Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4529

Pages:95

Published On:October 2025

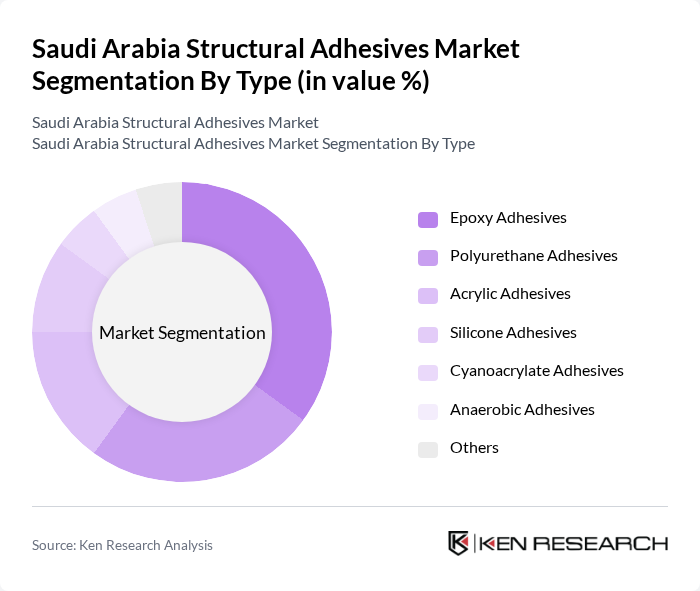

By Type:The market is segmented into various types of structural adhesives, including Epoxy Adhesives, Polyurethane Adhesives, Acrylic Adhesives, Silicone Adhesives, Cyanoacrylate Adhesives, Anaerobic Adhesives, and Others. Epoxy Adhesives hold the leading share due to their high bonding strength, chemical resistance, and versatility in demanding industrial and construction applications. Polyurethane Adhesives are also prominent, favored for flexibility and durability in automotive and building sectors. Acrylic and silicone adhesives are increasingly adopted for electronics and specialty uses, while cyanoacrylate and anaerobic adhesives serve niche and rapid-bonding requirements .

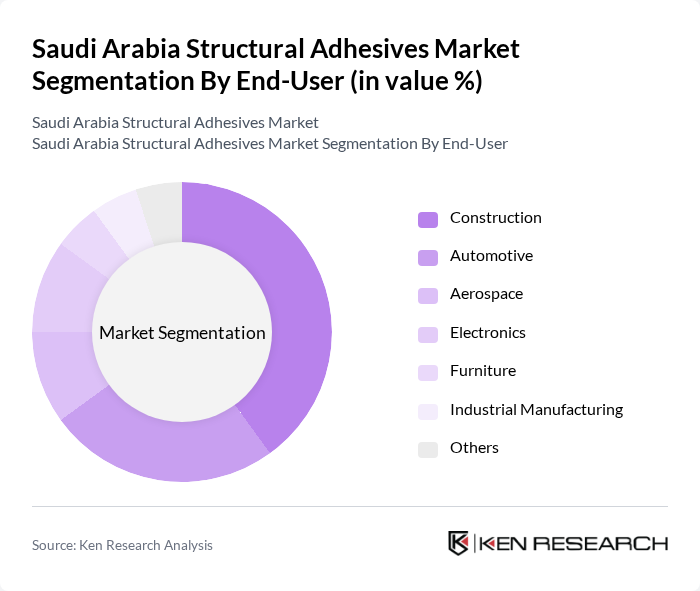

By End-User:The structural adhesives market is categorized by end-users, including Construction, Automotive, Aerospace, Electronics, Furniture, Industrial Manufacturing, and Others. The Construction sector is the largest consumer, propelled by extensive infrastructure development, high-rise projects, and the adoption of advanced building materials. Automotive and aerospace sectors are significant due to increased local assembly, lightweight material integration, and stringent performance requirements. Electronics and industrial manufacturing segments are growing, driven by miniaturization and automation trends .

The Saudi Arabia Structural Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, BASF SE, Dow Inc., Huntsman Corporation, Arkema S.A., ITW (Illinois Tool Works Inc.), RPM International Inc., Lord Corporation, Momentive Performance Materials Inc., Wacker Chemie AG, Covestro AG, Bostik SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the structural adhesives market in Saudi Arabia appears promising, driven by ongoing investments in infrastructure and technological advancements. As the construction and automotive sectors continue to expand, the demand for innovative adhesive solutions is expected to rise. Additionally, the shift towards sustainable practices will likely encourage the development of eco-friendly adhesives, creating new opportunities for manufacturers. Overall, the market is poised for growth, supported by favorable economic conditions and increasing awareness of advanced adhesive technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Adhesives Polyurethane Adhesives Acrylic Adhesives Silicone Adhesives Cyanoacrylate Adhesives Anaerobic Adhesives Others |

| By End-User | Construction Automotive Aerospace Electronics Furniture Industrial Manufacturing Others |

| By Application | Structural Bonding Assembly Coating Sealing Repair Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low Price Mid Price High Price Premium Price Others |

| By Brand | Local Brands International Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 120 | Project Managers, Procurement Officers |

| Automotive Adhesives | 90 | Manufacturing Engineers, Quality Control Managers |

| Industrial Adhesives | 80 | Operations Managers, Supply Chain Analysts |

| Consumer Adhesives | 70 | Retail Managers, Product Development Specialists |

| Specialty Adhesives | 50 | Research Scientists, Technical Sales Representatives |

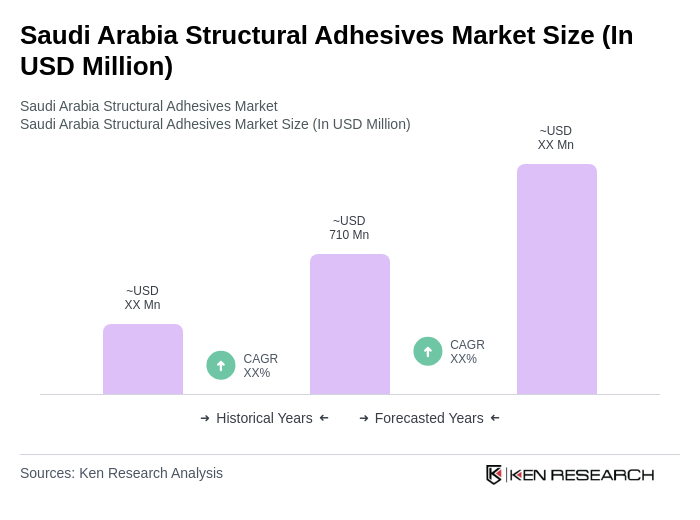

The Saudi Arabia Structural Adhesives Market is valued at approximately USD 710 million, driven by growth in the construction sector, automotive assembly activities, and the adoption of lightweight materials across various manufacturing industries.