Region:Asia

Author(s):Geetanshi

Product Code:KRAA1270

Pages:88

Published On:August 2025

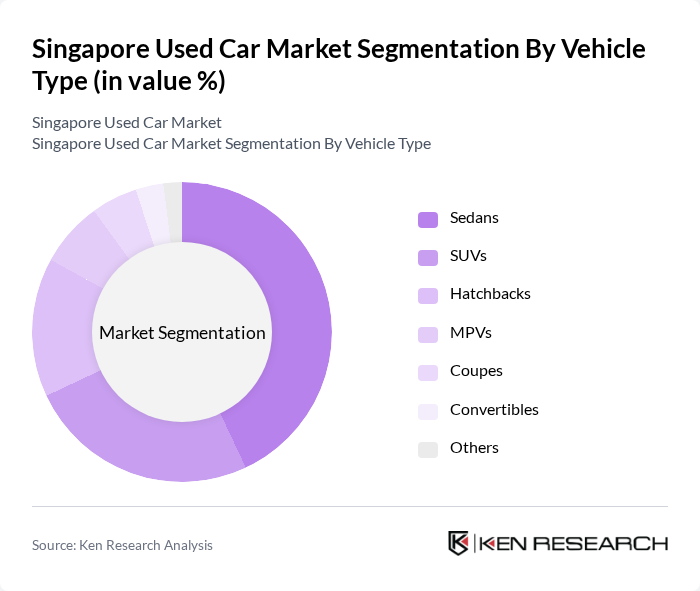

By Vehicle Type:The used car market in Singapore is segmented by vehicle type, including sedans, SUVs, hatchbacks, MPVs, coupes, convertibles, and others. Sedans remain the most popular due to their practicality and fuel efficiency, accounting for the largest share of transactions. SUVs are increasingly favored for their spaciousness and versatility, while hatchbacks appeal to urban dwellers for their compact size. MPVs are chosen by families for their seating capacity. Coupes and convertibles attract style- and performance-oriented buyers. This diversity allows consumers to select vehicles that match their lifestyle and budget.

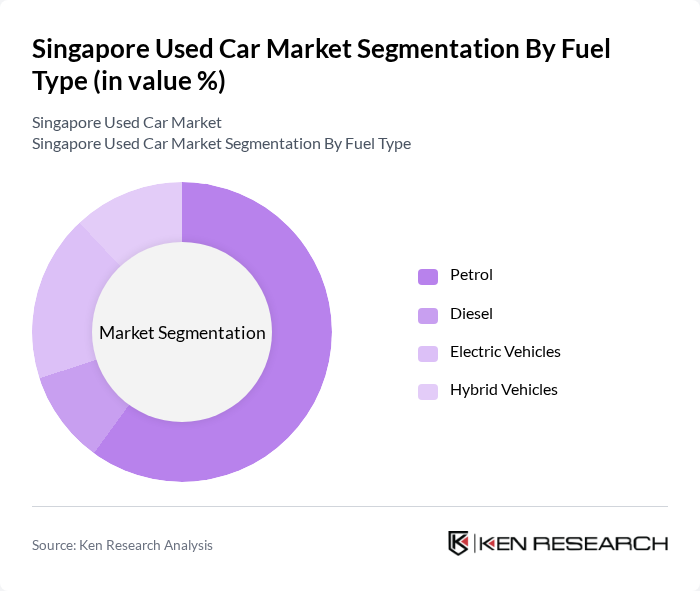

By Fuel Type:The segmentation by fuel type in the used car market includes petrol, diesel, electric vehicles, and hybrid vehicles. Petrol vehicles dominate the market due to their widespread availability and lower upfront costs. Diesel vehicles, while historically preferred for fuel efficiency, are declining due to regulatory restrictions. Electric vehicles are rapidly gaining share as consumers become more environmentally conscious and charging infrastructure expands. Hybrid vehicles offer a balance between traditional fuel and electric power, supporting the transition to cleaner mobility.

The Singapore Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carousell, Sgcarmart, Carsome, Motorist, Drive.sg, Borneo Motors (Singapore) Limited, Tan Chong Motor Holdings Limited, Cycle & Carriage Singapore, Eurokars Group, Inchcape Singapore, Wearnes Automotive, Volkswagen Group Singapore, Honda Motor Co., Ltd., Toyota Motor Corporation, Nissan Motor Co., Ltd., Carro, CarTimes Automobile Pte Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore used car market is poised for transformation as consumer preferences shift towards sustainability and digital engagement. With the anticipated rise in electric vehicle offerings and the expansion of online sales platforms, the market is likely to see increased accessibility and variety. Additionally, the growing trend of car subscription services may attract younger consumers seeking flexibility. These developments indicate a dynamic future for the used car market, driven by innovation and changing consumer behaviors.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Sedans SUVs Hatchbacks MPVs Coupes Convertibles Others |

| By Fuel Type | Petrol Diesel Electric Vehicles Hybrid Vehicles |

| By Age of Vehicle | 3 years 6 years 10 years + years |

| By Price Range | Below SGD 20,000 SGD 20,000 - SGD 40,000 SGD 40,000 - SGD 60,000 Above SGD 60,000 |

| By Sales Channel | Dealerships (Franchised & Independent) Online Platforms Auctions Private Sales |

| By Financing Options | Cash Purchases Loans Leasing Trade-ins |

| By Condition | Certified Pre-Owned Non-Certified Damaged |

| By Brand Origin | Japanese Brands European Brands American Brands Korean Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 60 | Dealership Owners, Sales Managers |

| Car Buyers | 100 | Recent Used Car Buyers, Prospective Buyers |

| Automotive Financing Institutions | 40 | Loan Officers, Financial Advisors |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| Automotive Experts | 40 | Industry Analysts, Market Researchers |

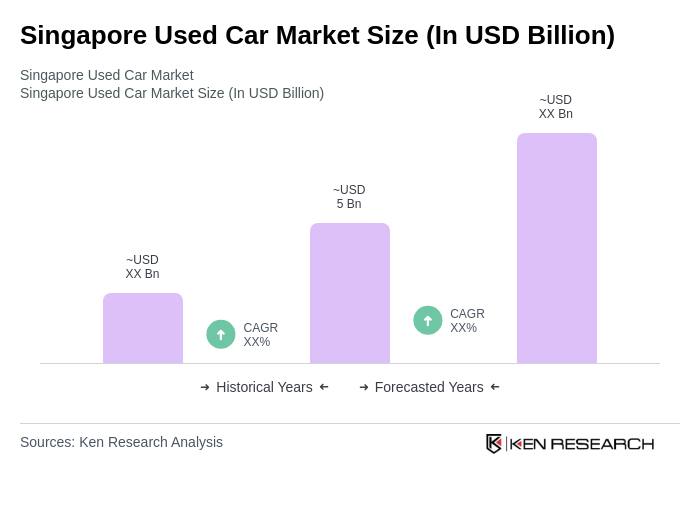

The Singapore used car market is valued at approximately USD 5 billion, driven by increasing consumer demand for affordable transportation, rising costs of new vehicles, and the popularity of online platforms for used car transactions.