Region:Middle East

Author(s):Dev

Product Code:KRAB6887

Pages:97

Published On:October 2025

E-commerce Logistics Market.png)

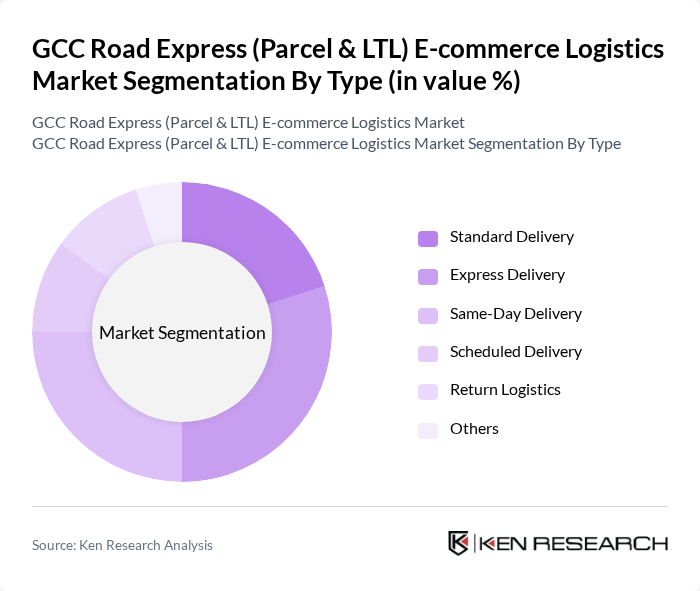

By Type:The market is segmented into various types of delivery services, including Standard Delivery, Express Delivery, Same-Day Delivery, Scheduled Delivery, Return Logistics, and Others. Each of these sub-segments caters to different consumer needs and preferences, with express and same-day deliveries gaining significant traction due to the increasing demand for speed and convenience in e-commerce.

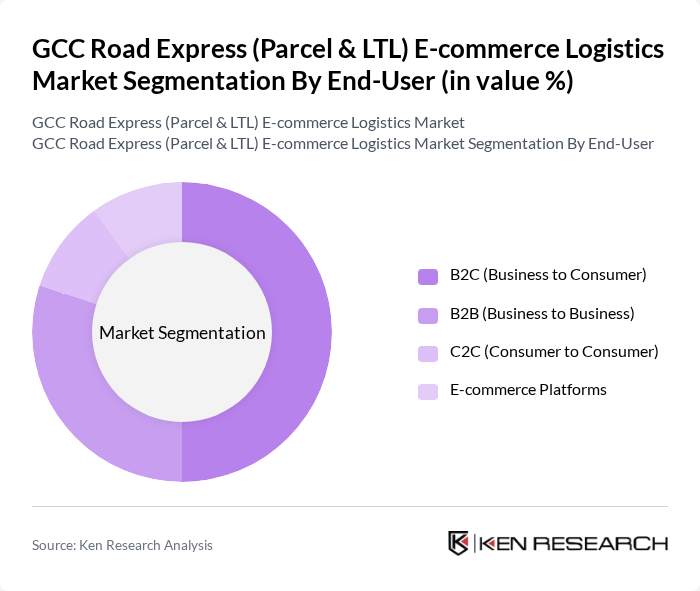

By End-User:The end-user segmentation includes B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), and E-commerce Platforms. The B2C segment is particularly dominant, driven by the increasing number of online shoppers and the growing preference for home delivery services.

The GCC Road Express (Parcel & LTL) E-commerce Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Express, FedEx, UPS, Naqel Express, Emirates Post, Zajil Express, Fetchr, QExpress, Postaplus, TCS, Mena Logistics, Al-Futtaim Logistics, Agility Logistics, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC road express logistics market appears promising, driven by the ongoing digital transformation and increasing consumer expectations for rapid delivery. As e-commerce continues to expand, logistics providers are likely to invest in innovative solutions, including automated systems and enhanced last-mile delivery strategies. Furthermore, the integration of sustainable practices will become essential, aligning with global trends towards environmental responsibility and efficiency in logistics operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Return Logistics Others |

| By End-User | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) E-commerce Platforms |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery |

| By Package Size | Small Packages Medium Packages Large Packages |

| By Payment Method | Prepaid Cash on Delivery Online Payment |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border |

| By Service Type | Door-to-Door Service Terminal-to-Terminal Service Value-Added Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parcel Delivery Services | 150 | Logistics Managers, Operations Directors |

| LTL Freight Services | 100 | Supply Chain Managers, Freight Coordinators |

| E-commerce Fulfillment Centers | 80 | Warehouse Supervisors, Inventory Managers |

| Last-Mile Delivery Solutions | 120 | Delivery Operations Managers, Customer Experience Leads |

| Cross-Border E-commerce Logistics | 90 | International Trade Specialists, Compliance Officers |

The GCC Road Express (Parcel & LTL) E-commerce Logistics Market is valued at approximately USD 15 billion, reflecting significant growth driven by the rapid expansion of e-commerce and increased consumer demand for fast delivery services.