Region:Asia

Author(s):Shubham

Product Code:KRAA1759

Pages:100

Published On:August 2025

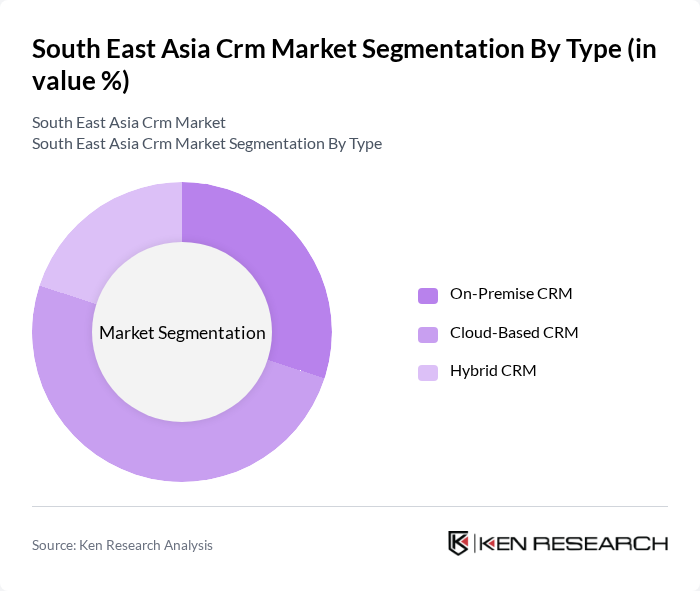

By Type:The CRM market can be segmented into three main types: On-Premise CRM, Cloud-Based CRM, and Hybrid CRM. Each of these types caters to different business needs and preferences, with varying levels of flexibility, control, and cost. Cloud-based CRM has become the dominant deployment model in Southeast Asia due to scalability, lower upfront costs, and ease of integration for SMEs and enterprises alike .

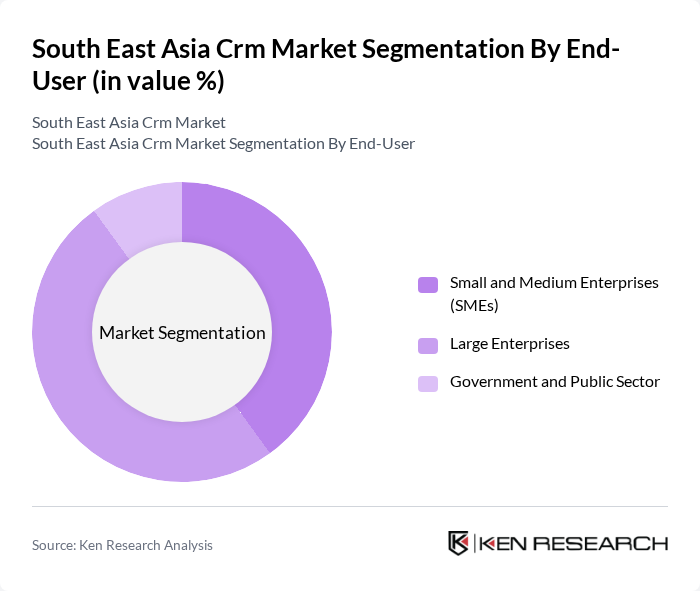

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, and Government and Public Sector. Each segment has unique requirements and challenges that influence their CRM adoption strategies. SMEs are a particularly active adopter group in Southeast Asia as they digitize sales and service processes to support e-commerce and omni-channel engagement .

The South East Asia CRM market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Inc., HubSpot, Inc., Zoho Corporation Pvt. Ltd., Microsoft Corporation (Dynamics 365), SAP SE (SAP Customer Experience), Oracle Corporation (Oracle CX), Freshworks Inc. (Freshsales), Pipedrive OÜ, SugarCRM Inc., Insightly, Inc., Nimble, Inc., Close CRM, Inc., Keap (Infusionsoft), Bitrix24 (Bitrix, Inc.), monday.com Ltd., Qontak (Mekari Qontak), LeadSquared (MarketXpander Services Pvt. Ltd.), Creatio, Zendesk, Inc. (Zendesk Sell/Sunshine), Oracle NetSuite (NetSuite CRM) contribute to innovation, geographic expansion, and service delivery in this space .

The South East Asia CRM market is poised for significant evolution, driven by technological advancements and changing consumer expectations. As businesses increasingly prioritize customer-centric strategies, the integration of AI and machine learning into CRM systems will enhance personalization and efficiency. Furthermore, the shift towards mobile CRM solutions will cater to the growing number of mobile users, ensuring that companies can engage customers effectively across various platforms. This dynamic landscape will create new opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise CRM Cloud-Based CRM Hybrid CRM |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector |

| By Industry Vertical | Retail & E-commerce Healthcare Banking, Financial Services & Insurance (BFSI) Telecommunications Manufacturing Logistics & Transportation |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Sales Force Automation (SFA) Marketing Automation Customer Service & Support Customer Data Platform (CDP) & Analytics Omnichannel & Social CRM |

| By Geography | Singapore Malaysia Indonesia Thailand Vietnam Philippines Myanmar Cambodia Laos |

| By Others | Verticalized CRM (e.g., BFSI, Healthcare, Retail) Low-Code/No-Code CRM Customization Open Source CRM |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME CRM Adoption | 120 | Business Owners, IT Managers |

| Enterprise CRM Solutions | 100 | Chief Marketing Officers, Sales Directors |

| Industry-Specific CRM Applications | 80 | Sector Specialists, Product Managers |

| Customer Experience Management | 70 | Customer Service Managers, Experience Officers |

| CRM Integration Challenges | 90 | IT Directors, System Integrators |

The South East Asia CRM market is valued at approximately USD 2.2 billion, driven by the increasing adoption of digital transformation strategies and the demand for personalized customer experiences across various sectors.