | Eastern Province (Including Jubail & Ras Al Khair Clusters) Western Province (Including Red Sea Industrial Corridor) Central Province Northern & Southern Regions (Emerging Mining Districts) |

| By Mining Technique | Solution Mining of Salt Caverns In-Situ Leaching / In-Situ Recovery (ISL/ISR) Hybrid Solution–Conventional Operations Other Advanced Leaching Technologies |

| By Application | Underground Hydrocarbon & Gas Storage Caverns Feedstock for Chlor-Alkali and Industrial Chemicals Fertilizer and Phosphate Derivatives Water Treatment and Desalination Chemicals Others |

| By Investment Source | Domestic Private Investments Government and Sovereign Funding (Including PIF) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy & Regulatory Support | Mining Investment Law Incentives Tax and Royalty Regime (Exemptions & Reductions) Licensing and Permit Facilitation Sustainability, ESG and Environmental Compliance Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Potash Solution Mining Operations | 100 | Mining Engineers, Operations Managers |

| Lithium Extraction Projects | 80 | Project Managers, Geologists |

| Regulatory Compliance in Mining | 60 | Compliance Officers, Environmental Managers |

| Market Trends in Solution Mining | 90 | Industry Analysts, Business Development Executives |

| Investment Opportunities in Mining | 70 | Investment Analysts, Financial Advisors |

The Saudi Arabia Solution Mining Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased demand for minerals and government initiatives under Vision 2030 aimed at diversifying the economy and enhancing industrial mineral production.