Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4493

Pages:97

Published On:October 2025

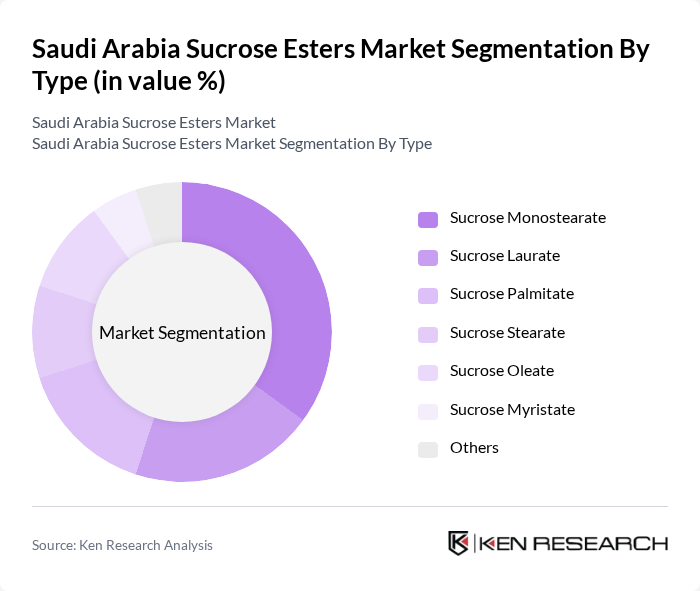

By Type:The sucrose esters market is segmented into various types, including Sucrose Monostearate, Sucrose Laurate, Sucrose Palmitate, Sucrose Stearate, Sucrose Oleate, Sucrose Myristate, and Others. Among these, Sucrose Monostearate is the leading subsegment due to its widespread application in food products as an emulsifier and stabilizer. The increasing consumer preference for clean-label products has further boosted its demand, making it a dominant player in the market .

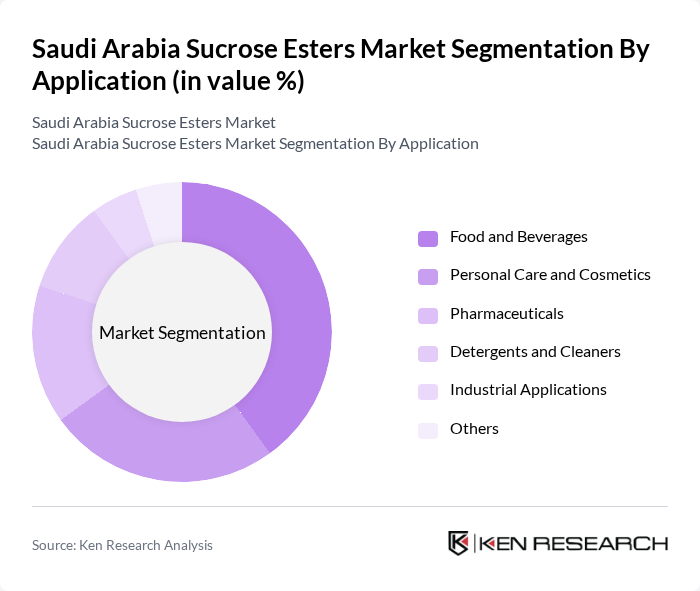

By Application:The applications of sucrose esters are diverse, including Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Detergents and Cleaners, Industrial Applications, and Others. The Food and Beverages segment is the most significant, driven by the increasing demand for natural emulsifiers and stabilizers in food formulations. The trend towards healthier eating habits and the clean label movement are key factors propelling this segment's growth .

The Saudi Arabia Sucrose Esters Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Croda International Plc, Evonik Industries AG, Mitsubishi Chemical Group Corporation, P&G Chemicals, Stepan Company, Wilmar International Limited, AAK AB, KAO Corporation, Solvay S.A., Dow Chemical Company, Ingredion Incorporated, Cargill, Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, Sisterna B.V., Alfa Chemicals, Compass Foods Pte Ltd, Dai-Ichi Kogyo Seiyaku Co., Ltd., Stearinerie Dubois, FELDA IFFCO, Adana Food Tech, Alchemy Ingredients contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia sucrose esters market is poised for significant growth, driven by increasing consumer demand for natural ingredients and healthier food options. As the food and beverage industry continues to expand, manufacturers are likely to invest in innovative applications of sucrose esters. Additionally, government initiatives promoting food safety and health awareness will further support market development. The focus on sustainability and clean label products will also shape future trends, encouraging the adoption of sucrose esters in various sectors beyond food, including personal care.

| Segment | Sub-Segments |

|---|---|

| By Type | Sucrose Monostearate Sucrose Laurate Sucrose Palmitate Sucrose Stearate Sucrose Oleate Sucrose Myristate Others |

| By Application | Food and Beverages Personal Care and Cosmetics Pharmaceuticals Detergents and Cleaners Industrial Applications Others |

| By Function | Emulsification Protein and Starch Interaction Antimicrobial Property Controlled Sugar Crystallization Aeration Others |

| By End-User | Food Manufacturers Cosmetic and Personal Care Companies Pharmaceutical Companies Detergent and Cleaner Manufacturers Industrial Processors Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesale Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Officers |

| Cosmetics and Personal Care Producers | 60 | Formulation Chemists, Brand Managers |

| Pharmaceutical Companies | 50 | Regulatory Affairs Specialists, R&D Managers |

| Food Safety Authorities | 40 | Compliance Officers, Food Safety Inspectors |

| Trade Associations and Industry Experts | 40 | Market Analysts, Industry Consultants |

The Saudi Arabia Sucrose Esters Market is valued at approximately USD 9 million, reflecting a five-year historical analysis and regional segmentation from leading global market studies.