Region:Middle East

Author(s):Shubham

Product Code:KRAD0988

Pages:97

Published On:November 2025

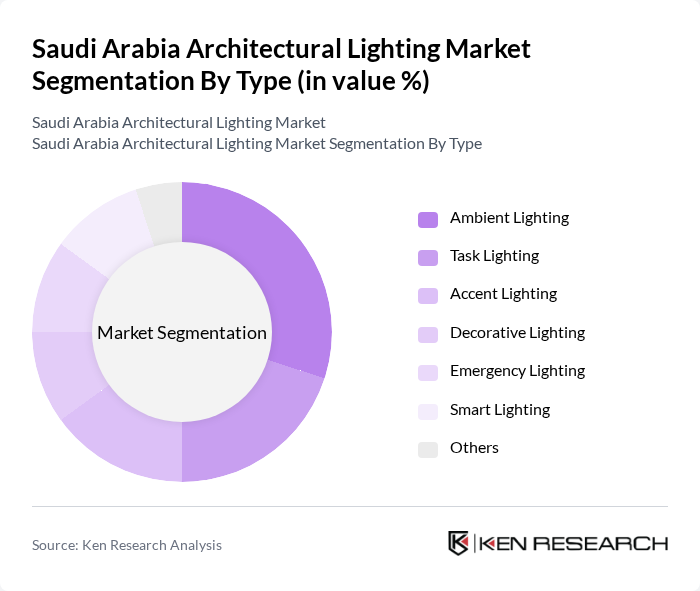

By Type:The market is segmented into various types of architectural lighting, including Ambient Lighting, Task Lighting, Accent Lighting, Decorative Lighting, Emergency Lighting, Smart Lighting, and Others. Each type serves distinct purposes, catering to different consumer needs and preferences.

The Ambient Lighting segment is currently dominating the market due to its essential role in creating a comfortable and inviting atmosphere in both residential and commercial spaces. This type of lighting is widely used in various applications, including homes, offices, and public areas, making it a staple in architectural design. The increasing focus on energy efficiency and aesthetic appeal has led to a surge in demand for ambient lighting solutions, particularly those that incorporate LED technology. As consumers become more aware of the benefits of energy-efficient lighting, the trend towards ambient lighting is expected to continue, solidifying its position as the leading segment in the market.

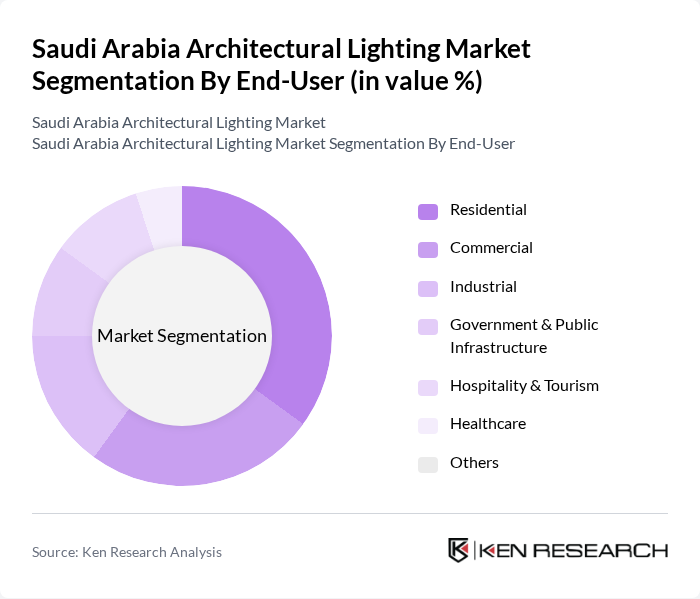

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, Government & Public Infrastructure, Hospitality & Tourism, Healthcare, and Others. Each end-user category has unique lighting requirements and preferences, influencing the overall market dynamics.

The Residential segment is the largest end-user category, driven by the increasing demand for home improvement and renovation projects. Homeowners are increasingly investing in modern lighting solutions that enhance aesthetics and energy efficiency. The trend towards smart home technologies has also contributed to the growth of this segment, as consumers seek integrated lighting systems that can be controlled remotely. Additionally, the rise in disposable income and changing consumer preferences towards stylish and functional lighting solutions further solidify the residential segment's dominance in the market.

The Saudi Arabia Architectural Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips Lighting), Osram Licht AG, Zumtobel Group, Fagerhult Group, Thorn Lighting, Cree Lighting, Eaton Lighting (Cooper Lighting Solutions), Hubbell Lighting, Legrand, Panasonic Corporation, Samsung Electronics, LG Electronics, Al Nasser Group, National Lighting Company (NLC), Arabian Lighting Company Ltd., Al AbdulKarim Holding (AKH Lighting), Alfanar Lighting contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia architectural lighting market is poised for significant growth, driven by urbanization and government initiatives. As cities expand, the demand for innovative lighting solutions will increase, particularly in smart city projects. The integration of IoT technology in lighting systems will enhance functionality and energy efficiency. Additionally, the focus on sustainability will encourage the adoption of eco-friendly lighting solutions, creating a favorable environment for market players to innovate and expand their offerings in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Lighting Task Lighting Accent Lighting Decorative Lighting Emergency Lighting Smart Lighting Others |

| By End-User | Residential Commercial Industrial Government & Public Infrastructure Hospitality & Tourism Healthcare Others |

| By Application | Retail Spaces Public Spaces (Parks, Streets, Monuments) Residential Buildings Commercial Buildings (Offices, Malls) Outdoor Architectural Lighting Cultural & Religious Institutions Others |

| By Lighting Control System | Manual Control Automated Control Smart/IoT-Based Control Centralized Control Others |

| By Material Type | Glass Metal Plastic Composite Materials Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Retail Stores Others |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah) Eastern Region (incl. Dammam, Khobar) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Lighting Projects | 85 | Architects, Lighting Designers |

| Residential Lighting Solutions | 65 | Homeowners, Interior Designers |

| Public Infrastructure Lighting | 55 | Urban Planners, Government Officials |

| Retail Lighting Applications | 45 | Store Managers, Visual Merchandisers |

| Hospitality Sector Lighting | 40 | Hotel Managers, Facility Directors |

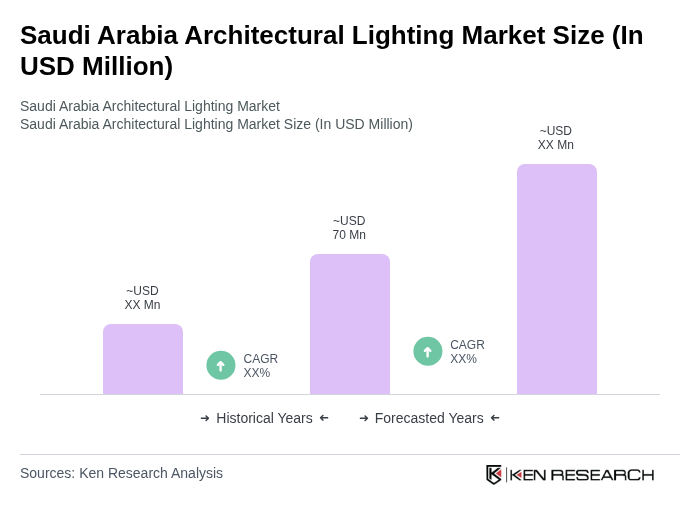

The Saudi Arabia Architectural Lighting Market is valued at approximately USD 70 million, driven by rapid urbanization, increased construction activities, and a growing emphasis on energy-efficient lighting solutions, particularly LED and smart lighting technologies.