Saudi Arabia Virtual Events Market Overview

- The Saudi Arabia Virtual Events Market is valued at USD 860 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital technologies, strong government-backed digital transformation initiatives under Vision 2030, and the need for businesses to engage with clients and stakeholders virtually. The COVID-19 pandemic significantly accelerated the shift towards virtual and hybrid events, leading to a sustained demand for innovative online solutions in conferencing, exhibitions, and corporate communication.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the Saudi Arabia Virtual Events Market due to their robust digital infrastructure, high internet and smartphone penetration, and a concentration of corporate and government headquarters. These urban centers are pivotal for hosting large-scale virtual and hybrid events, attracting both local and international participants, and are increasingly leveraged for trade shows, conferences, and entertainment events aligned with national tourism and events strategies.

- In 2023, the Saudi government advanced regulations to promote digital transformation across various sectors, including activities relevant to the virtual events industry. The framework is supported by instruments such as the E-Transactions Law issued by the Council of Ministers in 2007, and subsequent updates under the National Digital Transformation Program and Saudi Vision 2030, which mandate secure use of electronic systems, recognition of digital records and signatures, and compliance with cybersecurity and data protection requirements for online services, including virtual event platforms.

Saudi Arabia Virtual Events Market Segmentation

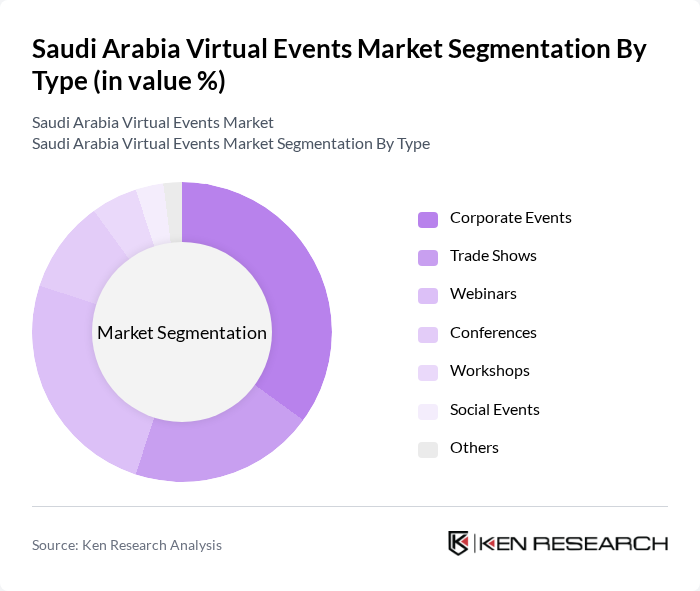

By Type:The segmentation of the market by type includes various formats such as corporate events, trade shows, webinars, conferences, workshops, social events, and others. Corporate events and webinars are particularly dominant due to the extensive use of virtual platforms for internal meetings, investor relations, product launches, sales enablement, and training activities among enterprises. The shift towards remote and hybrid work models has made webinars and virtual conferences a preferred choice for knowledge sharing, professional upskilling, and employee engagement, while virtual corporate events increasingly incorporate features such as AI-powered networking, interactive polling, and analytics to facilitate networking and collaboration in a virtual environment.

By End-User:The market is segmented by end-user into corporates, educational institutions, government agencies, non-profit organizations, and others. Corporates lead the market due to their extensive use of virtual events for training, town halls, investor days, product launches, and stakeholder engagement, supported by widespread deployment of enterprise collaboration tools and virtual event platforms. Educational institutions and government agencies are also increasingly adopting virtual and hybrid formats for e-learning, large-scale examinations, public consultations, and policy-related events, reflecting the broader push toward digital service delivery and remote participation across the Kingdom.

Saudi Arabia Virtual Events Market Competitive Landscape

The Saudi Arabia Virtual Events Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoom Video Communications, Microsoft Teams, Cisco Webex, Hopin, Eventbrite, InEvent, ON24, vFairs, Bizzabo, Cvent, Attendify, BigMarker, Whova, Airmeet, Run The World, Saudi Telecom Company (STC), Mobily (Etihad Etisalat), Zain KSA, Tadawul Group, Saudi Events Company (SEC) contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Virtual Events Market Industry Analysis

Growth Drivers

- Increased Internet Penetration:As of future, Saudi Arabia's internet penetration rate is projected to reach 99%, with approximately 36 million active internet users. This widespread access facilitates participation in virtual events, enabling organizations to reach broader audiences. The government's investment in digital infrastructure, amounting to $1.5 billion, supports this growth. Enhanced connectivity allows for seamless streaming and interaction, making virtual events more appealing to both organizers and attendees.

- Demand for Cost-Effective Solutions:The economic landscape in Saudi Arabia is shifting, with businesses increasingly seeking cost-effective solutions for events. In future, companies are expected to allocate around $300 million towards virtual event platforms, driven by the need to reduce travel and venue costs. This trend is particularly significant as organizations aim to optimize budgets while maintaining engagement levels. Virtual events provide a viable alternative, allowing for high-quality experiences without the associated expenses of traditional formats.

- Rise of Hybrid Events:The hybrid event model is gaining traction in Saudi Arabia, with an estimated 60% of events incorporating both in-person and virtual elements in future. This approach caters to diverse audience preferences, allowing for greater flexibility and participation. The Ministry of Culture's initiatives to promote hybrid formats have led to a 40% increase in event registrations. This trend not only enhances accessibility but also expands the reach of events, making them more inclusive and engaging for all participants.

Market Challenges

- Security and Privacy Concerns:As virtual events become more prevalent, security and privacy issues pose significant challenges. In future, 70% of event organizers express concerns about data breaches and unauthorized access. The lack of robust cybersecurity measures can deter potential users, impacting participation rates. Additionally, compliance with data protection regulations, such as the Personal Data Protection Law, adds complexity for organizers, necessitating investments in secure platforms to safeguard attendee information.

- Limited Awareness Among Potential Users:Despite the growth of virtual events, many potential users remain unaware of their benefits. In future, surveys indicate that 55% of businesses in Saudi Arabia have not yet adopted virtual event solutions. This lack of awareness can hinder market expansion, as organizations may not fully understand how virtual events can enhance engagement and reduce costs. Targeted educational campaigns are essential to bridge this knowledge gap and encourage wider adoption of virtual platforms.

Saudi Arabia Virtual Events Market Future Outlook

The future of the Saudi Arabia virtual events market appears promising, driven by technological advancements and evolving consumer preferences. As organizations increasingly embrace digital transformation, the integration of AI and machine learning into event platforms is expected to enhance personalization and engagement. Furthermore, the growing emphasis on sustainability will likely influence event planning, prompting organizers to adopt eco-friendly practices. These trends indicate a dynamic market landscape, poised for continued innovation and growth in the coming years.

Market Opportunities

- Growth in Corporate Training and Development:The corporate sector in Saudi Arabia is increasingly investing in virtual training solutions, with expenditures projected to reach $200 million. This shift presents a significant opportunity for virtual event platforms to cater to training needs, offering interactive and engaging formats that enhance learning outcomes. Companies are recognizing the value of virtual training in improving employee skills and knowledge retention.

- Collaboration with Influencers and Content Creators:The rise of social media influencers in Saudi Arabia presents a unique opportunity for virtual events. Collaborating with influencers can enhance event visibility and attract larger audiences. In future, brands are expected to invest approximately $150 million in influencer partnerships for virtual events, leveraging their reach to engage potential attendees. This strategy can significantly boost participation and create more dynamic event experiences.