Region:Asia

Author(s):Geetanshi

Product Code:KRAA1176

Pages:83

Published On:August 2025

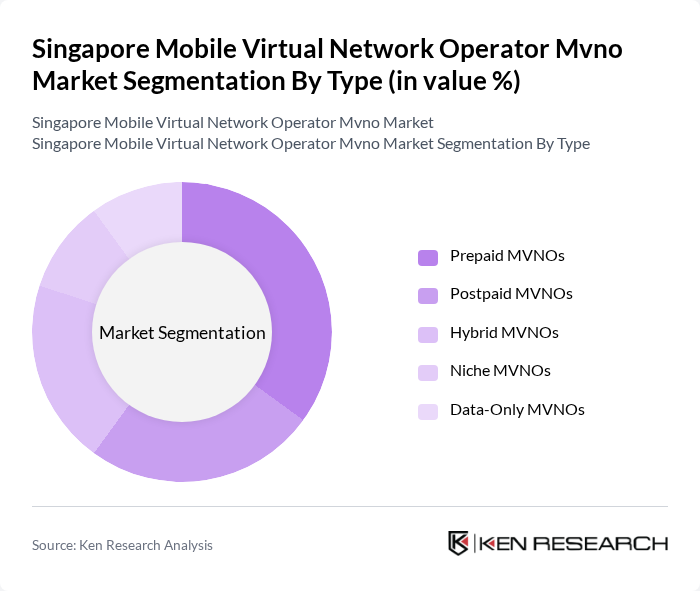

By Type:The MVNO market can be segmented into Prepaid MVNOs, Postpaid MVNOs, Hybrid MVNOs, Niche MVNOs, and Data-Only MVNOs. Each subsegment addresses distinct consumer needs and preferences, shaping their market dynamics. Prepaid MVNOs focus on flexibility and budget control, Postpaid MVNOs target users seeking bundled services and predictable billing, Hybrid MVNOs combine prepaid and postpaid features, Niche MVNOs serve specific communities or interest groups, and Data-Only MVNOs cater to users prioritizing mobile data over voice services.

The Prepaid MVNOs segment is currently dominating the market due to the growing preference for flexible payment options among consumers. This trend is particularly evident among younger demographics and budget-conscious users who prefer to avoid long-term contracts. The convenience of prepaid plans, which allow users to control their spending, has made them increasingly popular. Additionally, the rise of digital payment methods and mobile app-based account management has facilitated the growth of prepaid MVNOs, making it easier for consumers to purchase and manage their mobile services.

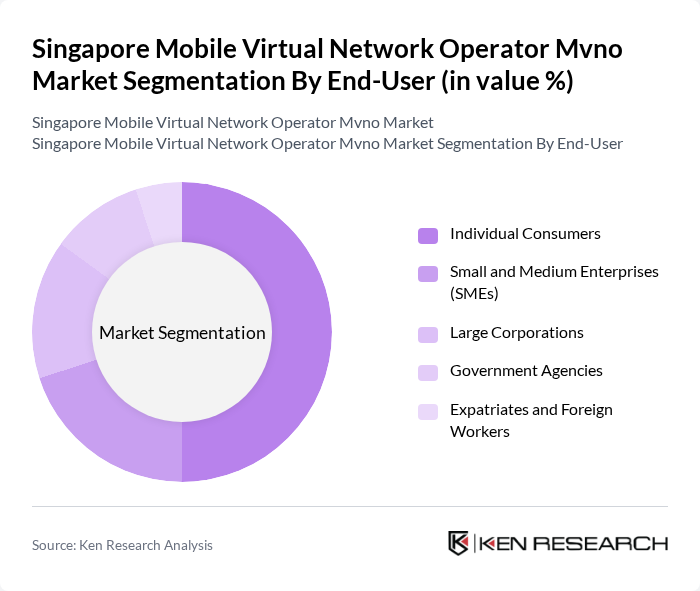

By End-User:The MVNO market can also be segmented by end-user categories, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, and Expatriates and Foreign Workers. Individual Consumers drive demand for affordable and flexible mobile plans, SMEs and Large Corporations seek scalable solutions and enterprise-grade connectivity, Government Agencies require secure and reliable communications, and Expatriates and Foreign Workers benefit from international calling and roaming packages.

The Individual Consumers segment is the largest in the MVNO market, driven by the increasing demand for affordable and flexible mobile plans. This segment encompasses a wide range of users, from students to professionals, who seek cost-effective solutions without compromising on service quality. The rise of digital services, mobile applications, and streaming platforms has further fueled this demand, as consumers look for plans that cater to their specific usage patterns and preferences.

The Singapore Mobile Virtual Network Operator MVNO market is characterized by a dynamic mix of regional and international players. Leading participants such as Circles.Life, MyRepublic, Zero1, Giga!, redONE, CMLink, Changi Mobile, VIVIFI, GOMO, Simba Telecom (formerly TPG Telecom), Grid Mobile, Zero Mobile, Singtel (as MNO host), StarHub (as MNO host), M1 (as MNO host) contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore MVNO market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As 5G technology becomes more widespread, MVNOs will have opportunities to offer enhanced services, including IoT connectivity. Additionally, the shift towards digital-first customer engagement will encourage MVNOs to innovate their service delivery models, focusing on personalized experiences. The regulatory environment will also play a crucial role in shaping market dynamics, influencing competition and operational strategies for MVNOs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Prepaid MVNOs Postpaid MVNOs Hybrid MVNOs Niche MVNOs Data-Only MVNOs |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Expatriates and Foreign Workers |

| By Distribution Channel | Online Sales Retail Stores Direct Sales Partnerships with E-commerce Platforms |

| By Pricing Model | Pay-As-You-Go Subscription Plans Bundled Services Unlimited Data Plans |

| By Customer Segment | Students Professionals Families Seniors Tourists |

| By Service Offering | Voice Services Data Services Value-Added Services International Roaming |

| By Market Positioning | Budget MVNOs Premium MVNOs Niche Market MVNOs Digital-Only MVNOs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Service Preferences | 100 | Mobile Users, Tech-Savvy Consumers |

| MVNO Operational Insights | 60 | MVNO Executives, Business Development Managers |

| Market Entry Strategies | 40 | Entrepreneurs, Telecom Consultants |

| Customer Experience Feedback | 80 | Customer Service Representatives, User Experience Designers |

| Regulatory Impact Assessment | 50 | Regulatory Affairs Specialists, Policy Analysts |

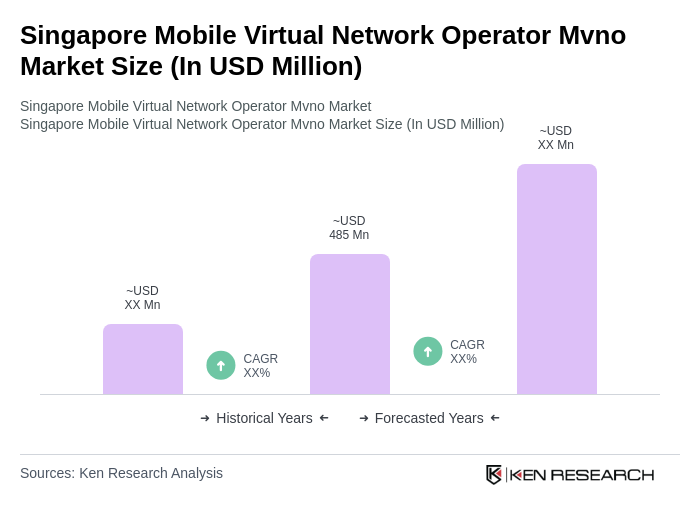

The Singapore Mobile Virtual Network Operator (MVNO) market is valued at approximately USD 485 million, driven by increasing demand for flexible mobile plans, competitive pricing, and the rise of digital services.