Region:North America

Author(s):Dev

Product Code:KRAA1558

Pages:96

Published On:August 2025

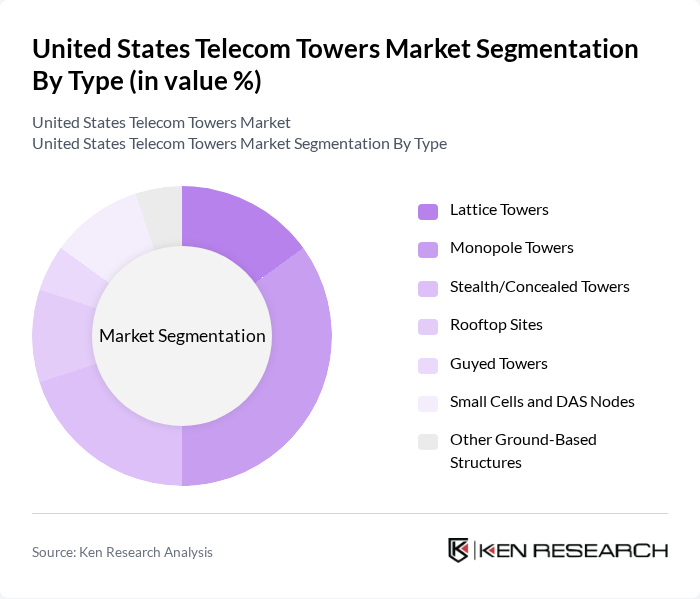

By Type:The market is segmented into various types of telecom towers, including Lattice Towers, Monopole Towers, Stealth/Concealed Towers, Rooftop Sites, Guyed Towers, Small Cells and DAS Nodes, and Other Ground-Based Structures. Each type serves specific needs based on location, aesthetic requirements, and structural capabilities. Among these, Monopole Towers are particularly prevalent in urban and suburban settings due to smaller footprints and faster permitting relative to lattice structures, while small cells and DAS nodes have expanded to address capacity hotspots and indoor coverage as part of 5G densification .

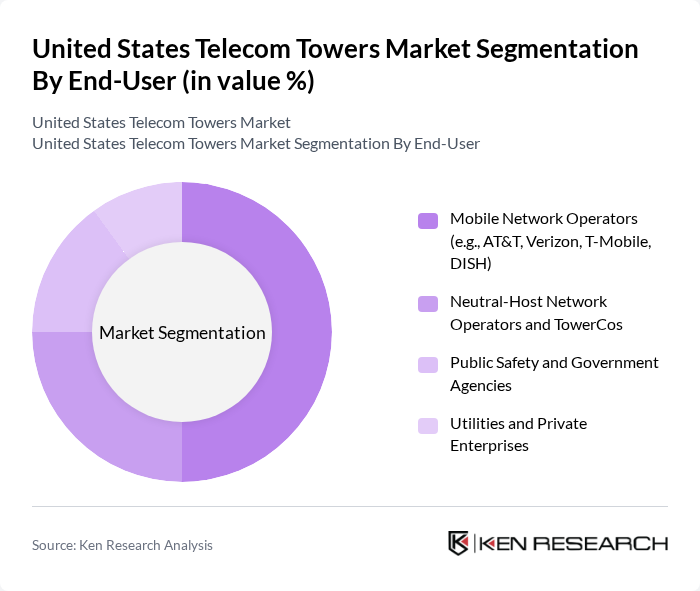

By End-User:The telecom towers market is also segmented by end-users, which include Mobile Network Operators (e.g., AT&T, Verizon, T-Mobile, DISH), Neutral-Host Network Operators and TowerCos, Public Safety and Government Agencies, and Utilities and Private Enterprises. Mobile Network Operators are the leading end-users, driven by extensive coverage and capacity requirements, while neutral-host/towercos continue to expand through build-to-suit, amendments, and colocation to support multi-tenant economics .

The United States Telecom Towers Market is characterized by a dynamic mix of regional and international players. Leading participants such as American Tower Corporation, Crown Castle Inc., SBA Communications Corporation, Vertical Bridge Holdings, LLC, Uniti Group Inc., AT&T Inc., Verizon Communications Inc., T-Mobile US, Inc., DISH Network Corporation, Phoenix Tower International (U.S. operations), ExteNet Systems, LLC, Mobilitie LLC (a BAI Communications company), Zayo Group Holdings, Inc., Tillman Infrastructure LLC, Harmoni Towers (Palistar Capital portfolio company) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the U.S. telecom towers market appears promising, driven by technological advancements and increasing connectivity demands. As 5G networks continue to expand, telecom operators are likely to invest in innovative tower solutions, including small cells and distributed antenna systems. Furthermore, the integration of renewable energy sources into tower operations is expected to enhance sustainability efforts, aligning with growing environmental concerns. Overall, the market is poised for significant transformation, adapting to evolving consumer needs and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Lattice Towers Monopole Towers Stealth/Concealed Towers Rooftop Sites Guyed Towers Small Cells and DAS Nodes Other Ground-Based Structures |

| By End-User | Mobile Network Operators (e.g., AT&T, Verizon, T-Mobile, DISH) Neutral-Host Network Operators and TowerCos Public Safety and Government Agencies Utilities and Private Enterprises |

| By Application | Macro Cell RAN (4G/5G) Broadcasting and Microwave Backhaul Mission-Critical and Emergency Communications IoT, Private LTE/5G, and Edge Use Cases |

| By Ownership Model | Independent TowerCos (Leasing/Colocation) Operator-Owned (Captive) Sites Shared/Neutral-Host Infrastructure |

| By Location | Urban Suburban Rural and Remote |

| By Financing Type | Private Investment and REIT Capital Public Funding (BEAD, RDOF, and other federal/state programs) Joint Ventures and Sale-Leaseback |

| By Power/Fuel Type | Grid-Connected Hybrid and Renewable-Backed (e.g., solar, battery, wind) Diesel/Backup Generators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operator Insights | 120 | Network Managers, Strategic Planners |

| Tower Management Companies | 90 | Operations Directors, Business Development Managers |

| Regulatory Compliance and Zoning | 60 | Compliance Officers, City Planners |

| Infrastructure Investment Firms | 70 | Investment Analysts, Portfolio Managers |

| Technology Providers for Telecom | 50 | Product Managers, Technical Sales Representatives |

The United States Telecom Towers Market is valued at approximately USD 4044 billion, reflecting a five-year historical analysis. This valuation is supported by ongoing demand for tower ownership and leasing, particularly driven by the expansion of 5G networks and increased mobile data consumption.