Region:Middle East

Author(s):Shubham

Product Code:KRAD6803

Pages:95

Published On:December 2025

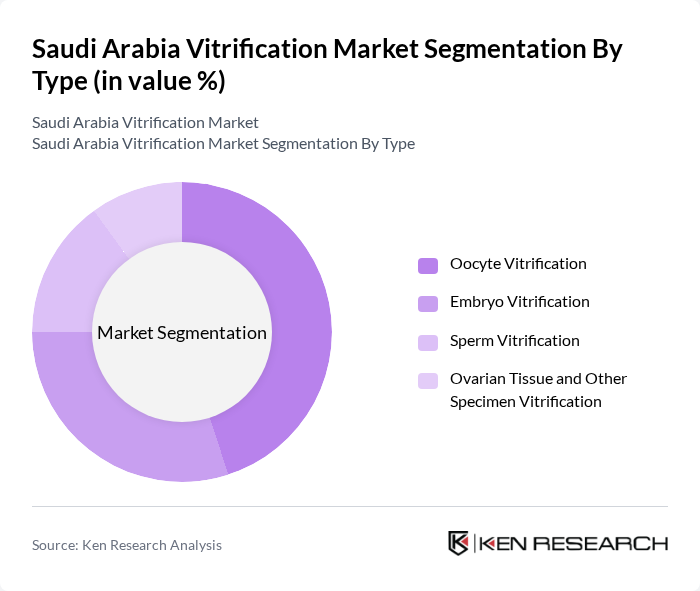

By Type:The segmentation by type includes Oocyte Vitrification, Embryo Vitrification, Sperm Vitrification, and Ovarian Tissue and Other Specimen Vitrification. Among these, Oocyte Vitrification is currently the leading sub-segment due to its critical role in female fertility preservation. The increasing trend of women delaying childbirth for personal or professional reasons has significantly boosted the demand for oocyte freezing. Additionally, advancements in vitrification techniques have improved the success rates of oocyte preservation, making it a preferred choice for many women.

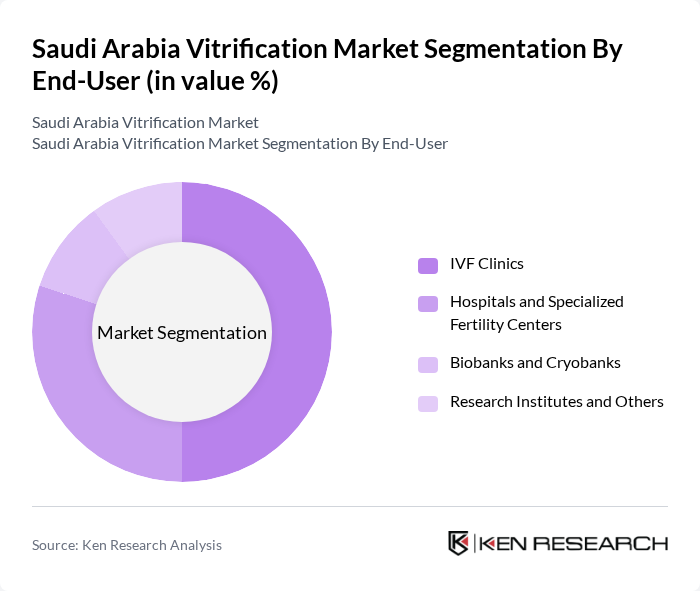

By End-User:The end-user segmentation includes IVF Clinics, Hospitals and Specialized Fertility Centers, Biobanks and Cryobanks, and Research Institutes and Others. IVF Clinics dominate this segment, driven by the increasing number of couples seeking assisted reproductive technologies. These clinics are often equipped with advanced vitrification technologies and have specialized staff, which enhances their ability to provide successful fertility treatments. The growing acceptance of IVF as a viable option for infertility has further solidified the position of IVF clinics in the market.

The Saudi Arabia Vitrification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dr. Sulaiman Al Habib Medical Group – IVF & Fertility Centers, Fakih IVF Fertility Center (Saudi Arabia), Saudi German Hospital Group – Fertility and IVF Units, Dr. Samir Abbas Hospital – IVF & Reproductive Medicine Center, Ibn Sina IVF Center, King Faisal Specialist Hospital & Research Centre – Reproductive Medicine, King Fahd Medical City – Assisted Reproduction Unit, Riyadh Fertility and Obstetrics Centers, IVF Clinic, Dr. Khalid Idris Hospital, Al Mana General Hospitals – IVF & Fertility Services, CryoSave Arabia (Gulf Cryo / Stemlife Arabia), Vitrolife AB, CooperSurgical Fertility Solutions, FUJIFILM Irvine Scientific, Merck Serono (Merck KGaA) – Fertility & Endocrinology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia vitrification market appears promising, driven by increasing government support and technological advancements. As the country continues to prioritize sustainable waste management, the integration of innovative vitrification solutions will likely gain momentum. Furthermore, the collaboration between public and private sectors is expected to enhance resource allocation and expertise, fostering a more robust market environment. This trend will be crucial in addressing the challenges posed by waste management and environmental sustainability in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Oocyte Vitrification Embryo Vitrification Sperm Vitrification Ovarian Tissue and Other Specimen Vitrification |

| By End-User | IVF Clinics Hospitals and Specialized Fertility Centers Biobanks and Cryobanks Research Institutes and Others |

| By Application | Female Infertility Treatment Male Infertility Treatment Fertility Preservation (Oncology and Social Freezing) Donor Gamete and Embryo Programs |

| By Material / Product Type | Vitrification Media and Kits Vitrification Devices (Carriers, Straws, Cryo?containers) Cryo-storage Equipment and Tanks Others |

| By Technology / Method | Closed Vitrification Systems Open Vitrification Systems Hybrid and Advanced Vitrification Protocols |

| By Investment Source | Government and Public Healthcare Funding Private Fertility Clinic Investments Foreign Direct Investment and International Partnerships Others |

| By Policy Support | Assisted Reproductive Technology (ART) Regulatory Framework Insurance Reimbursement and Coverage Policies Licensing and Accreditation Requirements for IVF Centers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nuclear Waste Management | 90 | Environmental Engineers, Waste Management Directors |

| Industrial Waste Vitrification | 80 | Operations Managers, Compliance Officers |

| Municipal Waste Solutions | 70 | City Planners, Waste Management Supervisors |

| Research and Development in Vitrification | 60 | Research Scientists, Technical Directors |

| Policy and Regulation Impact | 50 | Government Officials, Regulatory Affairs Managers |

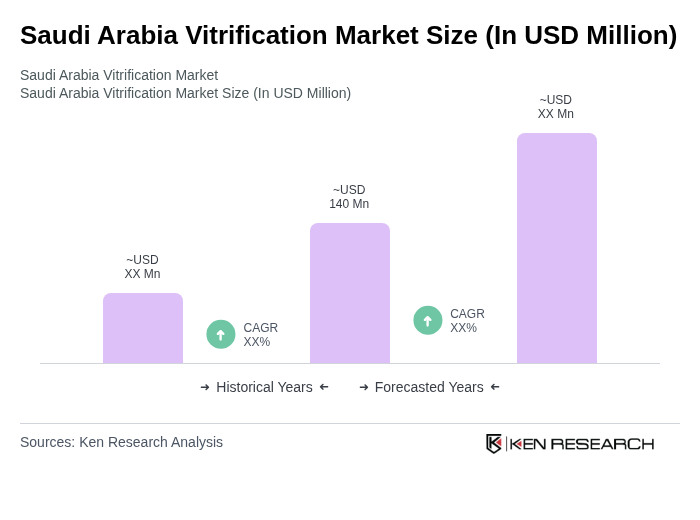

The Saudi Arabia Vitrification Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is attributed to rising infertility rates, advancements in reproductive technologies, and increased awareness regarding fertility preservation.