Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9008

Pages:80

Published On:November 2025

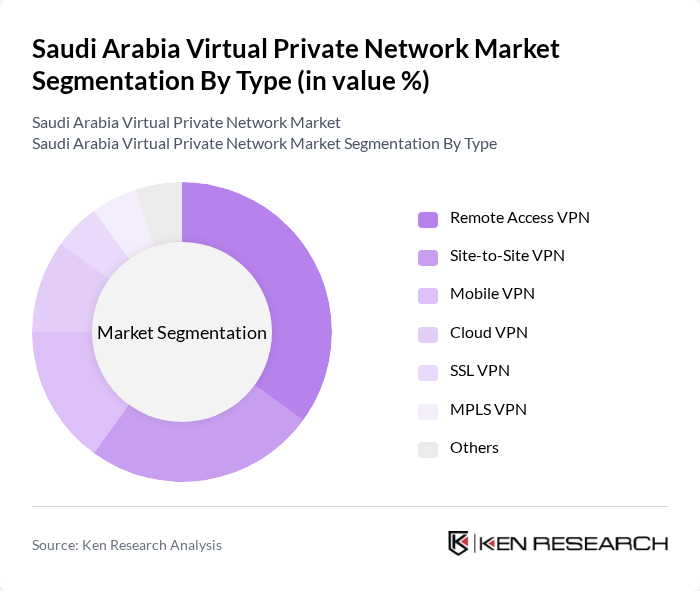

By Type:The market is segmented into various types of VPN services, including Remote Access VPN, Site-to-Site VPN, Mobile VPN, Cloud VPN, SSL VPN, MPLS VPN, and Others. Each type serves different user needs, with Remote Access VPN being particularly popular among individuals and businesses for secure remote connections. Site-to-Site VPN is favored by organizations with multiple locations, while Mobile VPN caters to users on the go. Cloud VPN is gaining traction due to the increasing shift towards cloud-based services and the need for scalable, flexible security solutions .

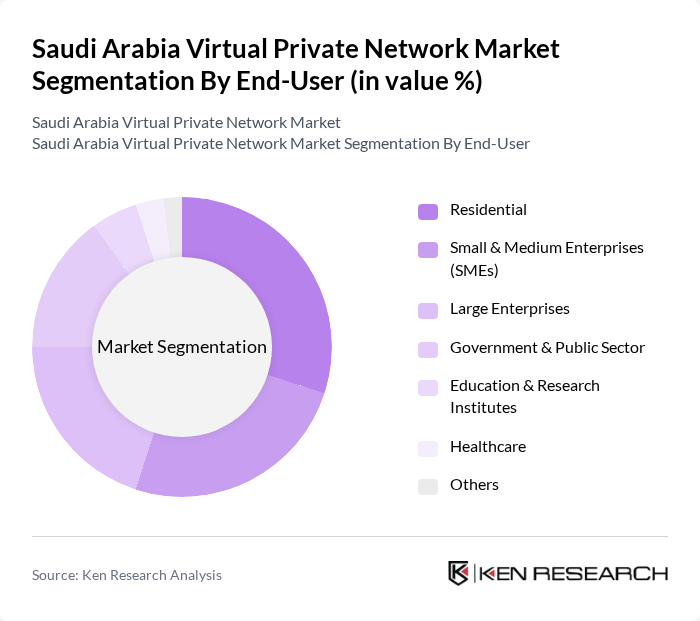

By End-User:The end-user segmentation includes Residential, Small & Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Education & Research Institutes, Healthcare, and Others. The Residential segment is witnessing significant growth as individuals seek secure browsing options, while SMEs are increasingly adopting VPNs to protect their business data and support remote work. Large enterprises utilize VPNs for secure communications across their global operations, and the government sector emphasizes VPN usage for national security and compliance with regulatory standards .

The Saudi Arabia Virtual Private Network market is characterized by a dynamic mix of regional and international players. Leading participants such as STC (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, VPN Arabia, PureVPN, NordVPN, ExpressVPN, CyberGhost, Surfshark, Private Internet Access, VyprVPN, Proton VPN, Atlas VPN, Ivacy VPN, Hotspot Shield, Cisco Systems, Fortinet, Palo Alto Networks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia VPN market appears promising, driven by ongoing digital transformation initiatives and increasing consumer awareness of online privacy. As the government continues to invest in cybersecurity infrastructure, the demand for secure internet access will likely rise. Furthermore, advancements in technology, such as AI integration in VPN services, will enhance user experiences. The market is expected to evolve with innovative solutions that cater to the growing needs of both individuals and businesses, ensuring robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Access VPN Site-to-Site VPN Mobile VPN Cloud VPN SSL VPN MPLS VPN Others |

| By End-User | Residential Small & Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Education & Research Institutes Healthcare Others |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-as-you-go Enterprise Licensing Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Managed Service Others |

| By Industry Vertical | IT & Telecom Healthcare BFSI (Banking, Financial Services & Insurance) Education Oil & Gas Government Retail & E-commerce Others |

| By Geographic Distribution | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate VPN Usage | 150 | IT Managers, Network Administrators |

| Consumer VPN Adoption | 100 | General Internet Users, Tech Enthusiasts |

| Government Sector VPN Implementation | 80 | Cybersecurity Officials, Policy Makers |

| VPN Service Provider Insights | 70 | Business Development Managers, Marketing Executives |

| Privacy Advocacy Groups | 60 | Activists, Legal Advisors |

The Saudi Arabia Virtual Private Network market is valued at approximately USD 2.7 billion, reflecting significant growth driven by the increasing demand for secure internet connections and the rise in remote work environments.