Region:Asia

Author(s):Geetanshi

Product Code:KRAB5714

Pages:98

Published On:October 2025

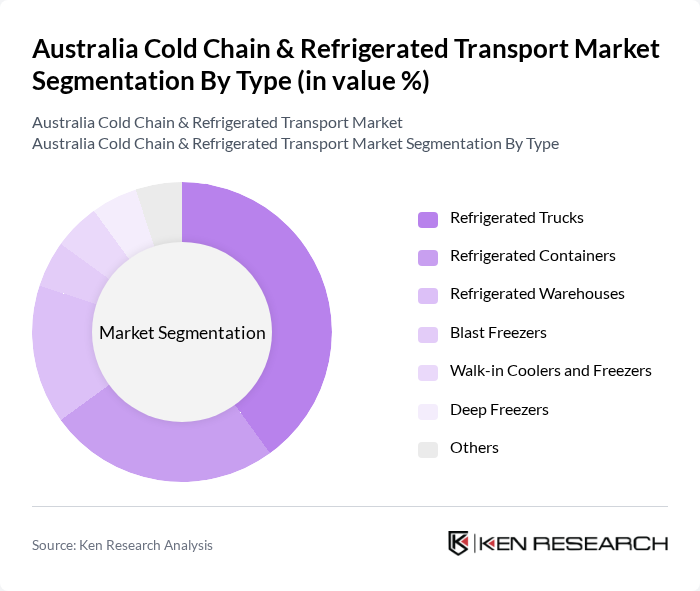

By Type:The cold chain and refrigerated transport market can be segmented into various types, including refrigerated trucks, refrigerated containers, refrigerated warehouses, blast freezers, walk-in coolers and freezers, deep freezers, and others. Each of these subsegments plays a crucial role in maintaining the integrity of temperature-sensitive products during transportation and storage. Among these, refrigerated trucks are particularly dominant due to their flexibility and ability to reach various locations efficiently. Storage facilities, such as refrigerated warehouses, also represent a significant share, supporting bulk storage and distribution for food and pharmaceutical supply chains .

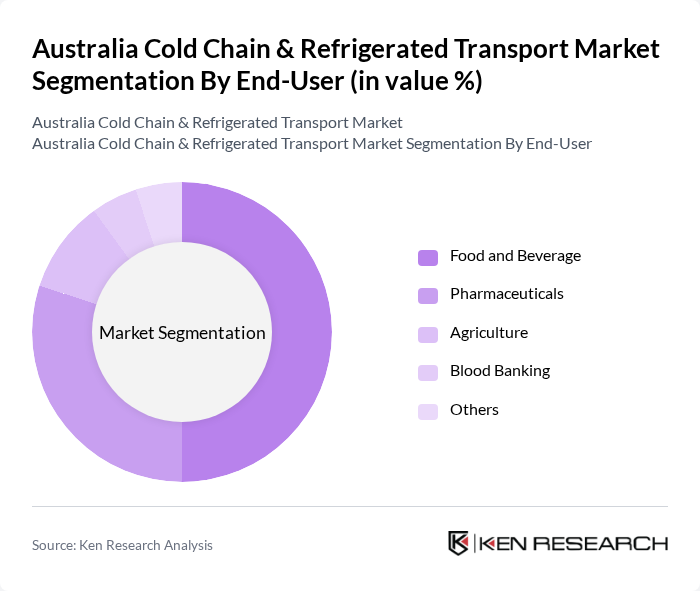

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals, agriculture, blood banking, and others. The food and beverage sector is the largest consumer of cold chain logistics, driven by the need for fresh produce and perishable goods. The pharmaceutical industry also significantly contributes to the market, requiring strict temperature control for vaccines and medications. Agriculture and blood banking are emerging segments, supported by increased demand for export-grade produce and temperature-sensitive biologicals .

The Australia Cold Chain & Refrigerated Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lineage Logistics, Americold, NewCold, Rand Refrigerated Logistics, Linfox, AHG Refrigerated Logistics, SCG Logistics, Toll Group, DB Schenker, Kuehne + Nagel, Emergent Cold, Matilda's Transport, C.H. Robinson, DHL Supply Chain, CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and refrigerated transport market in Australia appears promising, driven by technological advancements and evolving consumer preferences. As the demand for perishable goods continues to rise, logistics providers are expected to adopt innovative solutions, including IoT for real-time monitoring and electric refrigerated vehicles. Additionally, the focus on sustainability will likely lead to increased investments in eco-friendly practices, ensuring that the industry adapts to both market demands and regulatory requirements while enhancing operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Trucks Refrigerated Containers Refrigerated Warehouses Blast Freezers Walk-in Coolers and Freezers Deep Freezers Others |

| By End-User | Food and Beverage Pharmaceuticals Agriculture Blood Banking Others |

| By Distribution Mode | Road Sea Rail Air Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Payload Capacity | Less than 5 Tons 10 Tons 20 Tons More than 20 Tons |

| By Application | Temperature-Controlled Transport Cold Storage Solutions Last-Mile Delivery Export-Grade Fresh Produce Others |

| By Sales Channel | Online Sales Offline Sales Distributors Others |

| By Service Type | Full Truck Load (FTL) Less than Truck Load (LTL) Dedicated Contract Carriage Value-Added Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Networks | 70 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Cold Chain Operations | 50 | Quality Assurance Managers, Operations Directors |

| Retail Cold Storage Facilities | 40 | Warehouse Managers, Inventory Control Specialists |

| Transport Fleet Management | 45 | Fleet Managers, Compliance Officers |

| Technology Providers in Cold Chain | 40 | Product Development Managers, Sales Executives |

The Australia Cold Chain & Refrigerated Transport Market is valued at approximately USD 6.3 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and online grocery shopping.