Region:Middle East

Author(s):Dev

Product Code:KRAA3566

Pages:86

Published On:September 2025

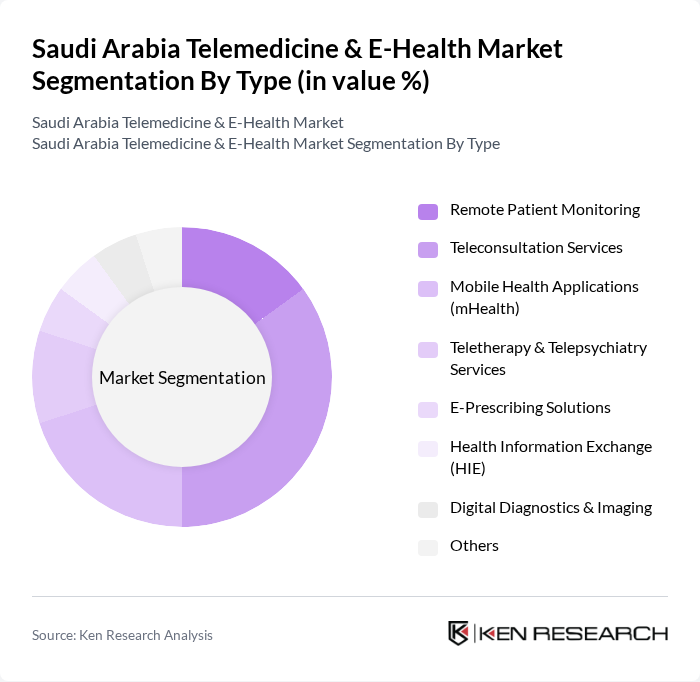

By Type:The market is segmented into various types, including Remote Patient Monitoring, Teleconsultation Services, Mobile Health Applications (mHealth), Teletherapy & Telepsychiatry Services, E-Prescribing Solutions, Health Information Exchange (HIE), Digital Diagnostics & Imaging, and Others. Among these, Teleconsultation Services is currently the leading sub-segment, driven by the increasing demand for virtual consultations, especially during the COVID-19 pandemic. Patients prefer the convenience and accessibility of teleconsultations, which has led to a significant rise in their adoption.

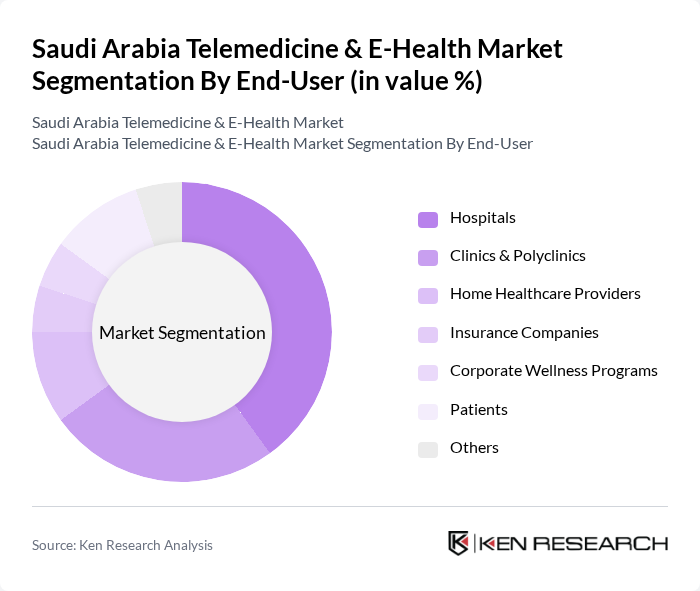

By End-User:The end-user segmentation includes Hospitals, Clinics & Polyclinics, Home Healthcare Providers, Insurance Companies, Corporate Wellness Programs, Patients, and Others. Hospitals are the dominant end-user segment, as they are increasingly integrating telemedicine solutions to enhance patient care and streamline operations. The need for efficient healthcare delivery and the ability to manage patient loads effectively have made hospitals the primary adopters of telehealth technologies.

The Saudi Arabia Telemedicine & E-Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seha Virtual Hospital, Altibbi, Vezeeta, Okadoc, Mawid (Ministry of Health), Cura, Medisense, Tibbiyah, Nahdi Medical Company, Dr. Sulaiman Al Habib Medical Group, King Faisal Specialist Hospital & Research Centre, Aster DM Healthcare, Saudi German Hospital Group, King Saud Medical City, AlMouwasat Medical Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telemedicine and e-health market in Saudi Arabia appears promising, driven by ongoing technological innovations and increasing health awareness among the population. As the government continues to support digital health initiatives, the integration of advanced technologies like AI and machine learning will enhance service delivery. Furthermore, the growing acceptance of telehealth services among patients is expected to foster a more patient-centric healthcare model, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Patient Monitoring Teleconsultation Services Mobile Health Applications (mHealth) Teletherapy & Telepsychiatry Services E-Prescribing Solutions Health Information Exchange (HIE) Digital Diagnostics & Imaging Others |

| By End-User | Hospitals Clinics & Polyclinics Home Healthcare Providers Insurance Companies Corporate Wellness Programs Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare & Wellness Emergency & Acute Care Services Rehabilitation & Post-Acute Care Maternal & Child Health Others |

| By Distribution Channel | Direct Sales Online Platforms & Marketplaces Partnerships with Healthcare Providers Telehealth Networks & Aggregators Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Freemium & Tiered Pricing Others |

| By Technology | Video Conferencing Platforms Mobile Applications (iOS/Android) Cloud-Based Solutions AI-Driven Platforms & Chatbots IoT & Connected Devices Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Women’s Health Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patients Using Telemedicine | 150 | Telehealth Users, Chronic Disease Patients, General Public |

| Healthcare Policy Makers | 45 | Government Officials, Health Ministry Representatives |

| Technology Providers | 65 | IT Managers, Software Developers, System Integrators |

| Insurance Companies | 55 | Underwriters, Claims Managers, Product Development Heads |

The Saudi Arabia Telemedicine & E-Health Market is valued at approximately USD 1.06 billion, reflecting significant growth driven by the adoption of digital health solutions and government initiatives aimed at enhancing healthcare accessibility.