Region:Asia

Author(s):Geetanshi

Product Code:KRAA0108

Pages:85

Published On:August 2025

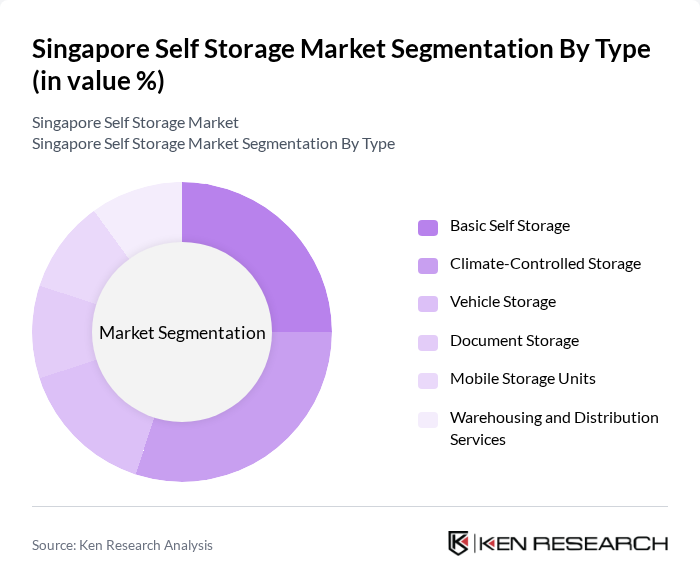

By Type:The self-storage market is segmented into Basic Self Storage, Climate-Controlled Storage, Vehicle Storage, Document Storage, Mobile Storage Units, and Warehousing and Distribution Services. Among these, Climate-Controlled Storage is gaining traction due to the growing need for temperature- and humidity-sensitive storage, especially for electronics, documents, and perishables. Basic Self Storage continues to see robust demand, driven by residential and commercial users seeking additional, flexible space for general belongings .

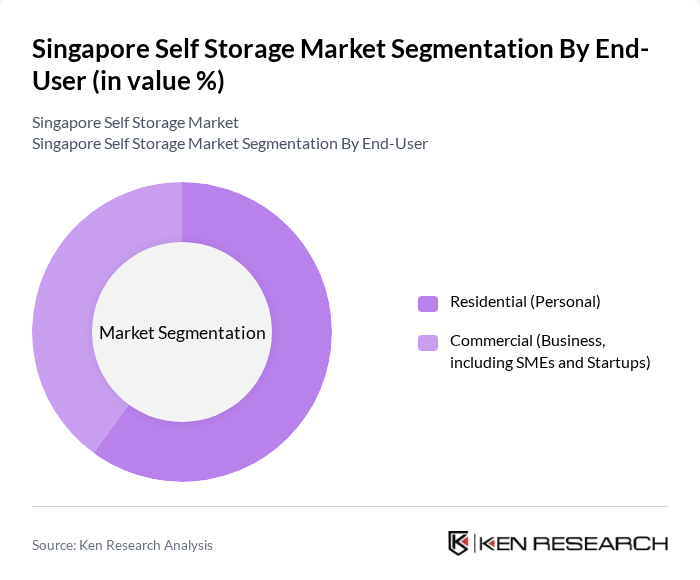

By End-User:The self-storage market is primarily segmented into Residential (Personal) and Commercial (Business, including SMEs and Startups). The Residential segment is experiencing significant growth as urban dwellers seek additional space for personal belongings amid shrinking apartment sizes. The Commercial segment is expanding, driven by the proliferation of e-commerce, startups, and SMEs that require scalable, short-term storage for inventory and business equipment .

The Singapore Self Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as StorHub, Extra Space Asia, Lock+Store, Store Friendly, Spaceship, Store Room, Spacebox, Cube Self Storage, Space Next Door, Work+Store, MyStorage, SpaceMax, Self Storage Singapore, The Storage Space, and Store It contribute to innovation, geographic expansion, and service delivery in this space .

The Singapore self-storage market is poised for continued growth, driven by urbanization and evolving consumer preferences. As the population density increases, the demand for flexible storage solutions will likely rise, particularly among e-commerce businesses. Additionally, technological advancements in security and management systems will enhance operational efficiency. The market is expected to adapt to these trends, with new facilities and innovative services emerging to meet the diverse needs of consumers and businesses alike, ensuring a dynamic landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Basic Self Storage Climate-Controlled Storage Vehicle Storage Document Storage Mobile Storage Units Warehousing and Distribution Services |

| By End-User | Residential (Personal) Commercial (Business, including SMEs and Startups) |

| By Size of Storage Unit | Small (up to 50 sq ft) Medium (50–150 sq ft) Large (150–300 sq ft) Extra-large (above 300 sq ft) |

| By Location | Central Business District Suburban Industrial |

| By Duration of Rental | Short-Term Rentals Long-Term Rentals |

| By Security Features | Basic Security Advanced Security Systems (e.g., biometric access, smart surveillance) /7 Surveillance |

| By Value-Added Services | Packing Supplies Transportation Services Insurance Options |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Self-Storage Users | 60 | Homeowners, Renters |

| Commercial Storage Clients | 50 | Business Owners, Office Managers |

| Event and Seasonal Storage Users | 40 | Event Planners, Seasonal Retailers |

| Students and Young Professionals | 40 | University Students, Young Professionals |

| Corporate Clients for Document Storage | 40 | Corporate Administrators, Compliance Officers |

The Singapore self-storage market is valued at approximately USD 1.1 billion, driven by urbanization, limited living spaces, and the growth of e-commerce and startups, indicating a robust demand for flexible storage solutions.