Region:Middle East

Author(s):Dev

Product Code:KRAD6456

Pages:87

Published On:December 2025

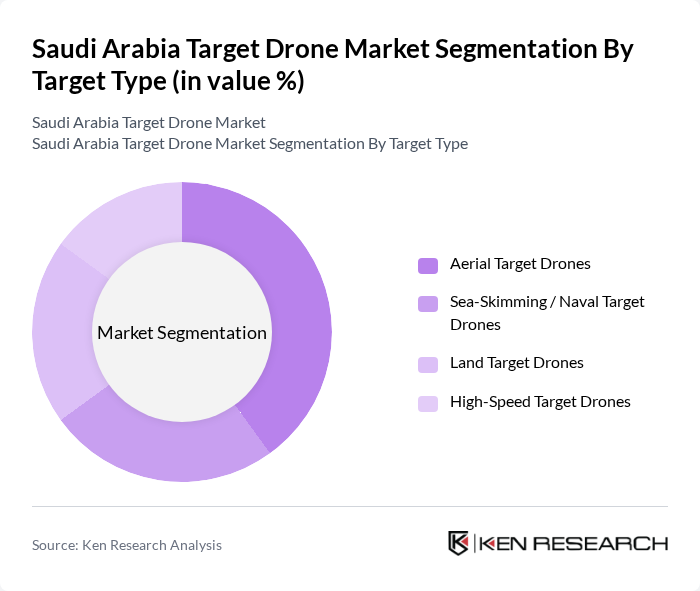

By Target Type:The target type segmentation includes various categories of drones designed for specific training and operational purposes. The subsegments are Aerial Target Drones, Sea-Skimming / Naval Target Drones, Land Target Drones, and High-Speed Target Drones. Each type serves distinct roles in military training and operational scenarios, catering to the diverse needs of the Saudi defense forces.

The Aerial Target Drones segment is currently dominating the market due to their versatility and effectiveness in simulating various aerial threats during training exercises. These drones are widely used by the Royal Saudi Air Force for air-to-air combat training, making them essential for enhancing pilot skills and operational readiness. The increasing focus on advanced aerial combat training methodologies further solidifies the position of aerial target drones in the market.

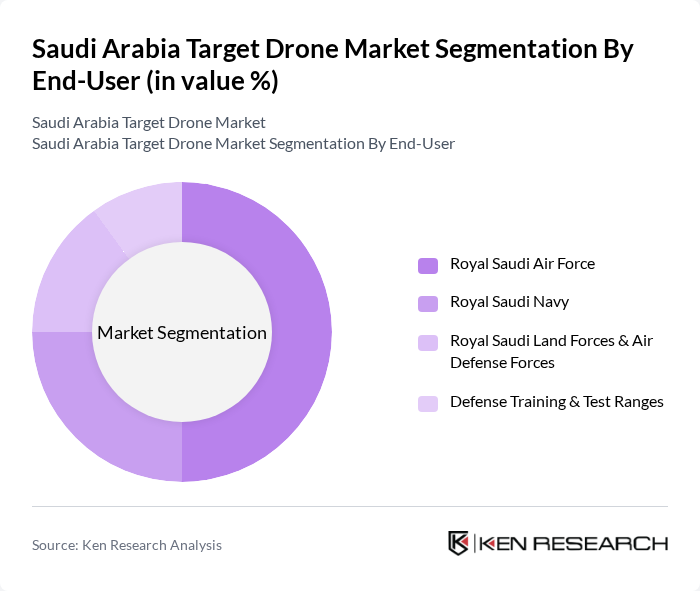

By End-User:The end-user segmentation encompasses the primary military branches utilizing target drones, including the Royal Saudi Air Force, Royal Saudi Navy, Royal Saudi Land Forces & Air Defense Forces, and Defense Training & Test Ranges. Each end-user has specific requirements and applications for target drones, contributing to the overall market dynamics.

The Royal Saudi Air Force is the leading end-user of target drones, primarily due to its extensive training programs and operational requirements. The air force's focus on enhancing combat readiness through realistic training scenarios drives the demand for advanced target drones. Additionally, the integration of these drones into air defense training further emphasizes their importance in the overall defense strategy of Saudi Arabia.

The Saudi Arabia Target Drone Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kratos Defense & Security Solutions, Inc., QinetiQ Group plc, Airbus Defence and Space, Leonardo S.p.A., Saab AB, Northrop Grumman Corporation, The Boeing Company (Defense, Space & Security), Lockheed Martin Corporation, Textron Systems Corporation, Elbit Systems Ltd., BAE Systems plc, MBDA, Denel Dynamics, Intra Defense Technologies (Saudi Arabia), Advanced Electronics Company (AEC) – A Saudi Arabian Military Industries Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia target drone market is poised for significant growth, driven by increasing defense expenditures and technological advancements. As the nation continues to modernize its military capabilities, the integration of autonomous systems and AI technologies will play a pivotal role. Furthermore, the expansion of military training programs and collaborations with global defense firms will enhance operational readiness. These trends indicate a robust future for the target drone market, with opportunities for innovation and strategic partnerships on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Target Type | Aerial Target Drones Sea-Skimming / Naval Target Drones Land Target Drones High-Speed Target Drones |

| By End-User | Royal Saudi Air Force Royal Saudi Navy Royal Saudi Land Forces & Air Defense Forces Defense Training & Test Ranges |

| By Application | Air-to-Air Combat Training Surface-to-Air & Air-Defense Training Naval Gunnery & Missile Training Weapons Testing & Evaluation |

| By Speed / Performance Class | Subsonic Target Drones High-Subsonic Target Drones Supersonic Target Drones |

| By Control & Autonomy | Remotely Piloted Target Drones Autonomous / Programmable Target Drones Optionally Piloted / Recoverable Targets |

| By Launch & Recovery Method | Ground-Launched (Rail / Catapult) Air-Launched Targets Ship-Launched Targets Parachute / Net-Recovered Targets |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam & Military Cities) Western Region (incl. Jeddah & Red Sea Bases) Southern & Northern Border Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Drone Procurement | 120 | Defense Procurement Officers, Military Strategists |

| Agricultural Drone Usage | 90 | Agronomists, Farm Managers |

| Commercial Drone Applications | 100 | Business Owners, Operations Managers |

| Surveillance and Security Drones | 80 | Security Managers, Law Enforcement Officials |

| Drone Technology Innovators | 60 | R&D Managers, Technology Developers |

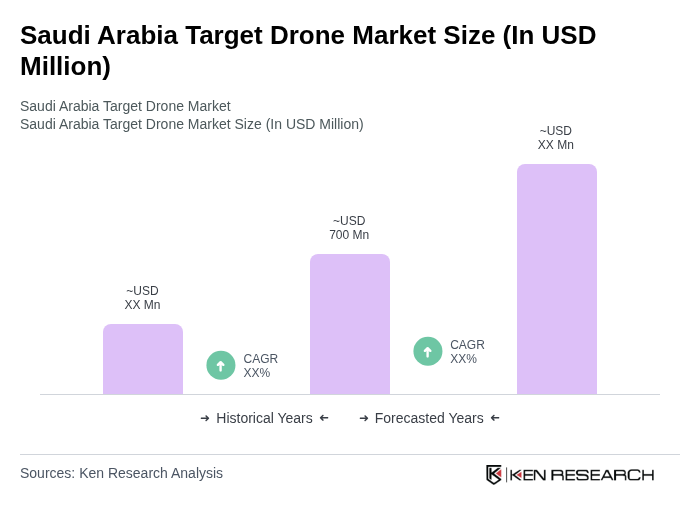

The Saudi Arabia Target Drone Market is valued at approximately USD 700 million, driven by increased defense budgets, advancements in drone technology, and the need for effective military training solutions.