Region:Middle East

Author(s):Shubham

Product Code:KRAA8540

Pages:87

Published On:November 2025

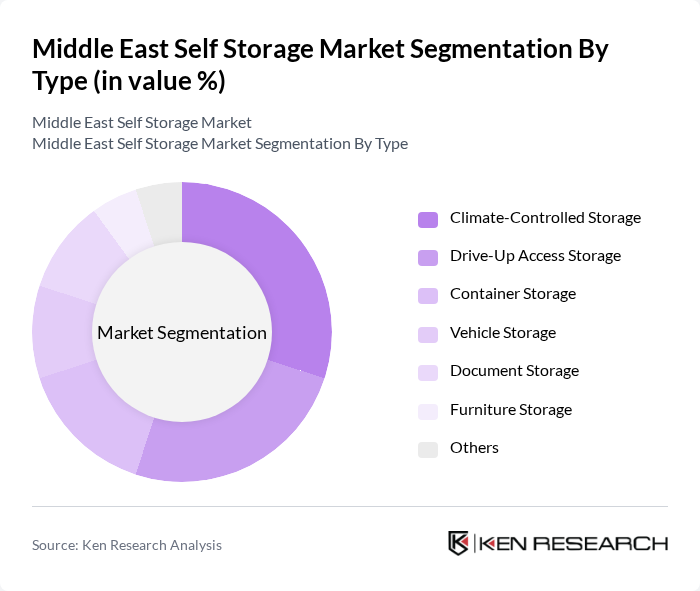

By Type:The self-storage market can be segmented into various types, includingClimate-Controlled Storage,Drive-Up Access Storage,Container Storage,Vehicle Storage,Document Storage,Furniture Storage, andOthers. Each type caters to specific consumer needs, with climate-controlled storage being particularly popular for sensitive items such as electronics, artwork, and important documents, especially in regions with extreme temperatures and humidity.

TheClimate-Controlled Storagesegment is currently leading the market due to the increasing need for protecting sensitive items from extreme temperatures and humidity. This type of storage is particularly favored by businesses and individuals who require assurance that their valuables are kept in optimal conditions. The growing awareness of the benefits of climate-controlled environments has driven consumer preference towards this segment, making it a dominant force in the self-storage market.

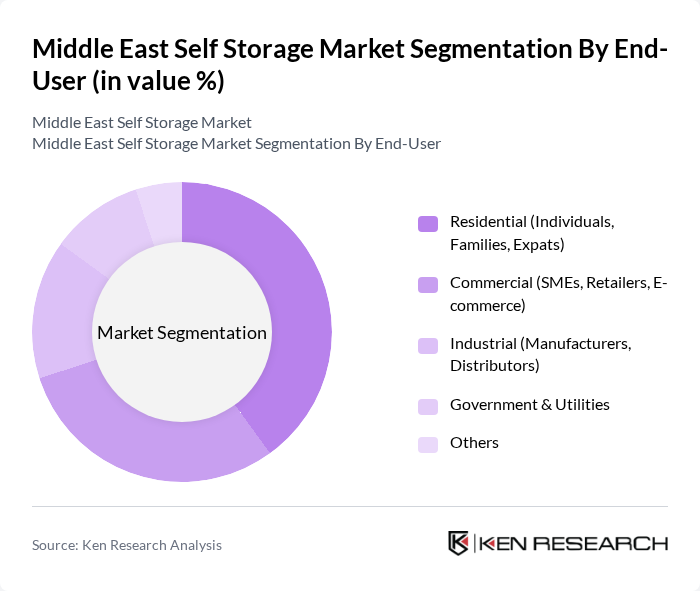

By End-User:The market can also be segmented by end-user categories, includingResidential (Individuals, Families, Expats),Commercial (SMEs, Retailers, E-commerce),Industrial (Manufacturers, Distributors),Government & Utilities, andOthers. Each segment has unique storage needs, with residential users often seeking short-term solutions while businesses may require long-term storage. The surge in e-commerce and the need for inventory management among SMEs have also contributed to commercial demand.

TheResidentialsegment is the largest end-user category, driven by the increasing number of expatriates and urban dwellers who require additional space for their belongings. This trend is particularly pronounced in cities with high population density, where living spaces are often limited. The flexibility and convenience offered by self-storage solutions make them an attractive option for individuals and families looking to manage their space effectively.

The Middle East Self Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Box Self Storage (UAE), Extra Space Storage (UAE, KSA), Storage Souq (UAE), Vachi Storage (UAE), Self Storage Dubai (UAE), CubeSmart (International, MEA), Public Storage (International), Shurgard Self Storage (International, MEA), The Storage Place (KSA), Storall (UAE), Safestore Holdings PLC (International, MEA), Big Yellow Group PLC (International, MEA), Lockable Storage (UAE), Smart Box Storage (KSA), Easytruck Storage (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the self-storage market in the Middle East appears promising, driven by urbanization and technological advancements. As cities expand and populations grow, the demand for storage solutions will likely increase. Additionally, the integration of smart technologies and IoT in storage facilities will enhance operational efficiency and customer experience. Providers that adapt to these trends and focus on sustainability will be well-positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Climate-Controlled Storage Drive-Up Access Storage Container Storage Vehicle Storage Document Storage Furniture Storage Others |

| By End-User | Residential (Individuals, Families, Expats) Commercial (SMEs, Retailers, E-commerce) Industrial (Manufacturers, Distributors) Government & Utilities Others |

| By Facility Size | Small Facilities (<5,000 sq. ft.) Medium Facilities (5,000–20,000 sq. ft.) Large Facilities (>20,000 sq. ft.) Mega Facilities (>50,000 sq. ft.) Others |

| By Location | Urban Areas Suburban Areas Industrial Zones Rural Areas Others |

| By Security Features | Gated Access Surveillance Cameras Alarm Systems Biometric Access On-site Security Personnel Others |

| By Duration of Rental | Short-Term Rentals (<3 months) Medium-Term Rentals (3–12 months) Long-Term Rentals (>12 months) Others |

| By Pricing Model | Monthly Rentals Annual Rentals Pay-As-You-Go Dynamic Pricing (Seasonal/Promotional) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Self-Storage Users | 100 | Homeowners, Renters |

| Commercial Self-Storage Clients | 60 | Small Business Owners, Retail Managers |

| Real Estate Developers | 40 | Project Managers, Investment Analysts |

| Facility Operators | 50 | Operations Managers, Marketing Managers |

| Potential Investors in Self-Storage | 40 | Venture Capitalists, Private Equity Investors |

The Middle East Self Storage Market is valued at approximately USD 2.2 billion, driven by factors such as urbanization, an increase in expatriate populations, and a growing trend of downsizing among individuals and businesses seeking flexible storage solutions.