Region:Asia

Author(s):Rebecca

Product Code:KRAB0205

Pages:82

Published On:August 2025

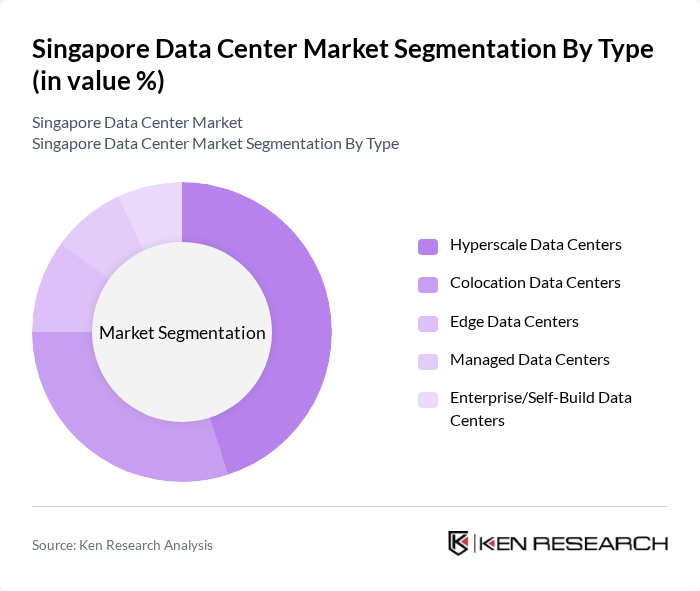

By Type:The data center market can be segmented into Hyperscale Data Centers, Colocation Data Centers, Edge Data Centers, Managed Data Centers, and Enterprise/Self-Build Data Centers. Hyperscale Data Centers are currently leading the market due to their ability to support large-scale operations, high compute density, and provide cost-effective solutions for cloud service providers. The demand for scalable and flexible infrastructure, driven by cloud adoption and AI workloads, has led enterprises to invest significantly in hyperscale models.

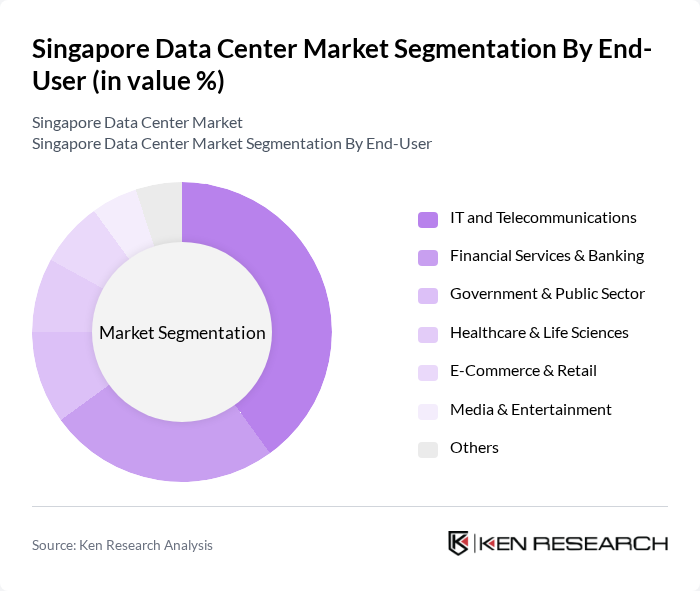

By End-User:The end-user segmentation of the data center market includes IT and Telecommunications, Financial Services & Banking, Government & Public Sector, Healthcare & Life Sciences, E-Commerce & Retail, Media & Entertainment, and Others. The IT and Telecommunications sector is the largest end-user, driven by the increasing demand for cloud computing, data storage solutions, and digital transformation initiatives. As businesses continue to digitize their operations and deploy AI-driven applications, the reliance on data centers for IT infrastructure has become paramount, leading to substantial growth in this segment.

The Singapore Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Digital Realty Trust, Inc., ST Telemedia Global Data Centres (STT GDC), NTT Global Data Centers (NTT Ltd.), Keppel Data Centres, Singtel, 1-Net Singapore, Iron Mountain Data Centers, Global Switch, Alibaba Cloud, Microsoft Azure, Amazon Web Services (AWS), Google Cloud, Rackspace Technology, Vantage Data Centers contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore data center market is poised for continued growth, driven by technological advancements and increasing digitalization across industries. The shift towards hybrid cloud solutions is expected to gain momentum, as businesses seek flexibility and scalability. Additionally, the integration of AI and machine learning technologies will enhance operational efficiencies. As sustainability becomes a priority, investments in green technologies will likely rise, positioning Singapore as a leader in environmentally friendly data center solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Colocation Data Centers Edge Data Centers Managed Data Centers Enterprise/Self-Build Data Centers |

| By End-User | IT and Telecommunications Financial Services & Banking Government & Public Sector Healthcare & Life Sciences E-Commerce & Retail Media & Entertainment Others |

| By Application | Cloud Computing Big Data Analytics Disaster Recovery & Business Continuity Content Delivery & Streaming AI & Machine Learning Workloads Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Sovereign Wealth Funds Government Schemes |

| By Policy Support | Tax Incentives Subsidies for Renewable Energy Regulatory Support for Infrastructure Green Building Certifications Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Colocation Services Others |

| By Data Center Size | Small Data Centers (<1 MW) Medium Data Centers (1–5 MW) Large Data Centers (>5 MW) Mega/Hyperscale Data Centers (>20 MW) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Directors |

| Hyperscale Data Centers | 80 | Cloud Architects, Infrastructure Engineers |

| Enterprise Data Center Operations | 70 | IT Operations Managers, Facility Managers |

| Energy Efficiency Initiatives | 50 | Sustainability Officers, Energy Managers |

| Data Center Security Solutions | 90 | Security Analysts, Compliance Officers |

The Singapore Data Center Market is valued at approximately USD 3.1 billion, driven by increasing demand for cloud services, data storage, and digital transformation initiatives across various sectors, including the rise of IoT and AI technologies.