Region:Asia

Author(s):Geetanshi

Product Code:KRAB5751

Pages:82

Published On:October 2025

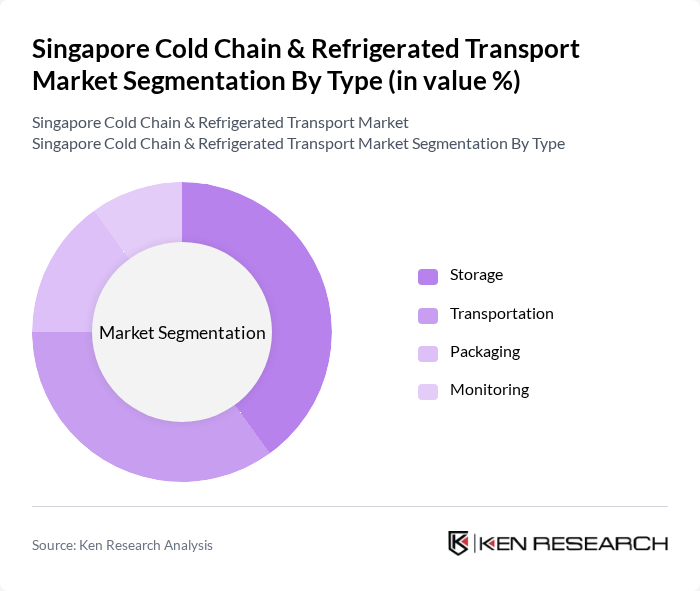

By Type:The cold chain and refrigerated transport market can be segmented into four main types: Storage, Transportation, Packaging, and Monitoring. Each of these segments plays a crucial role in ensuring the integrity and quality of temperature-sensitive products throughout the supply chain. The storage segment dominates the market with a significant market share, while transportation is emerging as the most lucrative segment registering the fastest growth.

The Storage segment dominates the market due to the increasing need for temperature-controlled warehouses that can accommodate a variety of perishable goods. Cold storage is a cold chain's static part that aids in preserving perishable items, with consumer inclination towards packaged foods and changing dietary patterns and lifestyles contributing to driving the market in the storage segment. With the rise in e-commerce, businesses are investing heavily in cold storage facilities to ensure product quality and safety. The demand for efficient storage solutions is further fueled by the growing consumer preference for fresh and organic products, which require stringent temperature controls.

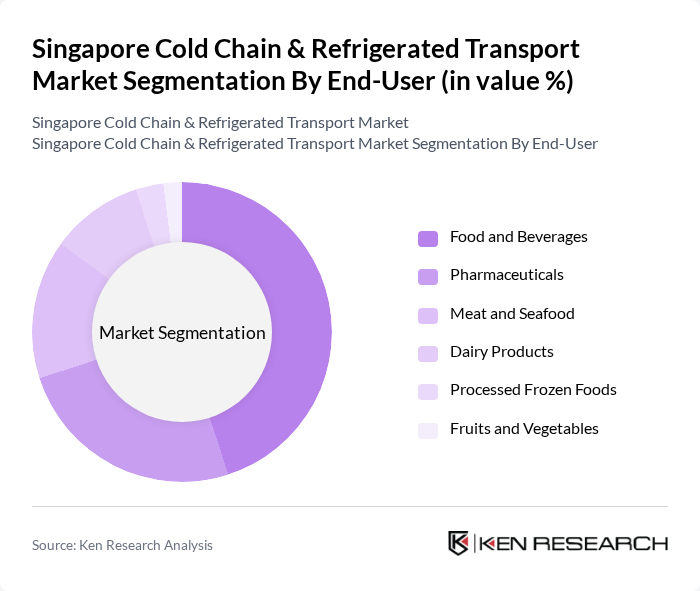

By End-User:The market can be segmented by end-user into Food and Beverages, Pharmaceuticals, Meat and Seafood, Dairy Products, Processed Frozen Foods, and Fruits and Vegetables. Each end-user segment has unique requirements and contributes differently to the overall market dynamics. The food and beverages segment dominated the Singapore cold chain market with the largest market share, driven by the growth of pharmaceutical and biotech industries and stringent food safety regulations.

The Food and Beverages segment leads the market, driven by the increasing demand for fresh and frozen food products. Food and beverages are preserved by cold storage facilities by slowing down microbial growth which is responsible for spoilage. The rise in health consciousness among consumers has led to a surge in demand for organic and minimally processed foods, which require efficient cold chain logistics to maintain quality. Additionally, the growth of the food service industry and online grocery shopping has further propelled the need for reliable cold chain solutions. In the healthcare sector, the storage and distribution of vaccines, biologics, and other temperature-sensitive medicines are further boosting the cold chain infrastructure.

The Singapore Cold Chain & Refrigerated Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as ST Logistics, YCH Group, DB Schenker, Kuehne + Nagel, DHL Supply Chain, JWD Group, CWT Limited, Agility Logistics, Nippon Express, XPO Logistics, Kintetsu World Express, Sinotrans Limited, CEVA Logistics, Kerry Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore cold chain and refrigerated transport market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of IoT and smart technologies is expected to enhance operational efficiency and transparency in the supply chain. Additionally, the focus on sustainability will likely lead to increased investments in energy-efficient refrigeration solutions. As the market adapts to these trends, companies that prioritize innovation and compliance with food safety regulations will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Storage Transportation Packaging Monitoring |

| By End-User | Food and Beverages Pharmaceuticals Meat and Seafood Dairy Products Processed Frozen Foods Fruits and Vegetables |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Payload Capacity | Less than 5 Tons to 10 Tons to 20 Tons More than 20 Tons |

| By Application | Fresh Produce Frozen Foods Dairy Products Pharmaceuticals Others |

| By Sales Channel | Online Sales Offline Sales Wholesale Distribution Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Cold Chain | 120 | Supply Chain Managers, Quality Assurance Officers |

| Pharmaceutical Refrigerated Transport | 90 | Logistics Coordinators, Compliance Managers |

| Retail Cold Storage Solutions | 80 | Operations Managers, Inventory Control Specialists |

| Temperature-Controlled Logistics Technology | 60 | IT Managers, Technology Officers |

| Cold Chain Infrastructure Development | 50 | Project Managers, Urban Planners |

The Singapore Cold Chain & Refrigerated Transport Market is valued at approximately USD 1.5 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and online grocery shopping.