Region:Middle East

Author(s):Rebecca

Product Code:KRAD2932

Pages:81

Published On:November 2025

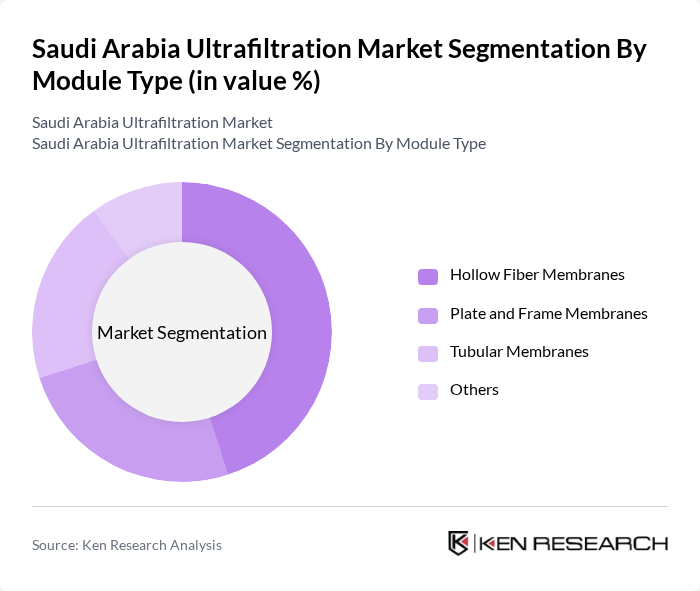

By Module Type:The ultrafiltration market can be segmented into four main module types: Hollow Fiber Membranes, Plate and Frame Membranes, Tubular Membranes, and Others. Among these, Hollow Fiber Membranes dominate the market due to their high surface area and efficiency in water treatment applications. Their compact design and cost-effectiveness make them a preferred choice for both municipal and industrial applications. The increasing focus on water quality and treatment efficiency further drives the demand for this sub-segment.

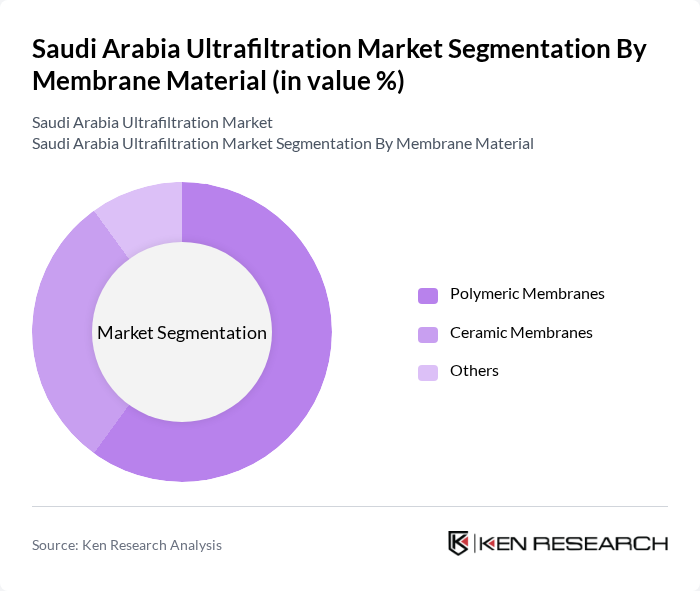

By Membrane Material:The ultrafiltration market is also categorized by membrane material, which includes Polymeric Membranes, Ceramic Membranes, and Others. Polymeric Membranes hold the largest market share due to their versatility, lower cost, and ease of manufacturing. They are widely used in various applications, including municipal water treatment and industrial processes, owing to their effective filtration capabilities and adaptability to different water qualities.

The Saudi Arabia Ultrafiltration Market is characterized by a dynamic mix of regional and international players. Leading participants such as SUEZ Water Technologies & Solutions, Veolia Water Technologies, Pall Corporation, Xylem Inc., Dow Water & Process Solutions, Aquatech International, Membrane Technology and Research (MTR), Koch Membrane Systems, Alfa Laval, Ecolab Inc., IDE Technologies, H2O Innovation, Pentair plc, Toray Industries, and Hyflux Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ultrafiltration market in Saudi Arabia appears promising, driven by increasing investments in water infrastructure and a growing emphasis on sustainable solutions. As the government continues to implement its National Water Strategy, the demand for advanced filtration technologies is expected to rise. Additionally, the integration of IoT and smart water management systems will likely enhance operational efficiency, making ultrafiltration systems more attractive to various sectors, including industrial and municipal applications.

| Segment | Sub-Segments |

|---|---|

| By Module Type | Hollow Fiber Membranes Plate and Frame Membranes Tubular Membranes Others |

| By Membrane Material | Polymeric Membranes Ceramic Membranes Others |

| By Application | Municipal Water Treatment Industrial Water Treatment Food and Beverage Processing Pharmaceutical Processing Others |

| By End-User | Municipal Authorities Industrial Facilities Commercial Establishments Others |

| By Industry Vertical | Oil and Gas Chemical Processing Food and Beverage Pharmaceutical Power Generation Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region Northern Region |

| By Policy Support | Vision 2030 Initiatives Government Subsidies Tax Incentives Research and Development Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Authorities | 60 | Water Treatment Managers, Environmental Engineers |

| Industrial Water Users | 50 | Facility Managers, Operations Directors |

| Commercial Water Treatment Providers | 40 | Business Development Managers, Technical Sales Representatives |

| Research Institutions in Water Technology | 50 | Research Scientists, Academic Professors |

| Consultants in Water Management | 40 | Industry Analysts, Environmental Consultants |

The Saudi Arabia Ultrafiltration Market is valued at approximately USD 1.4 billion, driven by the increasing demand for clean water, industrial applications, and advancements in membrane technology.