Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2351

Pages:85

Published On:October 2025

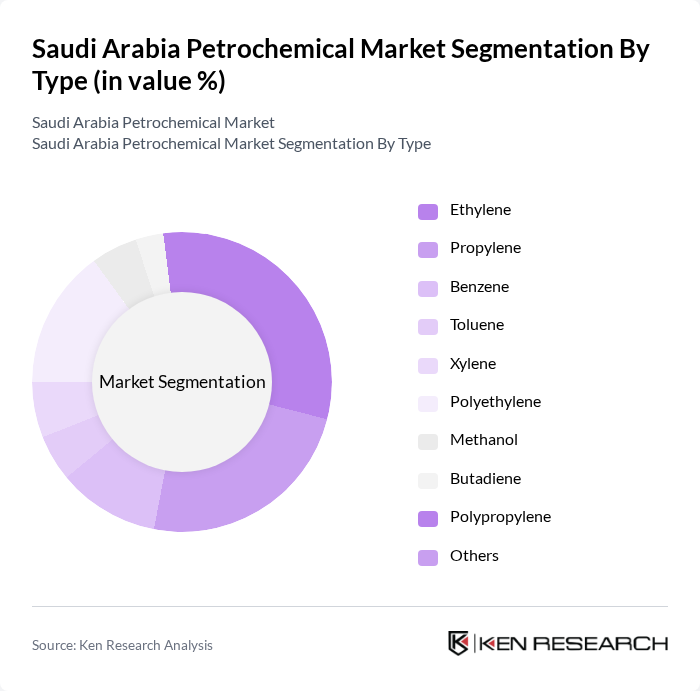

By Type:The petrochemical market is segmented into Ethylene, Propylene, Benzene, Toluene, Xylene, Polyethylene, Methanol, Butadiene, Polypropylene, and Others. Each subsegment plays a crucial role in market dynamics, with ethylene and propylene as primary building blocks for plastics, methanol for solvents and fuels, and aromatics like benzene and toluene for specialty chemicals and polymers. Demand drivers include the expansion of packaging, construction, automotive, and consumer goods sectors, as well as increased investment in specialty and high-performance materials .

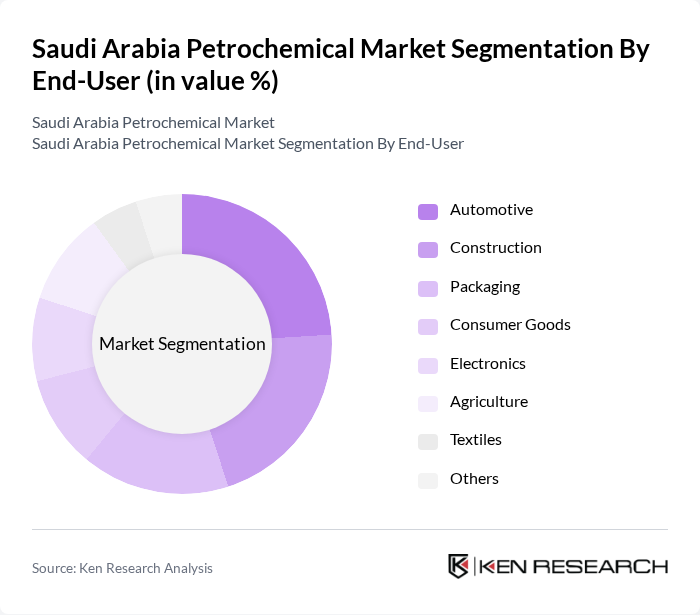

By End-User:The end-user segmentation includes Automotive, Construction, Packaging, Consumer Goods, Electronics, Agriculture, Textiles, and Others. The automotive and construction sectors are major consumers due to the use of plastics, composites, and synthetic materials in vehicles and infrastructure. Packaging remains a significant driver, fueled by population growth and e-commerce, while agriculture, textiles, and electronics also contribute to demand for specialty polymers and chemical intermediates .

The Saudi Arabia Petrochemical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Aramco, Advanced Petrochemical Company, National Petrochemical Company (Petrochem), Saudi Kayan Petrochemical Company, Yanbu National Petrochemical Company (Yansab), Alujain Corporation, National Industrialization Company (Tasnee), Sahara International Petrochemical Company (Sipchem), Rabigh Refining and Petrochemical Company (Petro Rabigh), Arabian Petrochemical Company (Petrokemya), Al-Jubail Petrochemical Company (KEMYA), Saudi Ethylene and Polyethylene Company (SEPC), Saudi Methanol Company (Ar-Razi), and Saudi Acrylic Acid Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi petrochemical market is poised for significant transformation, driven by a shift towards sustainability and innovation. As the industry embraces digital transformation, companies are expected to adopt advanced technologies to enhance operational efficiency. Furthermore, the focus on renewable petrochemicals and bioplastics is likely to reshape production processes, aligning with global sustainability trends. This evolution will not only address environmental concerns but also open new avenues for growth, positioning Saudi Arabia as a leader in sustainable petrochemical solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Propylene Benzene Toluene Xylene Polyethylene Methanol Butadiene Polypropylene Others |

| By End-User | Automotive Construction Packaging Consumer Goods Electronics Agriculture Textiles Others |

| By Application | Plastics Manufacturing Synthetic Fibers Adhesives Coatings Detergents & Surfactants Solvents Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Eastern Province Western Province Central Province Southern Province Northern Province Others |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Petrochemical Production Insights | 100 | Plant Managers, Production Supervisors |

| Market Demand Analysis | 80 | Sales Directors, Market Analysts |

| Export Strategies and Challenges | 70 | Export Managers, Trade Compliance Officers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Policy Advisors |

| Innovation and R&D in Petrochemicals | 40 | R&D Managers, Product Development Leads |

The Saudi Arabia Petrochemical Market is valued at approximately USD 560 billion, driven by the country's abundant hydrocarbon resources and strategic investments in downstream and specialty chemicals, catering to various industries such as automotive, construction, and packaging.