Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8232

Pages:93

Published On:November 2025

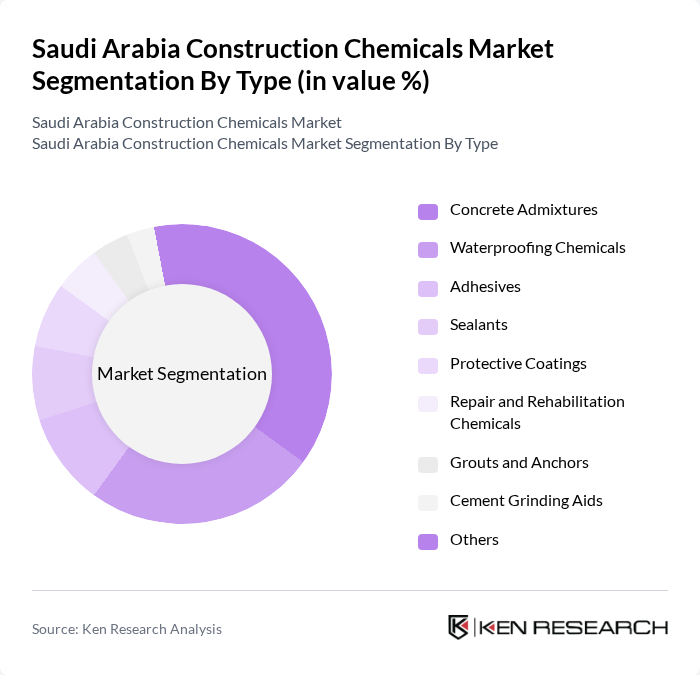

By Type:The market is segmented into various types of construction chemicals, including Concrete Admixtures, Waterproofing Chemicals, Adhesives, Sealants, Protective Coatings, Repair and Rehabilitation Chemicals, Grouts and Anchors, Cement Grinding Aids, and Others. Among these, Concrete Admixtures and Waterproofing Chemicals are the most prominent due to their essential roles in enhancing the performance and longevity of construction projects. Concrete admixtures held the highest market share at approximately 47.4% in recent years and are expected to maintain their dominance. The increasing focus on high-quality construction materials has led to a surge in demand for these subsegments.

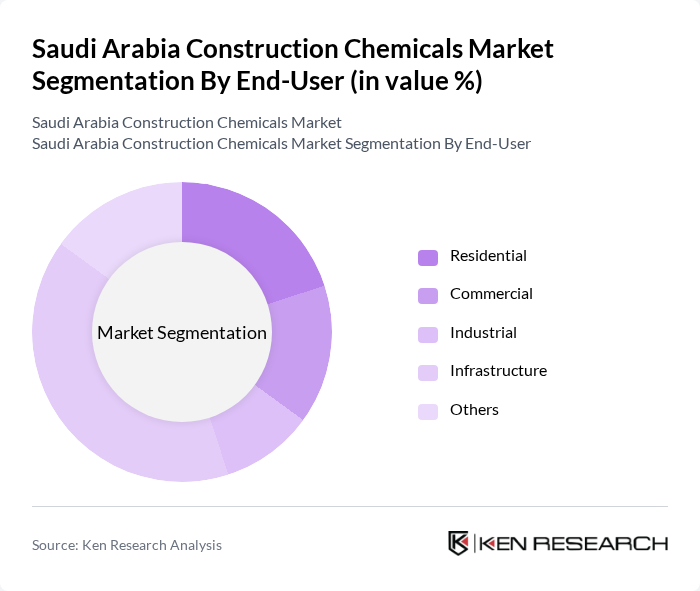

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Infrastructure, and Others. The Residential segment holds the largest share in terms of revenue and is expected to grow at a steady pace, supported by modernization and renovation projects. The Infrastructure segment remains critical due to the government's focus on large-scale infrastructure projects, including roads, bridges, and public facilities. The increasing urban population and the need for improved infrastructure are driving the demand for construction chemicals across multiple segments.

The Saudi Arabia Construction Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Sika Saudi Arabia, BASF Saudi Arabia Co. Ltd., Fosroc Saudi Arabia, Mapei S.p.A., Saint-Gobain Weber Saudi Arabia, Chryso S.A.S., RPM International Inc., Ardex Group, Bostik Saudi Arabia, Dow Chemical Company, GCP Applied Technologies, Berger Paints Saudi Arabia Ltd., Meister Co. Saudi Arabia, H.B. Fuller Company contribute to innovation, geographic expansion, and service delivery in this space. Notable developments include Mapei Group's acquisition of Bitumat, a Saudi Arabian manufacturer specializing in waterproofing solutions, in 2024.

The future of the Saudi Arabia construction chemicals market appears promising, driven by ongoing infrastructure projects and a growing emphasis on sustainability. As the government continues to invest in smart construction technologies, the demand for high-performance chemicals is expected to rise. Additionally, the increasing focus on circular economy practices will likely encourage innovation in product development, leading to more eco-friendly solutions that align with global sustainability trends and local regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Concrete Admixtures Waterproofing Chemicals Adhesives Sealants Protective Coatings Repair and Rehabilitation Chemicals Grouts and Anchors Cement Grinding Aids Others |

| By End-User | Residential Commercial Industrial Infrastructure Others |

| By Application | Residential Buildings Commercial Buildings Industrial Facilities Infrastructure Projects (e.g., Roads, Bridges, Airports) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Formulation | Water-based Solvent-based Powder-based Others |

| By Performance Characteristics | High Strength Durability Chemical Resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Managers | 100 | Project Managers, Site Engineers |

| Manufacturers of Construction Chemicals | 60 | Production Managers, Sales Directors |

| Distributors and Suppliers | 50 | Supply Chain Managers, Procurement Officers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

| End-users in Construction | 80 | Architects, Contractors |

The Saudi Arabia Construction Chemicals Market is valued at approximately USD 960 million, driven by rapid urbanization, government infrastructure investments, and the demand for high-performance construction materials.