Region:Africa

Author(s):Shubham

Product Code:KRAA1043

Pages:100

Published On:August 2025

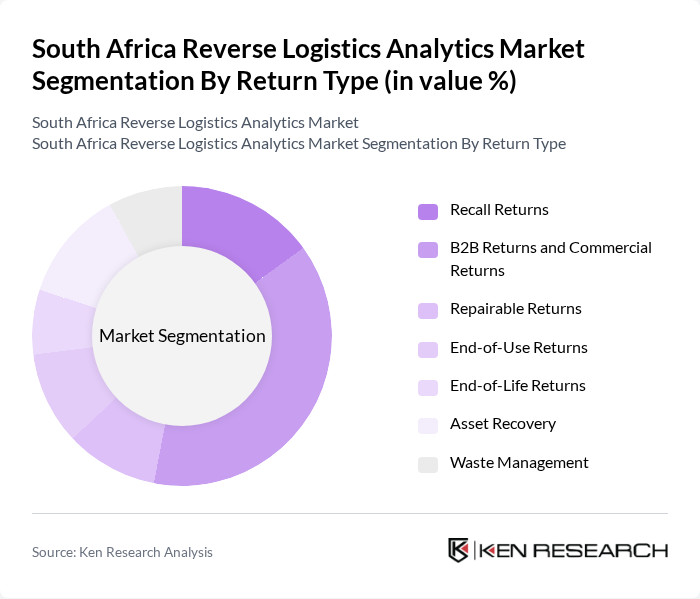

By Return Type:The return type segmentation includes various categories such as Recall Returns, B2B Returns and Commercial Returns, Repairable Returns, End-of-Use Returns, End-of-Life Returns, Asset Recovery, and Waste Management. Among these, B2B Returns and Commercial Returns are currently leading the market due to the increasing volume of returns in the business sector, driven by e-commerce growth and customer return policies. The trend towards sustainability and efficient resource management is also pushing companies to focus on asset recovery and waste management, which are gaining traction .

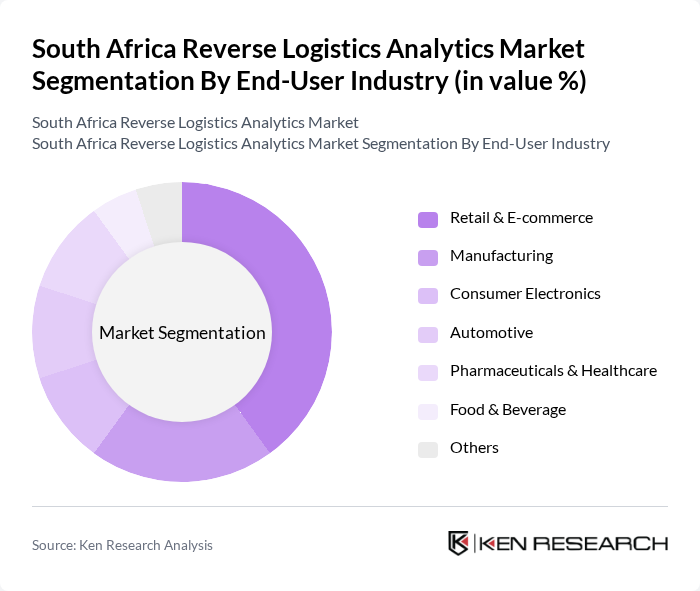

By End-User Industry:The end-user industry segmentation encompasses Retail & E-commerce, Manufacturing, Consumer Electronics, Automotive, Pharmaceuticals & Healthcare, Food & Beverage, and Others. The Retail & E-commerce sector is the dominant segment, driven by the rapid growth of online shopping and the increasing need for efficient return processes. This sector's focus on customer satisfaction, streamlined logistics operations, and adoption of analytics for returns management is propelling the demand for reverse logistics analytics, making it a critical area for investment and innovation .

The South Africa Reverse Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Bidvest Logistics, Imperial Logistics, Kuehne + Nagel, Barloworld Logistics, TFG Logistics, Transnet Freight Rail, DSV South Africa, Rhenus Logistics, Aramex South Africa, Cargo Carriers, Sappi Logistics, Onelogix Group, Laser Logistics, and Value Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The South African reverse logistics analytics market is poised for significant transformation as businesses increasingly prioritize sustainability and efficiency. The integration of advanced technologies, such as AI and IoT, will enhance data-driven decision-making, enabling companies to optimize their reverse logistics processes. Additionally, the growing emphasis on circular economy practices will drive innovation in logistics networks, fostering collaboration between businesses and technology providers. As these trends evolve, the market is expected to adapt, creating new opportunities for growth and improved operational performance.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Recall Returns B2B Returns and Commercial Returns Repairable Returns End-of-Use Returns End-of-Life Returns Asset Recovery Waste Management |

| By End-User Industry | Retail & E-commerce Manufacturing Consumer Electronics Automotive Pharmaceuticals & Healthcare Food & Beverage Others |

| By Solution Type | Services Software & Analytics Platforms |

| By Process Type | Recycling & Waste Management Remanufacturing Refurbishment Servicing & Repairs Others |

| By Distribution Channel | Direct Distribution Third-Party Logistics Providers (3PL) E-commerce Platforms Retail Partnerships Others |

| By Geographic Presence | Urban Areas Rural Areas Suburban Areas Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 70 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 60 | E-commerce Managers, Fulfillment Center Supervisors |

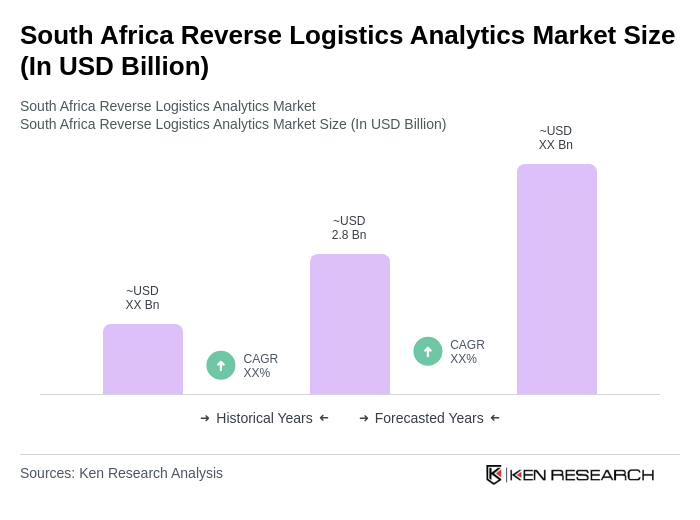

The South Africa Reverse Logistics Analytics Market is valued at approximately USD 2.8 billion, reflecting a significant growth trend driven by sustainability initiatives, e-commerce expansion, and improved supply chain management practices.