Region:Middle East

Author(s):Dev

Product Code:KRAD3389

Pages:96

Published On:November 2025

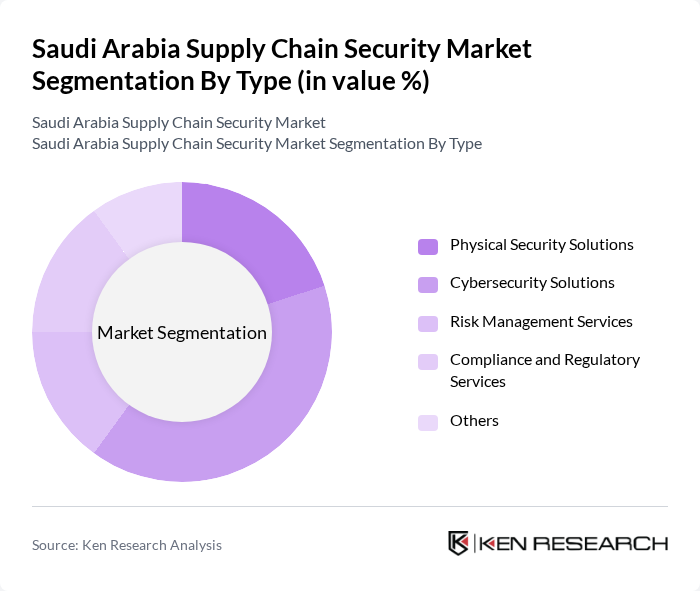

By Type:The market is segmented into various types, including Physical Security Solutions, Cybersecurity Solutions, Risk Management Services, Compliance and Regulatory Services, and Others. Among these, Cybersecurity Solutions are currently leading the market due to the increasing frequency of cyber threats and the growing need for organizations to protect sensitive data. The rise in digital transformation initiatives across sectors has further fueled the demand for advanced cybersecurity measures.

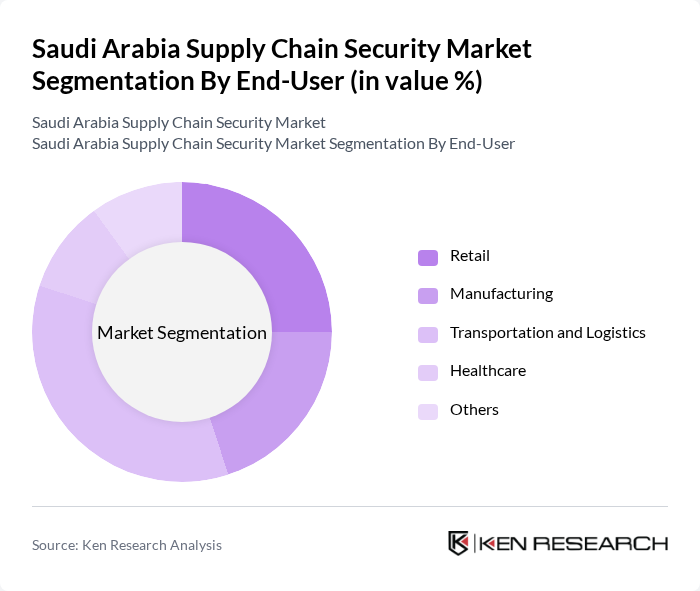

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, Healthcare, and Others. The Transportation and Logistics sector is currently the dominant segment, driven by the increasing need for secure and efficient supply chain operations. The rise in e-commerce and global trade has necessitated enhanced security measures to protect goods in transit, making this sector a key focus for supply chain security investments.

The Saudi Arabia Supply Chain Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, STC Solutions, Al-Falak Electronic Equipment & Supplies, SISCO, Zain KSA, Mobily, Al-Mabani General Trading & Contracting, AECOM Arabia, G4S Secure Solutions Saudi Arabia, IBM Saudi Arabia, Cisco Systems Saudi Arabia, Honeywell Saudi Arabia, Siemens Saudi Arabia, Oracle Saudi Arabia, Schneider Electric Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia supply chain security market appears promising, driven by technological advancements and increased government support. As businesses continue to prioritize resilience and security, the integration of AI and machine learning will enhance predictive capabilities and risk management. Furthermore, the emphasis on sustainable practices will likely shape supply chain strategies, aligning with global trends and consumer expectations, ultimately fostering a more secure and efficient supply chain ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions Cybersecurity Solutions Risk Management Services Compliance and Regulatory Services Others |

| By End-User | Retail Manufacturing Transportation and Logistics Healthcare Others |

| By Industry Vertical | Automotive Food and Beverage Pharmaceuticals Electronics Others |

| By Security Level | Basic Security Measures Advanced Security Solutions Comprehensive Security Systems Others |

| By Technology | IoT-based Solutions Blockchain Technology AI and Machine Learning Others |

| By Geographic Distribution | Central Region Eastern Region Western Region Southern Region Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Supply Chain Security | 100 | Supply Chain Managers, Security Analysts |

| Healthcare Logistics Security | 80 | Procurement Officers, Compliance Managers |

| Retail Supply Chain Risk Management | 70 | Operations Managers, Risk Assessment Specialists |

| Manufacturing Security Protocols | 60 | Plant Managers, Security Coordinators |

| Technology and Cybersecurity in Supply Chains | 90 | IT Security Managers, Supply Chain Analysts |

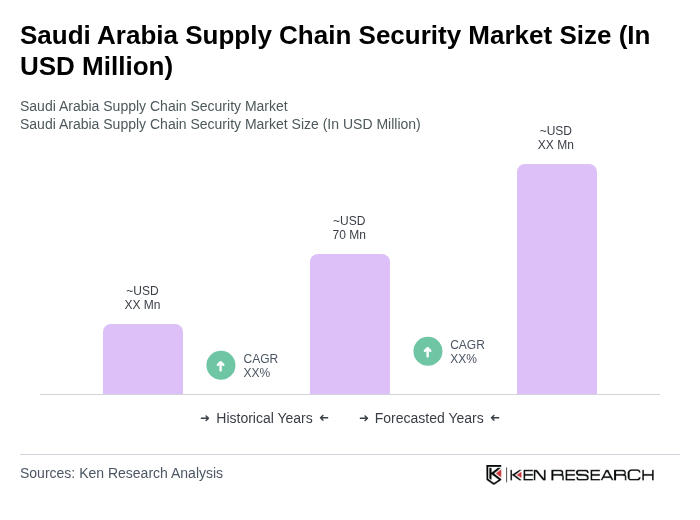

The Saudi Arabia Supply Chain Security Market is valued at approximately USD 70 million, reflecting a five-year historical analysis. This growth is driven by increased investments in technology and heightened awareness of cybersecurity threats across various sectors.