Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3741

Pages:94

Published On:November 2025

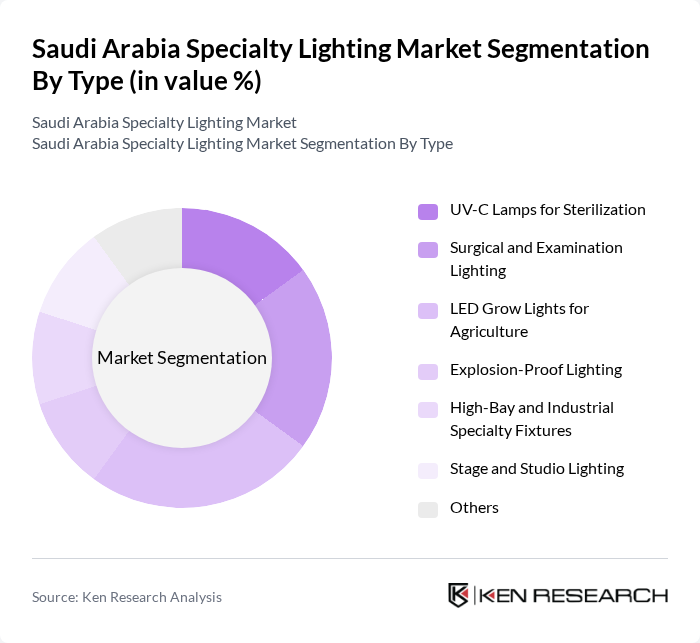

By Type:The market is segmented into various types of specialty lighting, including UV-C lamps for sterilization, surgical and examination lighting, LED grow lights for agriculture, explosion-proof lighting, high-bay and industrial specialty fixtures, stage and studio lighting, and others. Among these, LED grow lights for agriculture are gaining traction due to the increasing focus on sustainable farming practices and controlled-environment agriculture.

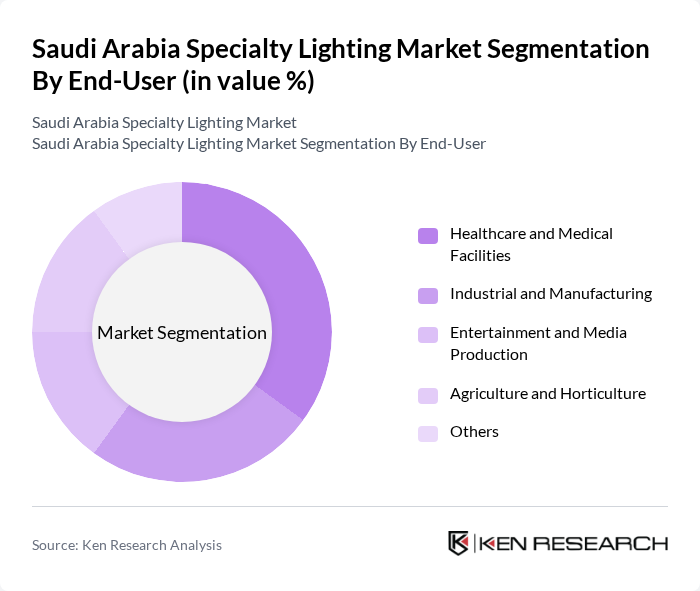

By End-User:The specialty lighting market is further segmented by end-user, including healthcare and medical facilities, industrial and manufacturing, entertainment and media production, agriculture and horticulture, and others. The healthcare sector is the leading end-user, driven by the need for advanced lighting solutions in surgical and examination settings.

The Saudi Arabia Specialty Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting (Signify N.V.), OSRAM Licht AG, Cree Middle East, General Electric Lighting Solutions, Acuity Brands, Inc., Zumtobel Group AG, Eaton Corporation Lighting Division, Hubbell Incorporated Lighting, Panasonic Corporation Lighting Solutions, Samsung Electronics Lighting Division, Lutron Electronics Co., Inc., Legrand Group, Toshiba Lighting & Technology Corporation, FSL (Foshan Electrical and Lighting Co., Ltd.), Local Saudi Distributors and Assemblers contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia specialty lighting market is poised for significant growth, driven by increasing urbanization and government support for sustainable initiatives. As the country invests heavily in smart city projects, the integration of advanced lighting technologies will become essential. Additionally, the rising focus on energy efficiency and environmental sustainability will further propel the adoption of innovative lighting solutions. The market is expected to witness a shift towards smart and human-centric lighting, enhancing user experience and energy savings in future.

| Segment | Sub-Segments |

|---|---|

| By Type | UV-C Lamps for Sterilization Surgical and Examination Lighting LED Grow Lights for Agriculture Explosion-Proof Lighting High-Bay and Industrial Specialty Fixtures Stage and Studio Lighting Others |

| By End-User | Healthcare and Medical Facilities Industrial and Manufacturing Entertainment and Media Production Agriculture and Horticulture Others |

| By Application | Medical and Surgical Applications Purification and Sterilization Controlled-Environment Agriculture Entertainment and Broadcasting Others |

| By Technology | LED-Based Specialty Lighting Incandescent Specialty Lamps Smart-Enabled Specialty Systems Others |

| By Distribution Channel | Specialty Lighting Stores Online Retail Platforms Direct Sales to B2B Buyers Others |

| By Region | Riyadh Metropolitan Area Jeddah and Western Region Dammam and Eastern Region Other Regions |

| By Policy Support | Energy efficiency incentives and subsidies Smart city project funding Healthcare infrastructure investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Lighting Solutions | 100 | Facility Managers, Project Architects |

| Residential Lighting Products | 80 | Homeowners, Interior Designers |

| Industrial Lighting Applications | 70 | Operations Managers, Safety Officers |

| Smart Lighting Technologies | 60 | IT Managers, Smart Home Consultants |

| Energy-Efficient Lighting Initiatives | 90 | Energy Auditors, Sustainability Managers |

The Saudi Arabia Specialty Lighting Market is valued at approximately USD 133 million, driven by the increasing demand for energy-efficient lighting solutions and advancements in LED technology, alongside significant infrastructure projects under Vision 2030.