Region:Africa

Author(s):Geetanshi

Product Code:KRAA4541

Pages:96

Published On:September 2025

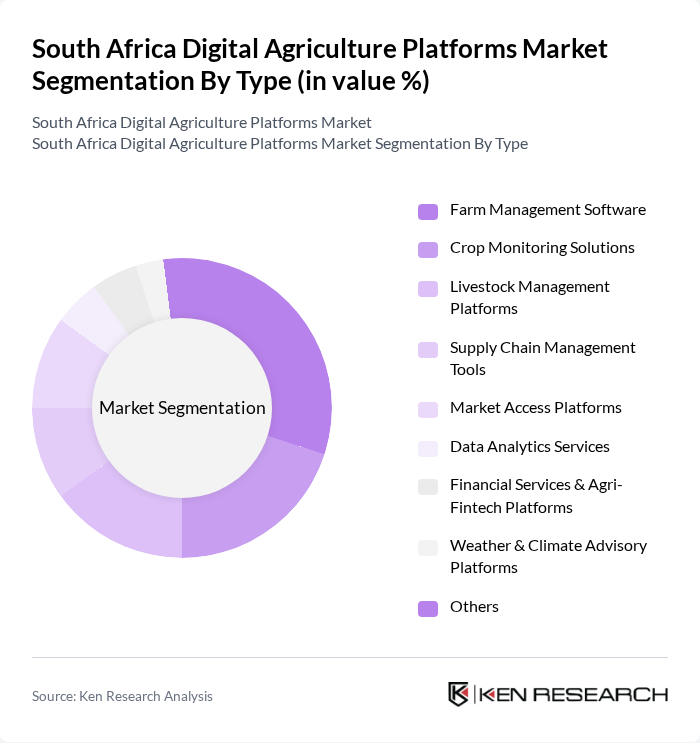

By Type:The market is segmented into various types of digital agriculture platforms, including Farm Management Software, Crop Monitoring Solutions, Livestock Management Platforms, Supply Chain Management Tools, Market Access Platforms, Data Analytics Services, Financial Services & Agri-Fintech Platforms, Weather & Climate Advisory Platforms, and Others. Farm Management Software leads due to its integrated features that support planning, monitoring, and analysis of farm activities. The demand for these platforms is driven by the need for data-driven decision-making, resource optimization, and compliance with sustainability standards. Precision agriculture and IoT sensor integration are accelerating the adoption of these platforms, enabling real-time monitoring and predictive analytics .

By End-User:The end-user segmentation includes Smallholder Farmers, Commercial Farmers, Agricultural Cooperatives, Agribusiness Companies, Government Agencies, Research Institutions, Agri-Input Suppliers, Financial Institutions & Insurers, and Others. Commercial Farmers are the dominant segment, as they are more likely to invest in advanced digital solutions to enhance productivity and profitability. The increasing focus on precision agriculture, sustainability, and compliance with export standards is propelling growth in this segment. Smallholder farmers are also increasingly adopting digital platforms, supported by government and private sector initiatives to improve access and affordability .

The South Africa Digital Agriculture Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aerobotics, FarmTrace, Khula!, Agri SA, Farmonaut, MySmartFarm, HelloChoice, Zylem, AgriCloud, eSusFarm, AgriEdge, GreenFingers Mobile, UjuziKilimo, CropIn Technology Solutions, Hello Tractor contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African digital agriculture platforms market appears promising, driven by technological advancements and increasing government support. As precision agriculture technologies become more mainstream, farmers are expected to leverage data analytics for improved decision-making. Additionally, the rise of community-based agricultural networks will foster collaboration and knowledge sharing among farmers, enhancing overall productivity. The focus on sustainable practices will further encourage the adoption of innovative solutions, positioning South Africa as a leader in digital agriculture in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Farm Management Software Crop Monitoring Solutions Livestock Management Platforms Supply Chain Management Tools Market Access Platforms Data Analytics Services Financial Services & Agri-Fintech Platforms Weather & Climate Advisory Platforms Others |

| By End-User | Smallholder Farmers Commercial Farmers Agricultural Cooperatives Agribusiness Companies Government Agencies Research Institutions Agri-Input Suppliers Financial Institutions & Insurers Others |

| By Application | Crop Production Livestock Farming Supply Chain Management Market Access Data Analytics Financial Inclusion & Credit Scoring Weather Forecasting & Risk Management Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Outlets Agri-Cooperatives & Associations Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Freemium Models Revenue Sharing/Commission Others |

| By Technology | Cloud-Based Solutions Mobile Applications IoT-Enabled Devices AI and Machine Learning Tools Blockchain & Traceability Solutions Remote Sensing & Satellite Platforms Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Limpopo Mpumalanga Free State North West Northern Cape Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Farm Management Platforms | 100 | Farm Owners, Agricultural Technologists |

| Supply Chain Optimization Tools | 60 | Logistics Coordinators, Supply Chain Managers |

| Market Access Platforms | 50 | Market Analysts, Cooperative Managers |

| Data Analytics Services for Agriculture | 40 | Agricultural Researchers, Data Scientists |

| Mobile Applications for Farmers | 70 | Smallholder Farmers, Agricultural Extension Officers |

The South Africa Digital Agriculture Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of precision agriculture technologies and improved access to digital tools among farmers.