Region:Africa

Author(s):Rebecca

Product Code:KRAB5908

Pages:90

Published On:October 2025

By Type:The market is segmented into various types of facility management services, including hard services, soft services, integrated facility management services, specialized services, and others. Each of these segments plays a crucial role in ensuring the smooth operation of retail and hospitality establishments. Hard services address the physical infrastructure, while soft services focus on the environment and experience. Integrated and specialized services are increasingly adopted for their efficiency and value-added benefits .

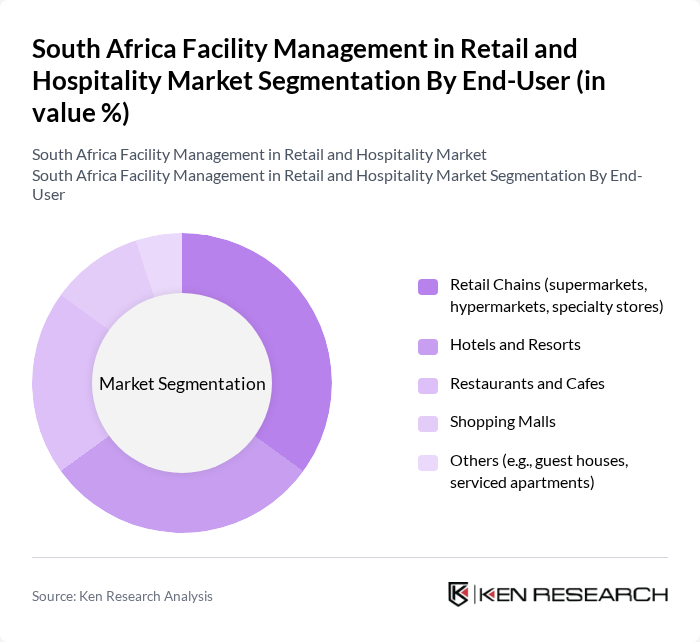

By End-User:The end-user segmentation includes retail chains, hotels and resorts, restaurants and cafes, shopping malls, and others. Each segment has unique requirements and contributes differently to the overall market dynamics. Retail chains and shopping malls require comprehensive solutions for high-traffic environments, while hotels and restaurants prioritize guest experience and compliance with health and safety standards .

The South Africa Facility Management in Retail and Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Facilities Management, Servest Group, Tsebo Solutions Group, G4S Facilities Management, Rentokil Initial South Africa, Ecolab South Africa, ISS Facility Services South Africa, Atalian Global Services South Africa, Mace Group South Africa, CSG Facilities Management, Envirosafe Solutions, SSG Group, AFS Facilities Management, FMS Group, and Broll Property Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of facility management in South Africa's retail and hospitality sectors appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt smart technologies, the demand for integrated facility management services is expected to rise. Additionally, the focus on employee well-being and experience will shape service delivery models, encouraging providers to innovate and adapt to changing market needs. This evolving landscape presents significant opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, electrical, plumbing, building maintenance) Soft Services (e.g., cleaning, security, landscaping, pest control) Integrated Facility Management Services Specialized Services (e.g., energy management, waste management, catering) Others (e.g., workspace management, concierge services) |

| By End-User | Retail Chains (supermarkets, hypermarkets, specialty stores) Hotels and Resorts Restaurants and Cafes Shopping Malls Others (e.g., guest houses, serviced apartments) |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Term Contracts Ad-Hoc Contracts Long-Term Contracts |

| By Service Frequency | Daily Services Weekly Services Monthly Services |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Facility Management | 80 | Facility Managers, Operations Directors |

| Hospitality Facility Services | 60 | Hotel Managers, Maintenance Supervisors |

| Cleaning and Maintenance Services | 50 | Service Providers, Quality Assurance Managers |

| Security Management in Retail | 40 | Security Managers, Risk Assessment Officers |

| Energy Management Solutions | 40 | Sustainability Officers, Facility Engineers |

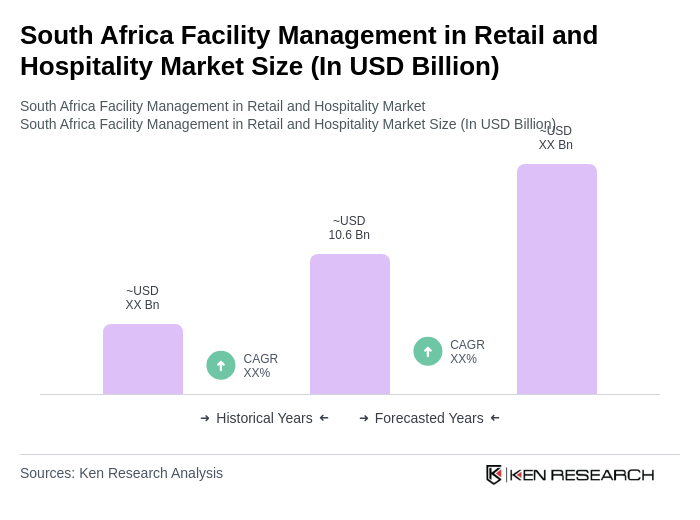

The South Africa Facility Management in Retail and Hospitality Market is valued at approximately USD 10.6 billion, reflecting a significant growth driven by the demand for efficient facility management services in these sectors.