Region:Asia

Author(s):Dev

Product Code:KRAB5512

Pages:81

Published On:October 2025

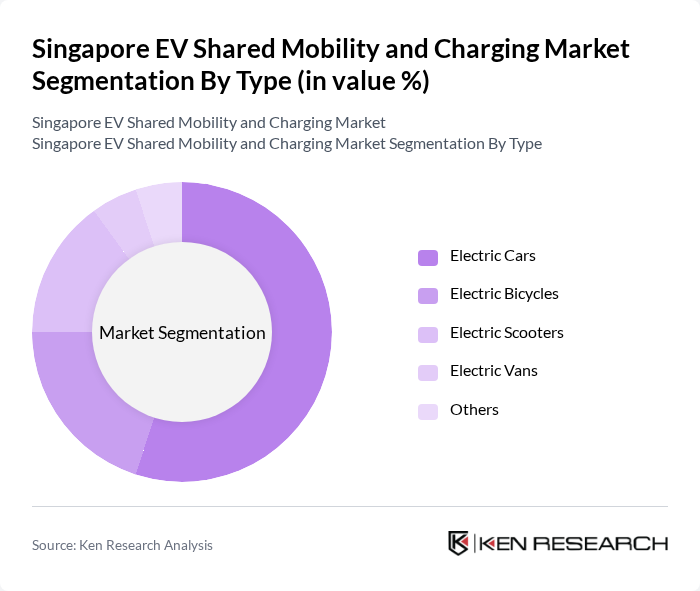

By Type:The market is segmented into various types of electric vehicles, including electric cars, electric bicycles, electric scooters, electric vans, and others. Among these, electric cars are the most popular due to their versatility and increasing consumer preference for personal mobility solutions. Electric bicycles and scooters are also gaining traction, particularly in urban areas, as they offer convenient and eco-friendly alternatives for short-distance travel.

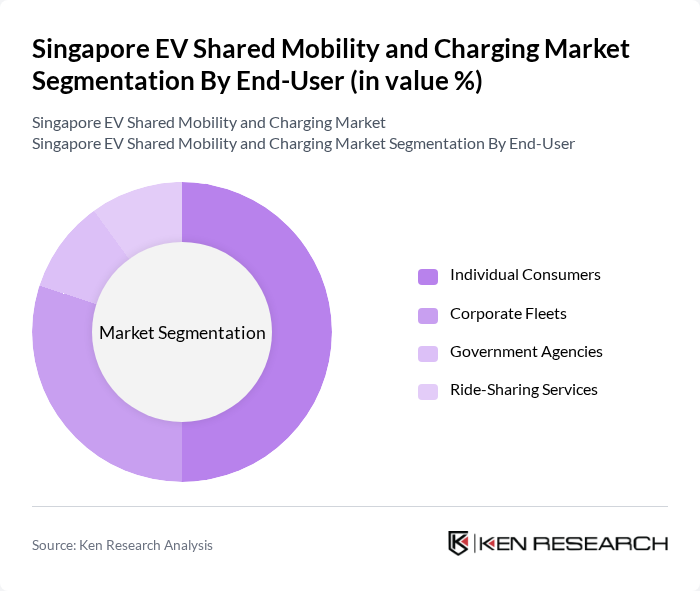

By End-User:The end-user segmentation includes individual consumers, corporate fleets, government agencies, and ride-sharing services. Individual consumers dominate the market as they increasingly opt for electric vehicles for personal use, driven by incentives and environmental concerns. Corporate fleets are also significant, as businesses seek to reduce their carbon footprint and operational costs through electric vehicle adoption.

The Singapore EV Shared Mobility and Charging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grab Holdings Inc., ComfortDelGro Corporation Limited, BlueSG, SP Group, GoJek, Carousell, ST Engineering, Charge+, NCS Group, Shell Singapore, Tesla, Inc., Hyundai Motor Company, BMW Group, Nissan Motor Corporation, Volkswagen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore EV shared mobility and charging market appears promising, driven by increasing government initiatives and consumer demand for sustainable transport solutions. In the future, the integration of smart technologies and renewable energy sources is expected to enhance the efficiency of EV operations. Additionally, the rise of autonomous electric vehicles could revolutionize shared mobility, making it more accessible and convenient. As infrastructure continues to develop, the market is poised for significant growth, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Cars Electric Bicycles Electric Scooters Electric Vans Others |

| By End-User | Individual Consumers Corporate Fleets Government Agencies Ride-Sharing Services |

| By Charging Type | Fast Charging Slow Charging Wireless Charging Others |

| By Service Model | Subscription Services Pay-Per-Use Fleet Management Services Others |

| By Distribution Channel | Online Platforms Physical Dealerships Direct Sales Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shared Mobility Users | 150 | Frequent Users, Occasional Users, Non-Users |

| EV Charging Infrastructure Providers | 100 | Business Development Managers, Operations Directors |

| Urban Mobility Planners | 80 | City Planners, Transportation Policy Analysts |

| Government Officials | 60 | Transport Ministry Representatives, Regulatory Authorities |

| Environmental NGOs | 50 | Sustainability Advocates, Policy Advisors |

The Singapore EV Shared Mobility and Charging Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by government initiatives, environmental awareness, and advancements in charging infrastructure.