Region:Europe

Author(s):Shubham

Product Code:KRAA0856

Pages:84

Published On:August 2025

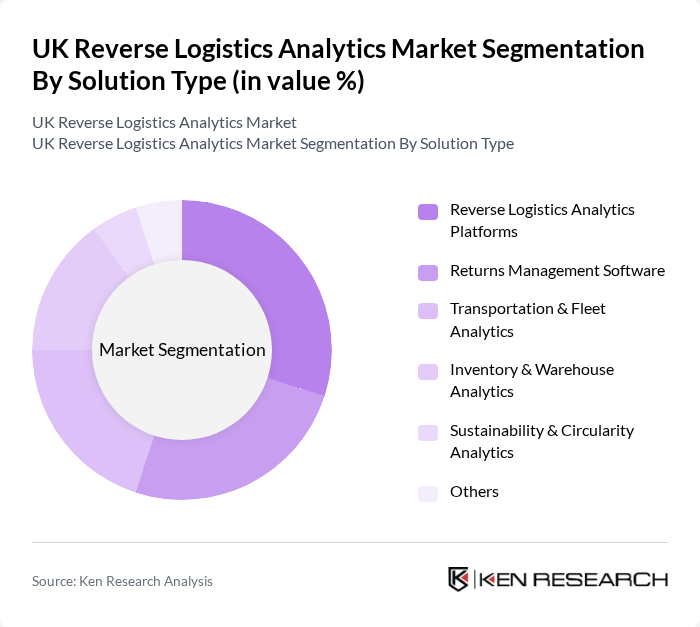

By Solution Type:The solution type segmentation includes various subsegments that address key aspects of reverse logistics analytics. The primary subsegments are Reverse Logistics Analytics Platforms, Returns Management Software, Transportation & Fleet Analytics, Inventory & Warehouse Analytics, Sustainability & Circularity Analytics, and Others. These solutions support process optimization, cost reduction, and regulatory compliance by providing actionable insights into returns, transportation, inventory, and sustainability initiatives .

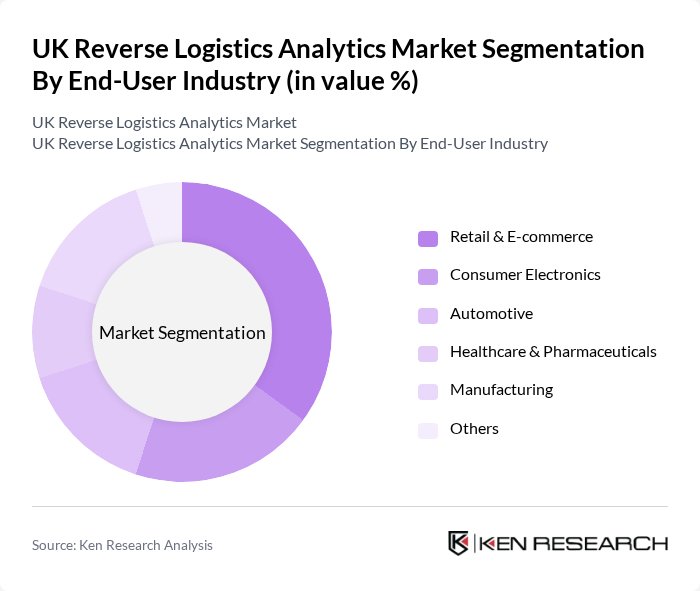

By End-User Industry:The end-user industry segmentation covers sectors that utilize reverse logistics analytics to streamline operations and improve returns management. The primary subsegments include Retail & E-commerce, Consumer Electronics, Automotive, Healthcare & Pharmaceuticals, Manufacturing, and Others. Each sector faces distinct challenges, such as high return volumes in retail and compliance requirements in healthcare, driving the adoption of tailored analytics solutions to optimize reverse logistics processes .

The UK Reverse Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, UPS Supply Chain Solutions, FedEx Logistics, Geodis, Kuehne + Nagel, CEVA Logistics, DB Schenker, DPD Group, Royal Mail Group, Whistl, Reconomy Group, Optoro, ZigZag Global, and Sorted Group contribute to innovation, geographic expansion, and service delivery in this space.

The UK reverse logistics analytics market is poised for significant transformation as businesses increasingly adopt advanced technologies and sustainable practices. The integration of AI and machine learning will enhance data-driven decision-making, enabling companies to optimize their return processes. Additionally, the growing emphasis on customer experience will drive innovations in return policies and logistics solutions, fostering a more efficient and responsive supply chain. As regulatory frameworks evolve, businesses will need to adapt to maintain compliance and meet consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Reverse Logistics Analytics Platforms Returns Management Software Transportation & Fleet Analytics Inventory & Warehouse Analytics Sustainability & Circularity Analytics Others |

| By End-User Industry | Retail & E-commerce Consumer Electronics Automotive Healthcare & Pharmaceuticals Manufacturing Others |

| By Deployment Mode | Cloud-Based On-Premise Hybrid |

| By Application | Returns Forecasting & Optimization Asset Recovery & Recommerce Analytics Warranty & Recall Analytics Fraud Detection & Prevention Environmental Impact Tracking Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Service Type | Consulting & Implementation Managed Analytics Services Support & Maintenance Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | eCommerce Managers, Fulfillment Center Supervisors |

The UK Reverse Logistics Analytics Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the demand for efficient returns management, increased e-commerce activities, and a focus on sustainability in supply chains.