Region:Middle East

Author(s):Shubham

Product Code:KRAA8935

Pages:85

Published On:November 2025

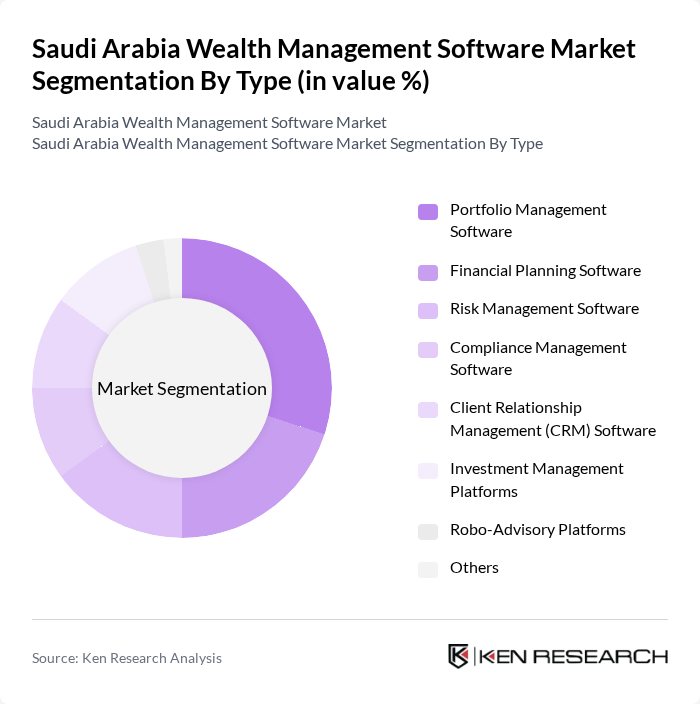

By Type:The market is segmented into various types of software solutions that cater to different aspects of wealth management. The subsegments include Portfolio Management Software, Financial Planning Software, Risk Management Software, Compliance Management Software, Client Relationship Management (CRM) Software, Investment Management Platforms, Robo-Advisory Platforms, and Others. Among these, Portfolio Management Software is currently leading the market due to its essential role in helping clients manage their investment portfolios effectively, driven by the increasing complexity of investment options and the need for real-time data analysis. Investment Management Platforms are also gaining traction, particularly among institutional and high-net-worth clients seeking comprehensive asset allocation and performance tracking capabilities .

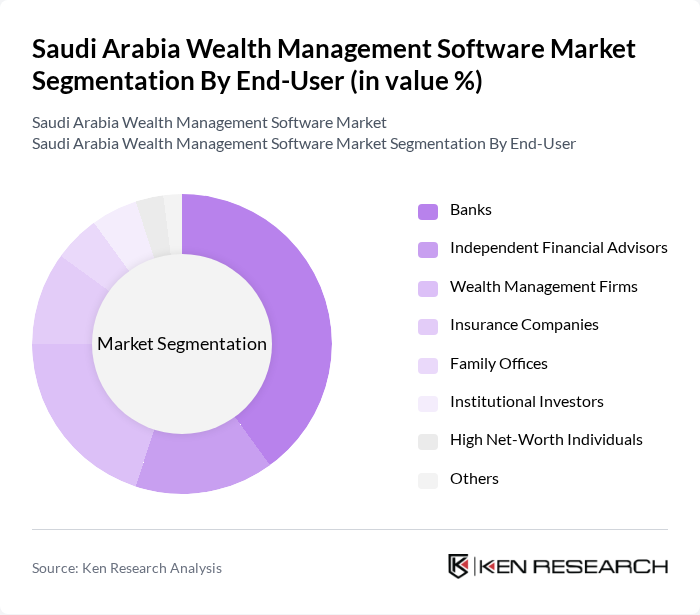

By End-User:The wealth management software market is also segmented by end-users, which include Banks, Independent Financial Advisors, Wealth Management Firms, Insurance Companies, Family Offices, Institutional Investors, High Net-Worth Individuals, and Others. Banks are the dominant end-user segment, as they increasingly adopt wealth management software to enhance their service offerings and improve client engagement, driven by the competitive landscape and the need for efficient asset management solutions. High-net-worth individuals and institutional investors are also significant end-users, seeking advanced digital platforms for tailored investment strategies and portfolio management .

The Saudi Arabia Wealth Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, SNB Capital (Saudi National Bank Group), Riyad Bank, Samba Financial Group, Arab National Bank, Banque Saudi Fransi, Alinma Bank, Gulf International Bank, Emirates NBD, HSBC Saudi Arabia, Morgan Stanley Saudi Arabia, UBS Saudi Arabia, Citigroup Saudi Arabia, J.P. Morgan Saudi Arabia, Deutsche Bank Saudi Arabia, FIS (Fidelity National Information Services), Temenos AG, SS&C Technologies Holdings Inc., Profile Software, Comarch contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia wealth management software market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to expand, firms will increasingly leverage artificial intelligence and analytics to enhance service delivery. Additionally, the growing interest in sustainable investments will likely shape product offerings, aligning with global trends. Overall, the market is poised for significant transformation, with opportunities for innovation and collaboration among service providers and fintech companies.

| Segment | Sub-Segments |

|---|---|

| By Type | Portfolio Management Software Financial Planning Software Risk Management Software Compliance Management Software Client Relationship Management (CRM) Software Investment Management Platforms Robo-Advisory Platforms Others |

| By End-User | Banks Independent Financial Advisors Wealth Management Firms Insurance Companies Family Offices Institutional Investors High Net-Worth Individuals Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Functionality | Investment Management Financial Planning Reporting and Analytics Compliance and Risk Management Client Onboarding & KYC Others |

| By Client Type | Individual Clients Institutional Clients Corporate Clients Government Entities Others |

| By Geographic Presence | Urban Areas Rural Areas Others |

| By Regulatory Compliance | Sharia-Compliant Solutions International Compliance Standards Local Compliance Standards Others |

| By Technology | Artificial Intelligence Big Data Analytics Blockchain Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Third-Party Resellers Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Freemium Models Others |

| By Service Type | Advisory Services Managed Services Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wealth Management Firms | 100 | Wealth Managers, Financial Advisors |

| Investment Advisory Services | 80 | Investment Analysts, Portfolio Managers |

| Private Banking Sector | 70 | Private Bankers, Relationship Managers |

| Financial Technology Providers | 50 | Product Managers, Software Developers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Analysts |

The Saudi Arabia Wealth Management Software Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for digital financial services and the rise of high-net-worth individuals in the region.