Global Athletic Wear Market Overview

- The Global Athletic Wear Market is valued at USD 210 billion, based on a five-year historical analysis of the global sports apparel / sportswear / activewear space, which is reported in the low? to mid?two hundred billion range for sports apparel alone. This growth is primarily driven by increasing health consciousness, the rise of athleisure trends, and the growing popularity of fitness and outdoor activities among consumers, supported by expanding gym memberships and home?fitness adoption. The demand for high-performance and stylish athletic wear has surged, with major brands investing in advanced moisture?wicking and compression fabrics, sustainable materials, and digital?first marketing strategies, including influencer collaborations and direct?to?consumer channels.

- Key players in this market include the United States, China, and Germany, which dominate due to their large consumer bases, advanced retail and e?commerce infrastructure, and strong presence of global and domestic sportswear brands. The U.S. is particularly influential, supported by a strong fitness and athleisure culture and high per?capita spending on sportswear, while China is rapidly expanding its market share through online platforms, social?commerce, and extensive local manufacturing capabilities. Germany benefits from a robust sports culture, leading global brands, and a growing focus on sustainable and performance?oriented textile innovation within its apparel sector.

- In 2023, the European Union advanced regulations aimed at reducing the environmental impact of textile production, including athletic wear, under initiatives such as the EU Strategy for Sustainable and Circular Textiles and the Ecodesign for Sustainable Products Regulation (ESPR) adopted by the European Parliament and the Council in 2023. These instruments require manufacturers placing textile products on the EU market to comply with stricter sustainability and circularity requirements, including durability and reparability criteria, restrictions on harmful substances, and the progressive incorporation of recycled content where relevant. This initiative is part of a broader effort to promote eco?friendly practices within the fashion industry, supported by measures on eco?design, transparency, and waste reduction across the textile value chain.

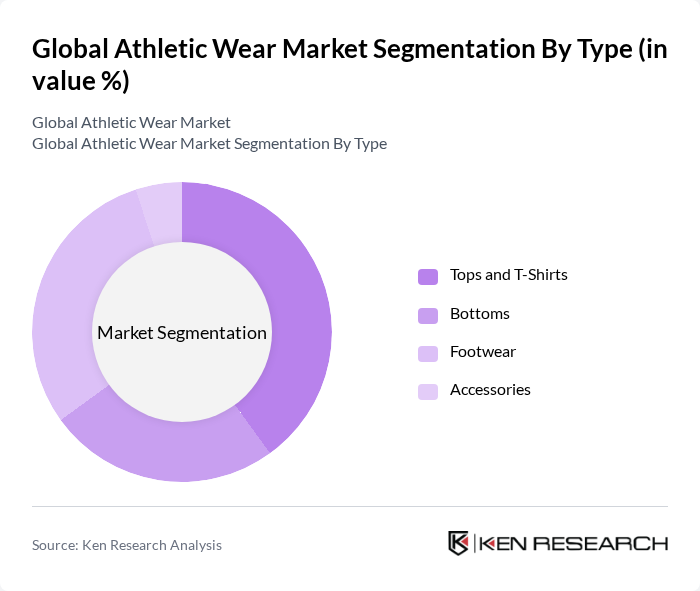

Global Athletic Wear Market Segmentation

By Type:The athletic wear market is segmented into various types, including Tops and T-Shirts, Bottoms, Footwear, and Accessories. Among these, Tops and T-Shirts represent a major portion of apparel revenues due to their versatility, frequent replacement cycles, and widespread appeal across different demographics for both casual and athletic purposes. Footwear also holds a significant share and often leads in value terms within broader sportswear, driven by the increasing popularity of running, training, and lifestyle sneakers as well as technical performance shoes.

By End-User:The market is categorized by end-users, including Men, Women, Children, and Others. The women's segment is currently one of the fastest-growing and leading categories in activewear and athleisure, driven by the growing participation of women in sports, fitness, yoga, and wellness activities, as well as increased focus on body?inclusive sizing and fashion?forward designs. Brands are increasingly targeting this demographic with specialized products that cater to their preferences, such as stylish silhouettes, high?support performance wear, and sustainable fabric options. The men's segment also remains strong, particularly in performance-oriented athletic wear and sports footwear, supported by demand for running, training, and team sports gear.

Global Athletic Wear Market Competitive Landscape

The Global Athletic Wear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Lululemon Athletica Inc., New Balance Athletics, Inc., ASICS Corporation, Hanesbrands Inc., VF Corporation, Gymshark Ltd., Fabletics, Inc., H&M Group, The North Face (VF Corporation), Athleta (Gap Inc.), Decathlon SE contribute to innovation, geographic expansion, and service delivery in this space.

Global Athletic Wear Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The global health and wellness market is projected to reach $4.24 trillion in future, indicating a significant rise in health consciousness among consumers. This trend is driving demand for athletic wear, as individuals increasingly prioritize fitness and active lifestyles. In future, 60% of adults in None reported engaging in regular physical activity, up from 55% in future, showcasing a growing commitment to health that directly influences athletic wear purchases.

- Rise in Participation in Sports Activities:According to the International Sports Federation, participation in organized sports has increased by 15% in None over the past three years. This surge is attributed to community initiatives and government support for sports programs. As more individuals engage in sports, the demand for specialized athletic wear rises, with sales of performance gear increasing by $1.2 billion in future alone, reflecting this growing trend.

- Growth of E-commerce Platforms:E-commerce sales in the athletic wear sector in None reached $3.5 billion in future, a 25% increase from the previous year. The convenience of online shopping, coupled with targeted marketing strategies, has significantly boosted consumer access to athletic wear. With 70% of consumers preferring online shopping for apparel, brands are investing heavily in digital platforms, enhancing their reach and driving sales growth in the athletic wear market.

Market Challenges

- Intense Competition:The athletic wear market in None is characterized by fierce competition, with over 200 brands vying for market share. Major players like Nike and Adidas dominate, holding approximately 40% of the market. This intense rivalry pressures smaller brands to innovate and differentiate their offerings, often leading to increased marketing costs and reduced profit margins, which can hinder overall market growth.

- Fluctuating Raw Material Prices:The prices of key raw materials, such as polyester and cotton, have seen significant volatility, with polyester prices rising by 30% in future due to supply chain disruptions. This fluctuation impacts production costs for athletic wear manufacturers, forcing them to either absorb costs or pass them on to consumers, which can affect sales and profitability in a price-sensitive market.

Global Athletic Wear Market Future Outlook

The future of the athletic wear market in None appears promising, driven by the increasing integration of technology in apparel and a growing focus on sustainability. As consumers become more environmentally conscious, brands are likely to invest in eco-friendly materials and production processes. Additionally, the rise of smart athletic wear, equipped with health-monitoring technology, is expected to attract tech-savvy consumers, further expanding market opportunities and enhancing brand loyalty.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in None present significant growth opportunities, with a projected increase in disposable income by 10% in future. This economic growth is likely to boost demand for athletic wear, as more consumers seek quality products. Brands that strategically enter these markets can capitalize on the rising middle class and their increasing interest in fitness and wellness.

- Increasing Demand for Sustainable Products:A recent survey indicated that 65% of consumers in None prefer purchasing sustainable products. This trend is driving brands to innovate and offer eco-friendly athletic wear options. Companies that prioritize sustainability in their product lines can enhance their market appeal and attract environmentally conscious consumers, potentially increasing their market share significantly.