Region:Middle East

Author(s):Shubham

Product Code:KRAB0754

Pages:98

Published On:August 2025

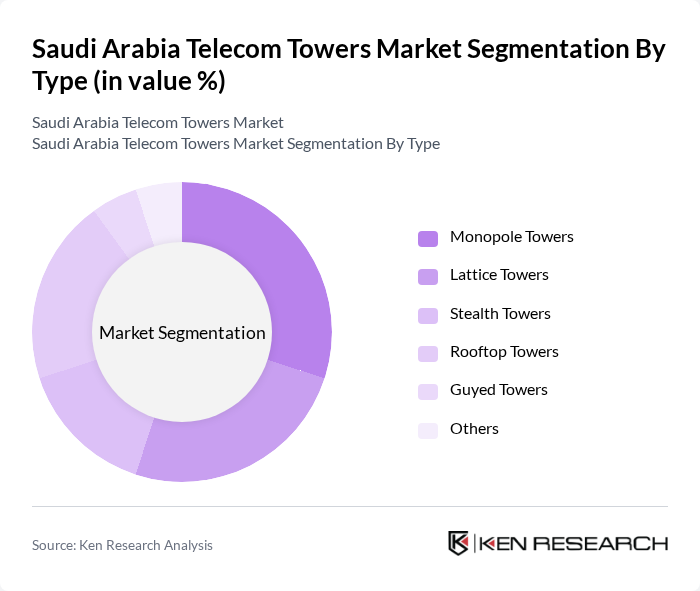

By Type:The telecom towers market can be segmented into Monopole Towers, Lattice Towers, Stealth Towers, Rooftop Towers, Guyed Towers, and Others. Each type serves specific needs based on location, aesthetic requirements, and structural capabilities. Monopole Towers are often preferred in urban areas due to their minimal footprint and ease of installation, while Lattice Towers are favored for their strength and ability to support multiple tenants in rural and suburban settings. Rooftop Towers are commonly used in densely populated city centers where ground space is limited. Stealth Towers are designed to blend with the environment, addressing aesthetic and zoning concerns, especially in residential or heritage areas. Guyed Towers, though less common, are used for their cost-effectiveness in open, rural locations .

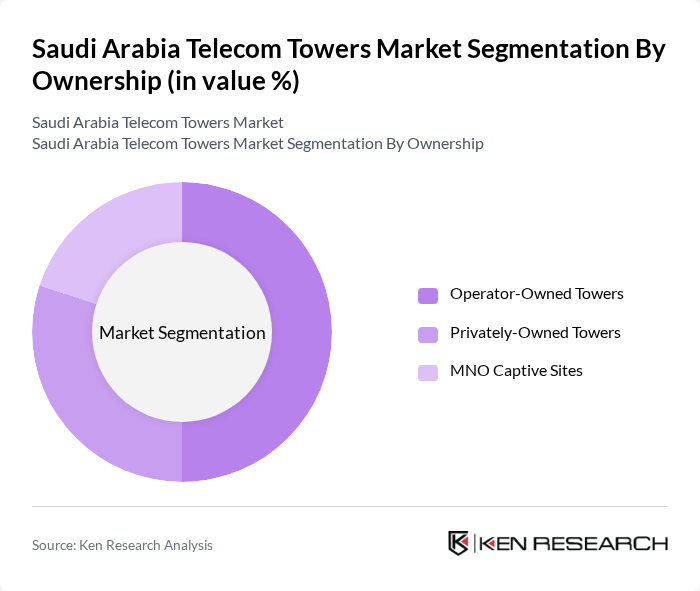

By Ownership:The ownership of telecom towers is categorized into Operator-Owned Towers, Privately-Owned Towers, and MNO Captive Sites. Operator-Owned Towers remain prevalent as telecom companies invest in their infrastructure to ensure service quality and network control. Privately-Owned Towers are gaining traction, driven by the emergence of independent tower companies and infrastructure-sharing mandates. MNO Captive Sites are essential for mobile network operators to maintain dedicated coverage in strategic locations, particularly for mission-critical and high-traffic areas .

The Saudi Arabia Telecom Towers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telecom Company (STC), TAWAL, Zain Saudi Arabia (Mobile Telecommunications Company Saudi Arabia), Golden Lattice Investment Company (GLIC/LATIS), Etihad Etisalat (Mobily), Integrated Telecom Company (ITC), Virgin Mobile Saudi Arabia, Salam (formerly Integrated Telecom Company), Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, ZTE Corporation, Cisco Systems, Inc., NEC Corporation, and CommScope Holding Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia telecom towers market is poised for significant growth, driven by increasing mobile data consumption and government initiatives aimed at digital transformation. The expansion of 5G networks will further necessitate the development of new infrastructure. As the market evolves, trends such as tower sharing and the adoption of green technologies will likely shape the competitive landscape, fostering innovation and sustainability in telecom operations. The focus on cybersecurity will also become paramount as digital services expand.

| Segment | Sub-Segments |

|---|---|

| By Type | Monopole Towers Lattice Towers Stealth Towers Rooftop Towers Guyed Towers Others |

| By Ownership | Operator-Owned Towers Privately-Owned Towers MNO Captive Sites |

| By Installation Type | Rooftop Ground-Based |

| By Fuel Type | Renewable Non-Renewable |

| By End-User | Mobile Network Operators (MNOs) Internet Service Providers (ISPs) Government Agencies Enterprises |

| By Application | Urban Connectivity Rural Connectivity Emergency Services Disaster Recovery |

| By Investment Source | Private Investments Public-Private Partnerships Government Funding |

| By Maintenance Type | Preventive Maintenance Corrective Maintenance Predictive Maintenance |

| By Ownership Model | Owned Towers Leased Towers Shared Towers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Infrastructure Development | 100 | Project Managers, Infrastructure Directors |

| Operational Efficiency in Tower Management | 80 | Operations Managers, Site Engineers |

| Regulatory Compliance and Policy Impact | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends in Telecom Services | 90 | Market Analysts, Business Development Managers |

| Future Technologies in Telecom | 50 | Technology Officers, R&D Managers |

The Saudi Arabia Telecom Towers Market is valued at approximately USD 20 million, driven by the rapid expansion of mobile network infrastructure, increased demand for high-speed internet, and government initiatives under Vision 2030 aimed at digital transformation.