Japan Used Car Market Overview

- The Japan Used Car Market is valued at USD 155 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for affordable transportation options, coupled with a robust supply of used vehicles due to Japan's strong automotive manufacturing sector. Elevated new-car prices and core inflation have widened the affordability gap, guiding budget-sensitive buyers toward pre-owned vehicles. The market has seen a steady rise in consumer preference for used cars, attributed to their cost-effectiveness, reliability, and the high quality standards maintained through Japan’s compulsory inspection system ("Shaken"), which ensures safety and environmental compliance .

- Key cities dominating this market includeTokyo, Osaka, and Yokohama. Tokyo, as the capital, has a high population density and a significant number of commuters, leading to a strong demand for used vehicles. Osaka and Yokohama also contribute significantly due to their economic activities and urbanization, making them key players in the used car market. The presence of organized dealer networks and advanced online platforms in these cities further strengthens their market position .

- In recent years, the Japanese government has implemented stricter regulations on vehicle emissions, mandating that all used cars sold must meet specific environmental standards. These policies, including routine inspections for emission compliance, aim to reduce air pollution and promote the sale of more environmentally friendly vehicles, thereby influencing consumer choices in the used car market. Stricter standards are expected to depress residual values for high-mileage internal combustion engine vehicles while boosting demand for newer, compliant models .

Japan Used Car Market Segmentation

By Vehicle Type:The used car market in Japan is segmented by vehicle type, which includes hatchbacks, sedans, SUVs, minivans/MPVs, trucks, electric vehicles (EVs) & hybrids, luxury cars, and others. Among these,SUVs and hatchbacksare particularly popular due to their versatility, safety, and fuel efficiency, appealing to a wide range of consumers. The increasing trend towards eco-friendly vehicles has also led to a rise in the demand for electric vehicles and hybrids, supported by government incentives and consumer awareness. Certified pre-owned luxury vehicles are gaining traction due to their value proposition and quality assurance .

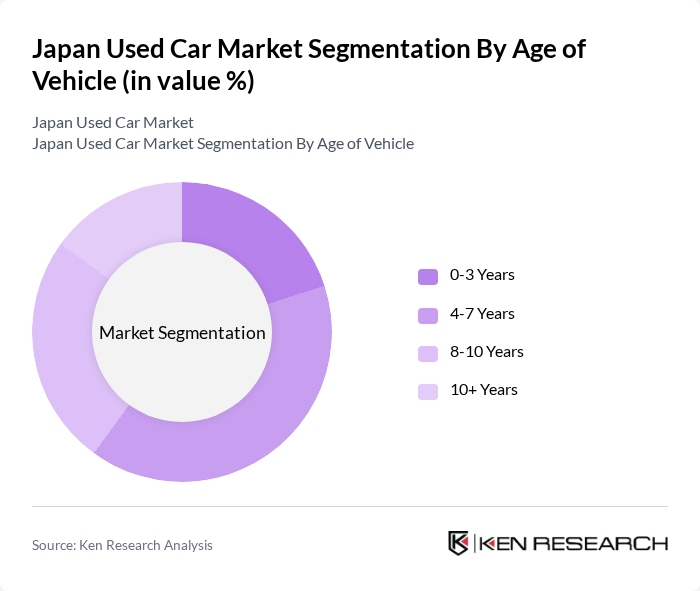

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-3 years, 4-7 years, 8-10 years, and 10+ years. The market is predominantly driven by vehicles aged4-7 years, as they offer a balance between affordability and reliability. Consumers often prefer slightly older vehicles that have already depreciated in value, making them more accessible while still providing modern features. Vehicles in this age group are also more likely to meet current emission standards and pass compulsory inspections, further supporting their popularity .

Japan Used Car Market Competitive Landscape

The Japan Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as PROTO Corporation (Goo-net), IDOM Inc. (Gulliver), Car Sensor (Recruit Holdings Co., Ltd.), Mobilico Co., Ltd., Nextage Co., Ltd., Bigmotor Co., Ltd., Carchs Holdings Co., Ltd., Toyota Motor Corporation (Toyota Certified Used Cars), Honda Motor Co., Ltd. (Honda Auto Terrace), Nissan Motor Co., Ltd. (Nissan Intelligent Choice), Suzuki Motor Corporation, Mazda Motor Corporation, Subaru Corporation, Mitsubishi Motors Corporation, Volkswagen Group Japan contribute to innovation, geographic expansion, and service delivery in this space.

Japan Used Car Market Industry Analysis

Growth Drivers

- Increasing Consumer Preference for Affordable Vehicles:The demand for used cars in Japan is significantly driven by consumers seeking affordability. In future, the average price of a used car was approximately ¥1.4 million, compared to ¥3.3 million for new vehicles. This price gap encourages buyers to opt for used cars, especially among younger demographics. Additionally, the rising cost of living, with household expenditures increasing by approximately 2.5% in future, further propels this trend as consumers prioritize budget-friendly options.

- Rising Urbanization and Population Density:Japan's urban population is projected to reach approximately 92% in future, leading to increased demand for compact and affordable vehicles. Urban areas, particularly Tokyo, are experiencing a surge in population density, which necessitates efficient transportation solutions. The number of registered used cars in urban regions has grown by approximately 4% annually, reflecting the need for accessible and economical transportation options. This trend is expected to continue as urbanization progresses, driving the used car market further.

- Expansion of Online Used Car Marketplaces:The digital transformation of the automotive sector is reshaping how consumers purchase used cars. In future, online used car sales accounted for approximately 30% of total transactions, a significant increase from 20% in the past. Platforms like Goo-net and CarSensor have facilitated this growth by providing comprehensive vehicle listings and transparent pricing. The convenience of online shopping, coupled with the increasing internet penetration rate of approximately 94%, is expected to further boost the used car market in Japan.

Market Challenges

- High Competition from New Car Sales:The used car market in Japan faces intense competition from new car sales, which have seen a resurgence due to attractive financing options and promotional offers. In future, new car sales reached approximately 4.3 million units, compared to approximately 3.5 million used cars sold. This competition is exacerbated by consumer perceptions that new cars offer better reliability and warranty coverage, making it challenging for the used car market to maintain its share amidst these favorable conditions.

- Regulatory Hurdles and Compliance Costs:The used car market is significantly impacted by stringent regulations and compliance costs. In future, the average cost of compliance for used car dealerships was estimated at approximately ¥500,000 annually, which includes safety inspections and emissions testing. These regulatory requirements can deter smaller dealerships from entering the market, limiting competition and innovation. Additionally, the complexity of import regulations for used vehicles can further complicate market dynamics, hindering growth potential.

Japan Used Car Market Future Outlook

The Japan used car market is poised for continued evolution, driven by technological advancements and changing consumer preferences. The shift towards online purchasing is expected to accelerate, with digital platforms enhancing user experience and transparency. Furthermore, the growing interest in eco-friendly vehicles will likely lead to increased demand for electric and hybrid used cars. As urbanization continues, the market will adapt to meet the needs of city dwellers, ensuring a dynamic and responsive automotive landscape in the coming years.

Market Opportunities

- Growth in Electric and Hybrid Used Car Segments:The demand for electric and hybrid used cars is on the rise, with sales increasing by approximately 15% in future. This trend is supported by government incentives, such as tax breaks for eco-friendly vehicles, which are expected to attract more buyers. As consumers become more environmentally conscious, this segment presents a significant opportunity for growth in the used car market.

- Increasing Demand for Certified Pre-Owned Vehicles:The certified pre-owned (CPO) vehicle market is expanding, with sales rising to approximately 1 million units in future. This growth is driven by consumer trust in CPO programs, which offer warranties and thorough inspections. As buyers seek assurance in their purchases, the CPO segment is likely to become a key focus for dealerships, enhancing customer satisfaction and loyalty.