Region:Africa

Author(s):Shubham

Product Code:KRAA4948

Pages:89

Published On:September 2025

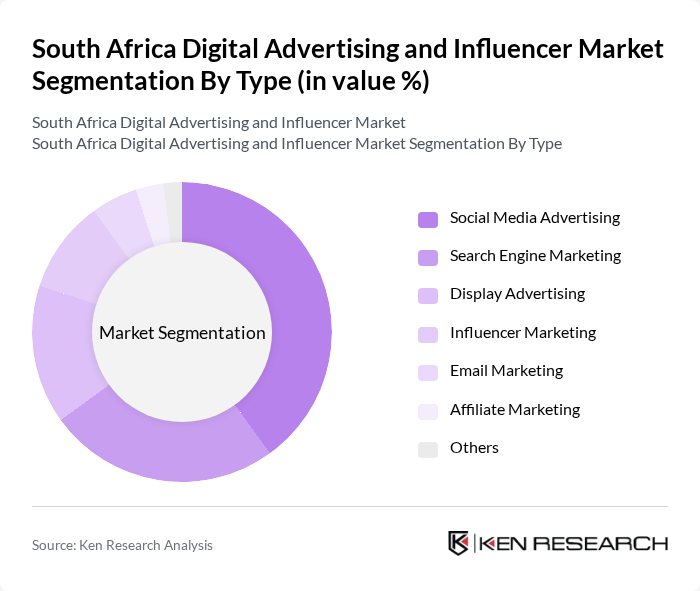

By Type:The digital advertising landscape in South Africa is diverse, encompassing various types of advertising strategies. Social media advertising has emerged as a leading segment, driven by the widespread use of platforms like Facebook and Instagram. Search engine marketing follows closely, leveraging the power of search engines to connect businesses with potential customers. Display advertising, influencer marketing, email marketing, affiliate marketing, and other forms also contribute significantly to the market, catering to different consumer preferences and business objectives.

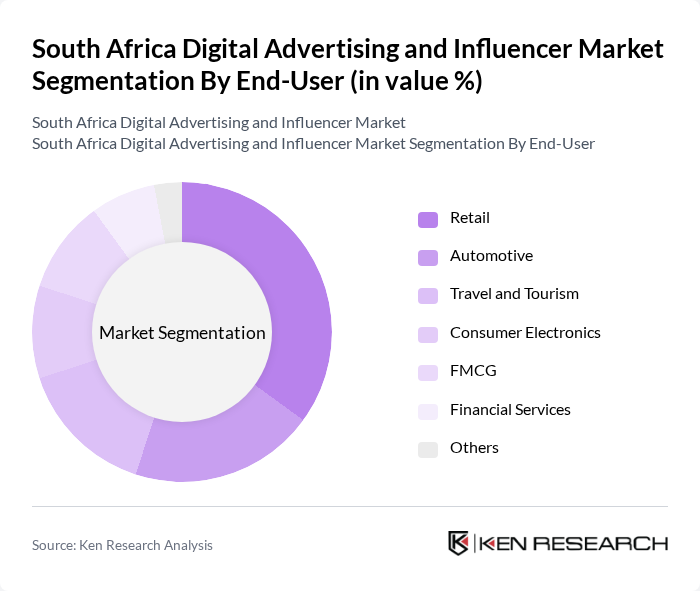

By End-User:The end-user segmentation of the digital advertising market in South Africa reveals a variety of industries leveraging digital channels for marketing. The retail sector is the largest consumer of digital advertising, driven by the need to reach tech-savvy consumers. The automotive, travel and tourism, consumer electronics, FMCG, and financial services sectors also utilize digital advertising to enhance brand visibility and engage with their target audiences effectively. Each sector employs tailored strategies to maximize their marketing efforts.

The South Africa Digital Advertising and Influencer Market is characterized by a dynamic mix of regional and international players. Leading participants such as NATIVE VML, Ogilvy South Africa, Wunderman Thompson South Africa, 24.com, The MediaShop, Isobar South Africa, Dentsu South Africa, Havas South Africa, Clicks Group, Red Ant Marketing, The Odd Number, M&C Saatchi Abel, VMLY&R South Africa, TBWA\South Africa, The Jupiter Drawing Room contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital advertising and influencer market is poised for significant evolution in the coming years. With the continued rise of mobile usage and social media engagement, brands will increasingly leverage these platforms for targeted advertising. Additionally, the integration of advanced technologies such as AI and machine learning will enhance campaign effectiveness. As consumer preferences shift towards personalized content, businesses that adapt to these trends will likely see improved engagement and conversion rates, driving overall market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Advertising Search Engine Marketing Display Advertising Influencer Marketing Email Marketing Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Consumer Electronics FMCG Financial Services Others |

| By Platform | YouTube TikTok Others |

| By Campaign Type | Brand Awareness Campaigns Product Launch Campaigns Seasonal Promotions Engagement Campaigns Retargeting Campaigns Others |

| By Content Format | Video Content Image-Based Content Text-Based Content Interactive Content Live Streaming Content Others |

| By Budget Size | Small Budget (< R50,000) Medium Budget (R50,000 - R200,000) Large Budget (> R200,000) Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas National Campaigns Regional Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 100 | Agency Owners, Account Managers |

| Brand Marketing Departments | 80 | Marketing Directors, Brand Managers |

| Influencers and Content Creators | 70 | Social Media Influencers, Content Strategists |

| Consumer Insights | 90 | General Consumers, Online Shoppers |

| Advertising Technology Providers | 60 | Product Managers, Sales Executives |

The South Africa Digital Advertising and Influencer Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online platforms for shopping and information.