Region:Middle East

Author(s):Rebecca

Product Code:KRAD1501

Pages:81

Published On:November 2025

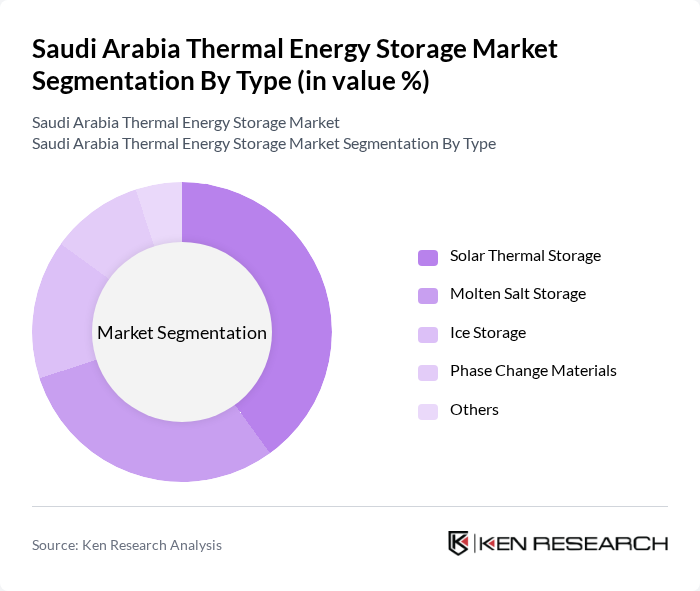

By Type:The market is segmented into various types of thermal energy storage solutions, including Solar Thermal Storage, Molten Salt Storage, Ice Storage, Phase Change Materials, and Others. Solar Thermal Storage is gaining traction due to its compatibility with solar power generation, while Molten Salt Storage is favored for its efficiency in large-scale applications. Ice Storage is also emerging as a popular choice for cooling applications, particularly in commercial buildings, driven by the high demand for air conditioning and HVAC systems in Saudi Arabia’s climate.

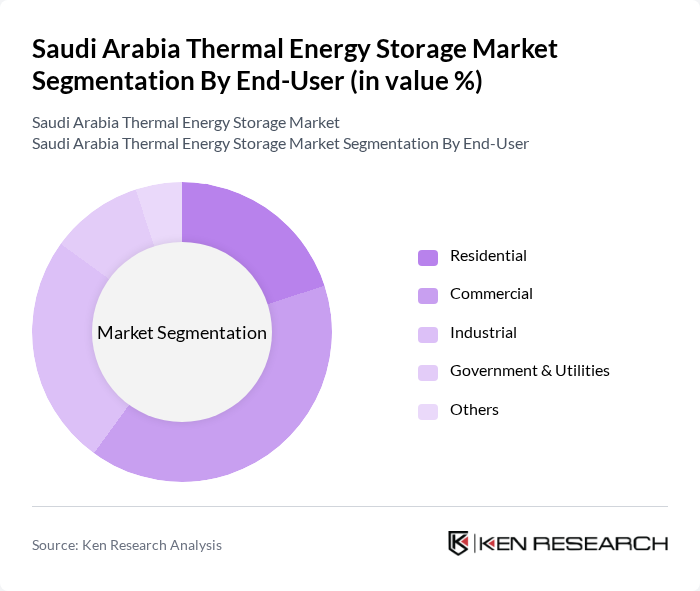

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Commercial segment currently leads the market, reflecting the high energy demands of commercial buildings, particularly for cooling and HVAC applications. The Industrial sector is also a significant adopter, while the Residential segment is experiencing rapid growth due to increased awareness and adoption of energy-efficient solutions.

The Saudi Arabia Thermal Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, Saudi Electricity Company, National Renewable Energy Program (NREP), Abengoa Solar, Siemens Energy, BrightSource Energy, Masdar, Engie, TotalEnergies, Schneider Electric, Wärtsilä, General Electric, Mitsubishi Power, Fluence Energy, Ice Energy, Caldwell Energy Company, Terrafore Technologies, Steffes Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermal energy storage market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and technological advancements. In the future, the integration of artificial intelligence in energy management systems is expected to enhance operational efficiency. Additionally, the growth of decentralized energy systems will facilitate localized energy solutions, further supporting the transition towards sustainable energy practices. As the government continues to promote energy diversification, the market is poised for significant developments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Thermal Storage Molten Salt Storage Ice Storage Phase Change Materials Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Concentrated Solar Power (CSP) Thermal Energy Storage Systems Biomass Thermal Storage Others |

| By Application | District Heating Industrial Process Heat Power Generation Others |

| By Investment Source | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 45 | Energy Managers, Project Directors |

| Renewable Energy Developers | 38 | Business Development Managers, Technical Leads |

| Technology Providers | 35 | Product Managers, R&D Engineers |

| Government Agencies | 22 | Policy Makers, Energy Analysts |

| Academic Institutions | 18 | Researchers, Professors in Energy Studies |

The Saudi Arabia Thermal Energy Storage Market is valued at approximately USD 160 million, reflecting a growing demand for renewable energy solutions and efficient energy management systems, particularly in urban centers like Riyadh, Jeddah, and Dammam.